Royal Gold (RGLD): Revisiting Valuation as Investor Interest Grows Without Major News

Most Popular Narrative: 13.1% Undervalued

The most widely followed narrative in the market currently sees Royal Gold as undervalued, emphasizing the company's diversified growth drivers and resilient cash flow profile.

The strategic acquisitions of Sandstorm Gold and Horizon Copper will significantly diversify Royal Gold's asset base, reduce single-asset risk, and increase exposure to long-term growth projects. This increased diversification could drive more stable and growing revenue streams and improve net margins.

How does Royal Gold's valuation calculation stack up, and what are the bold projections backing it? Want to know why analysts are betting on a reshaped future profit engine and a premium multiple for this once-sleepy royalty giant? The answer lies in a blend of strong growth assumptions and a re-rated profit forecast that is shaking up expectations. Ready to uncover what analysts believe could unlock the next leap in value?

Result: Fair Value of $220.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, any sustained weakness in gold prices or operational setbacks at key mines could quickly challenge this bullish outlook and force a market reassessment.

Find out about the key risks to this Royal Gold narrative.Another View: Market Valuation Metrics

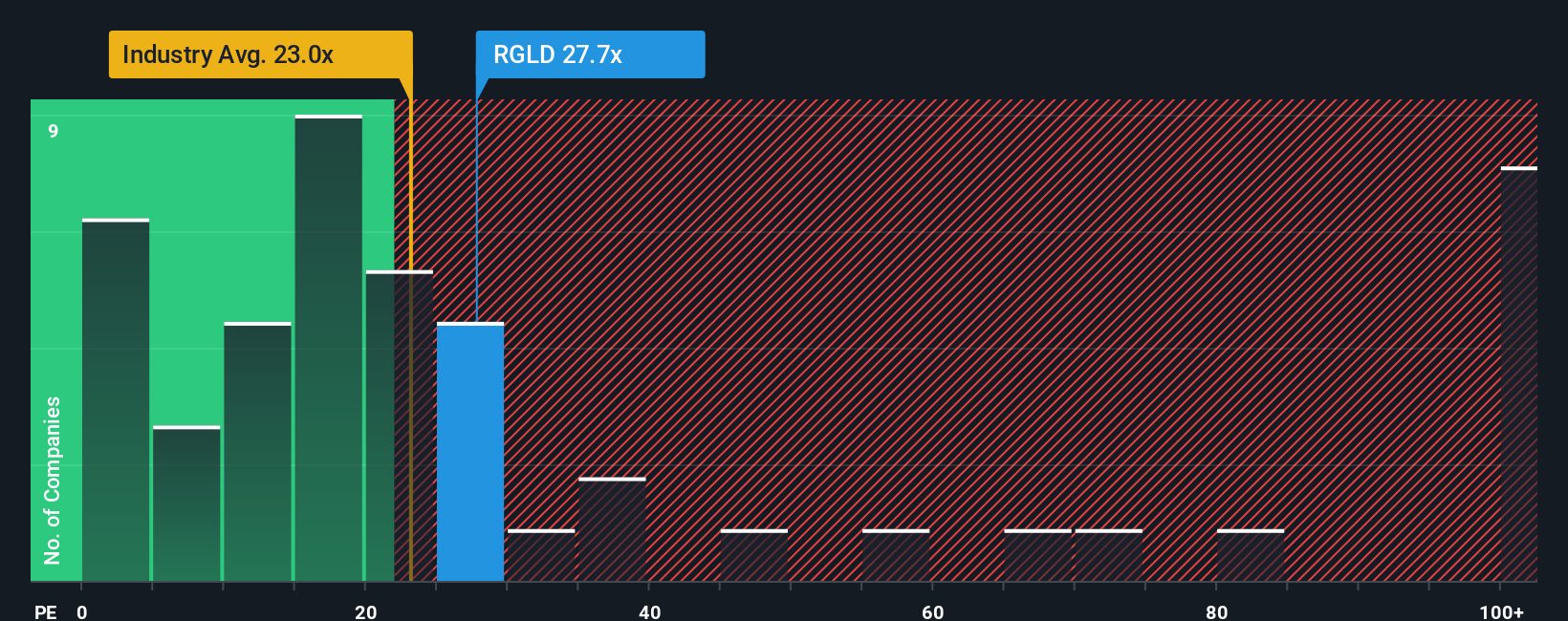

Yet, looking through a different lens reveals Royal Gold’s shares are currently priced higher than most peers in the US Metals and Mining sector based on common valuation ratios. This raises questions over how much future growth is already reflected in the stock.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Royal Gold Narrative

If you see things differently or prefer to dive into the data yourself, you can craft your own Royal Gold story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Royal Gold.

Looking for more investment ideas?

Smart investors do not stop at a single opportunity. Make your next move with ideas that have serious momentum or unique growth angles others might miss. Your future self may thank you.

- Supercharge your watchlist by tapping into innovative companies shaping medical tech, with the power of healthcare AI stocks at your fingertips.

- Boost your portfolio’s cash flow by uncovering high-yield potential through dividend stocks with yields > 3% featuring stocks with attractive dividend payouts.

- Leap ahead in tomorrow’s financial revolution by targeting companies driving blockchain progress via cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal