Assessing Warrior Met Coal: Insights From 4 Financial Analysts

During the last three months, 4 analysts shared their evaluations of Warrior Met Coal (NYSE: HCC), revealing diverse outlooks from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 0 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

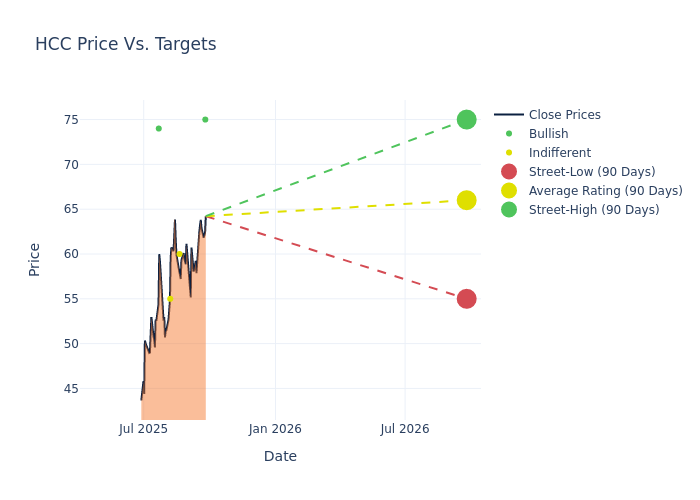

The 12-month price targets, analyzed by analysts, offer insights with an average target of $66.0, a high estimate of $75.00, and a low estimate of $55.00. This current average has increased by 12.49% from the previous average price target of $58.67.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Warrior Met Coal among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Matthew Key | Texas Capital Securities | Announces | Buy | $75.00 | - |

| Curt Woodworth | UBS | Raises | Neutral | $60.00 | $50.00 |

| Katja Jancic | BMO Capital | Raises | Market Perform | $55.00 | $50.00 |

| Nick Giles | B. Riley Securities | Lowers | Buy | $74.00 | $76.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Warrior Met Coal. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Warrior Met Coal compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Warrior Met Coal's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Warrior Met Coal's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Warrior Met Coal analyst ratings.

About Warrior Met Coal

Warrior Met Coal Inc is a U.S based company. It produces and exports of met coal that operates underground mines in Alabama. The company sells to steels manufacturers in Europe, Asia, and South America. Its mining operations consist of two underground met coal mines in Southern Appalachia's coal seam and other surface met and thermal coal mines. The Company generates ancillary revenues from the sale of natural gas extracted as a byproduct from the underground coal mines and royalty revenues from leased properties.

Warrior Met Coal's Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Warrior Met Coal's revenue growth over a period of 3M has faced challenges. As of 30 June, 2025, the company experienced a revenue decline of approximately -24.97%. This indicates a decrease in the company's top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Warrior Met Coal's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 1.88%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 0.27%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Warrior Met Coal's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.21%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.11, Warrior Met Coal adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal