Should HCA’s Strong Q2 Results and Digital Expansion Prompt a Fresh Look From HCA (HCA) Investors?

- HCA Healthcare reported robust second quarter results, with revenues and earnings per share surpassing analyst expectations and an improved full-year earnings outlook strengthened by multiple upward revisions from analysts in recent months.

- The launch of advanced cardiac care services at HCA Florida Woodmont Hospital, coupled with increased focus on operational efficiency and digital transformation initiatives, reflects HCA’s ongoing commitment to expanding healthcare access and enhancing patient outcomes.

- We’ll explore how HCA’s earnings momentum and operational advancements may influence the company’s investment narrative going forward.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

HCA Healthcare Investment Narrative Recap

To own HCA Healthcare stock, an investor should feel confident in the company’s ability to grow patient volumes and manage costs, especially as it pursues expansion plans and invests in digital clinical solutions. The recent quarterly earnings beat affirms strong execution but does not significantly alter the key focus on operational efficiency as a near-term catalyst or concerns around changes in federal policy as the most important risk. For now, these factors remain the most important variables to watch.

The newly launched cardiac catheterization lab at HCA Florida Woodmont Hospital is a tangible example of HCA's commitment to expanding specialized care and enhancing its service network. This investment aligns closely with the company’s recognized strength in driving volume growth across high-acuity specialties, one of the biggest catalysts supporting future revenue and margin trends. Yet, while such projects speak to HCA’s growth ambitions, attention is still needed on risks tied to regulatory developments and payer dynamics.

On the other hand, investors should be aware of potential regulatory shifts that might impact revenue stability and...

Read the full narrative on HCA Healthcare (it's free!)

HCA Healthcare's narrative projects $85.4 billion revenue and $6.9 billion earnings by 2028. This requires 5.5% yearly revenue growth and a $0.9 billion earnings increase from $6.0 billion.

Uncover how HCA Healthcare's forecasts yield a $403.81 fair value, in line with its current price.

Exploring Other Perspectives

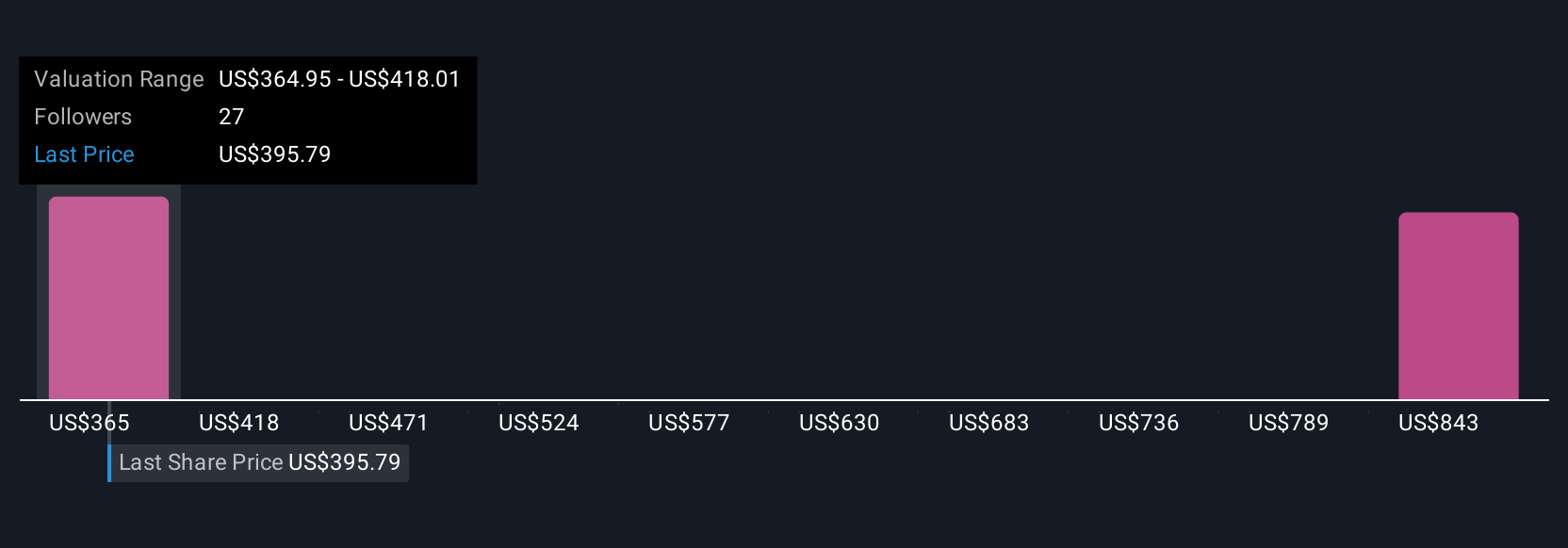

Seven fair value estimates from the Simply Wall St Community range from US$364.95 to US$815.34 per share. As opinions differ widely, keep in mind that operational improvements and digital investments have become central themes in HCA’s outlook, shaping both future performance and investor debate.

Explore 7 other fair value estimates on HCA Healthcare - why the stock might be worth 11% less than the current price!

Build Your Own HCA Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HCA Healthcare research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HCA Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HCA Healthcare's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal