Trump Never Expected This—His Most-Hated Stocks Are Crushing Nvidia, Gold Miners

President Donald Trump has never hidden his antipathy for clean energy, solar and wind investments, but what's happening in U.S. markets since April is delivering results that few, even his fiercest critics, saw coming.

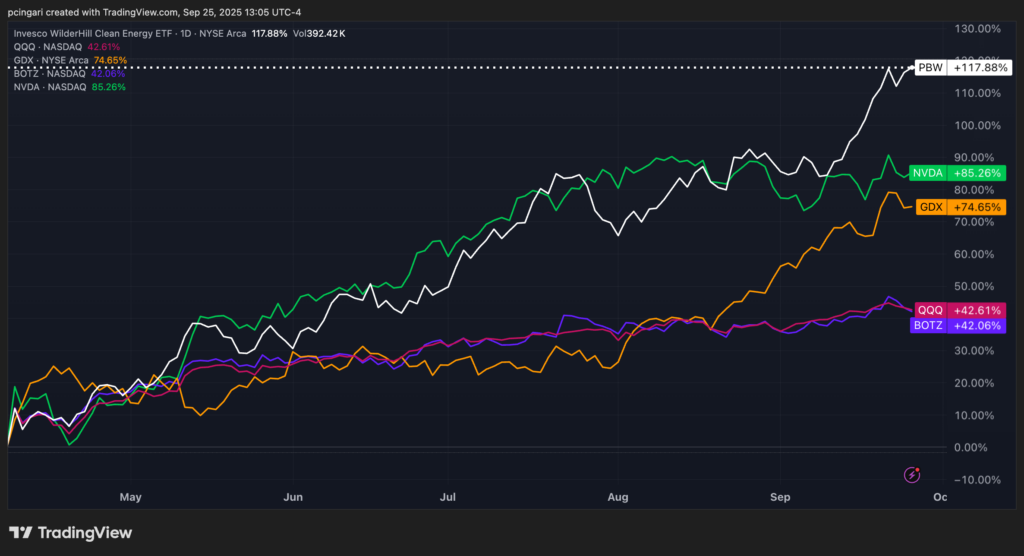

From the market's April 4 bottom through Sept. 25, no industry has posted more substantial gains than clean energy.

The Invesco WilderHill Clean Energy ETF (NYSE: PBW) has surged 118%, beating out tech, artificial intelligence stocks and even the gold miners that are on top of the 2025’s leaderboard.

Notably, the performance of renewable stocks has even outperformed Nvidia Corp. (NASDAQ: NVDA), which has rallied 85% since April’s lows.

During this period, Trump has continued his attacks on renewables.

On Aug. 20 he posted on Truth Social: "Any state that has built and relied on windmills and solar for power is seeing record-breaking increases in electricity and energy costs. The scam of the century! We will not approve wind or solar projects that harm farmers. The days of stupidity are over in the USA."

Just days ago, during his Sept. 23 address to the United Nations General Assembly, Trump called climate change a "scam" and said the concept of a "carbon footprint" is a "con job."

Despite that rhetoric, investors are flocking to renewable energy names.

The Clean Energy Stocks Trump Can't Ignore

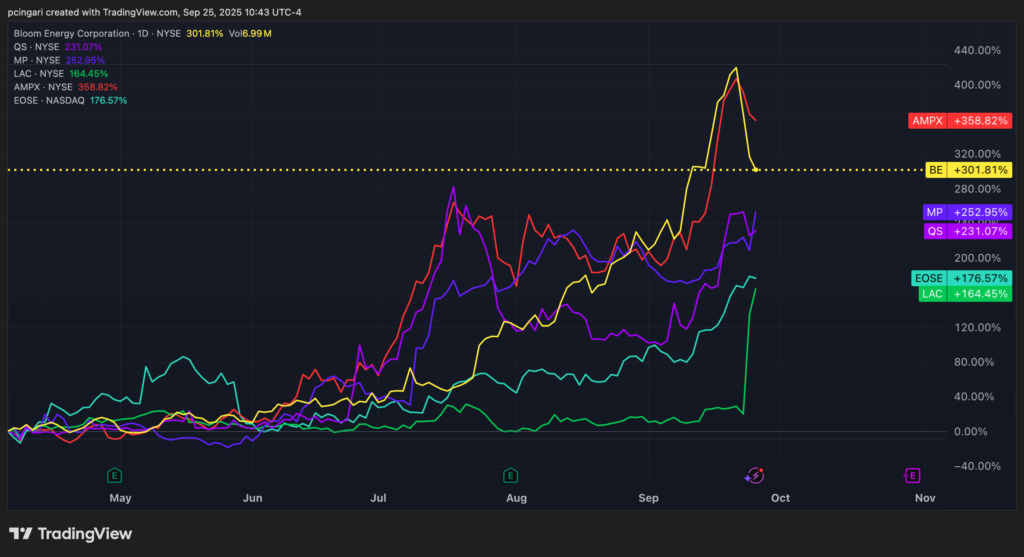

Several companies in the renewable and battery storage space have seen their share prices skyrocket since early April:

- Amprius Technologies (NYSE: AMPX), which develops advanced silicon-anode batteries, is up 359%.

- Bloom Energy Corp. (NYSE: BE), a fuel cell technology company, has soared 302%.

- MP Materials Corp. (NYSE: MP), the largest U.S. producer of rare earth materials crucial for EV motors and wind turbines, has jumped 251%.

- QuantumScape Corp. (NYSE: QS), working on solid-state batteries, has gained 231%.

- Eos Energy Enterprises Inc. (NASDAQ: EOSE), a grid-scale battery maker, has rallied 177%.

- Lithium Americas Corp. (NYSE: LAC), a lithium developer tied to the U.S. supply chain, has advanced 164%.

Analysts Flag Opportunity — And Risk

Bank of America analyst Dimple Gosai recently stated that Bloom Energy's technology is real and useful, citing a case where its fuel cells powered Oracle Corp. within 90 days after grid delays.

"That makes Bloom an attractive back-up option in a market where power procurement is usually secured years in advance," Gosai said.

However, she flagged that Bloom's valuation looks stretched, noting the stock is trading at 100 times projected 2025 enterprise value-to-EBITDA, far richer than GE Vernova (NYSE: GEV) and even Nvidia Corp.

In a broader picture, Bank of America's head of commodities research Francisco Blanch sees structural drivers supporting the clean energy story.

In a note shared earlier this month, He said the next five years will be shaped by soaring electricity demand, shifting global trade flows and China's dominance in renewable manufacturing.

"Any winning energy strategy may require ample doses of renewables and fuel storage," Blanch said.

What Comes Next?

The surge in clean energy stocks is being fueled by the same dynamics that helped AI earlier this year: investor enthusiasm, structural demand and geopolitical uncertainty.

But with valuations stretched, the big question is whether these gains can hold. For now, the irony is hard to miss — Trump's most-disliked industry is delivering Wall Street's strongest returns of the year.

Now Read:

Image: Shutterstock

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal