Analyzing Casey's Stock After Record Highs and Strong Cash Flow Outlook for 2025

Trying to decide what to do with Casey's General Stores stock right now? You are not alone. With the company sitting near all-time highs and returning an impressive 220.7% over the past five years, it is worth asking whether the stock still has more room to run or if the best days have already been priced in. Even in just the past year, Casey's has surged 48.9%, with a particularly strong 9.5% gain in the last 30 days despite a slight dip of -1.8% over the most recent week. That uptick has come alongside broader optimism about the convenience store sector and consumer resilience, which has attracted new attention from both retail and institutional investors. Yet, with these kinds of gains, the question is always about valuation: is Casey's truly a bargain or has excitement driven the price ahead of fundamentals? On that score, the company earns a value score of 1 out of 6, suggesting it passes just one key undervaluation check. In the next sections, we will break down what different valuation methods reveal about Casey's and toward the end, explore an even more insightful way to cut through the noise and judge the stock's real worth.

Casey's General Stores scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Casey's General Stores Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and discounting them back to their present value. This provides a way to judge whether a stock is currently undervalued, overvalued, or priced about right based on realistic expectations of its future profitability.

For Casey's General Stores, the latest reported Free Cash Flow stands at $635.2 Million. Analyst forecasts estimate this will continue to grow, with projections reaching $830.4 Million by 2029. After the first few years, long-term projections are extrapolated. Overall, Casey's is expected to steadily boost its cash generation through 2035.

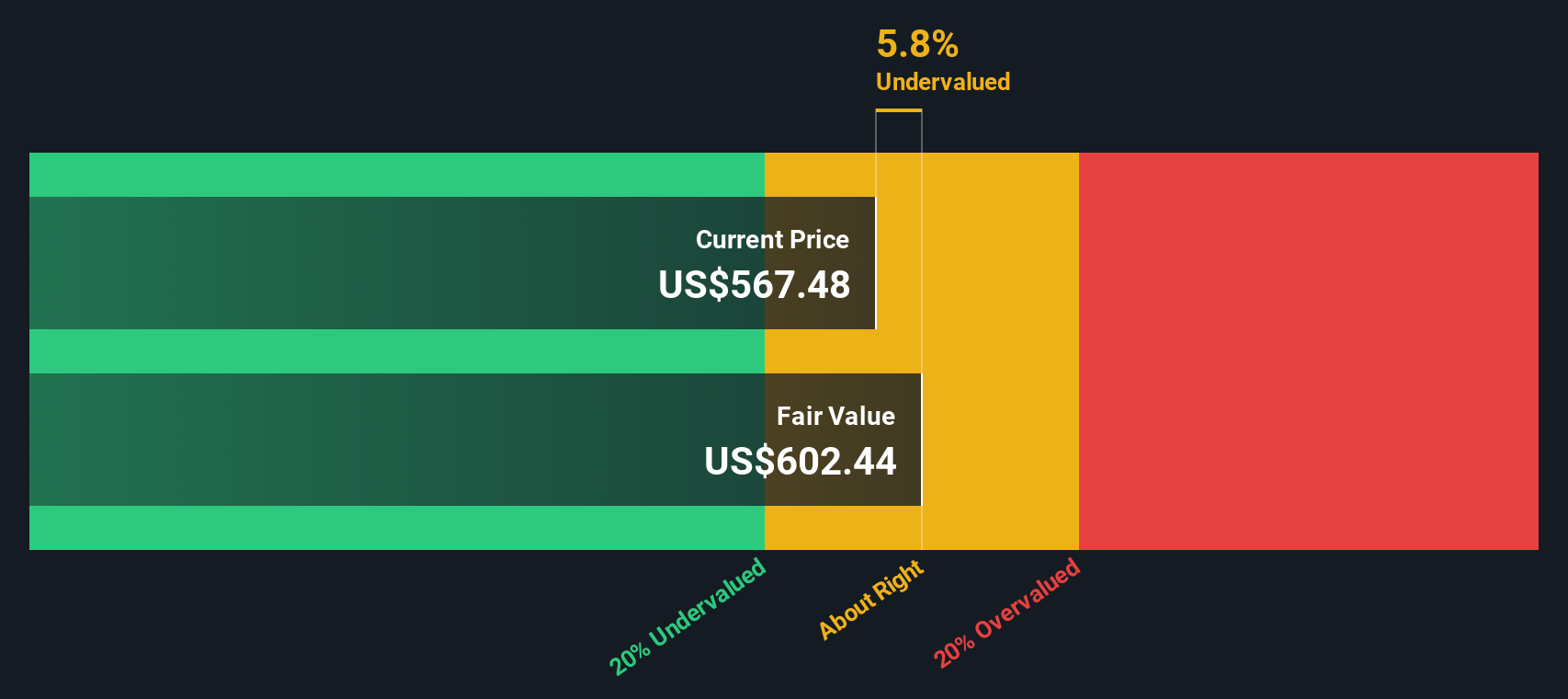

According to the DCF model, the estimated intrinsic value of Casey's General Stores is $604.50 per share. Compared to the current price, this suggests the stock trades at an 8.8% discount to its true value, implying it is just a bit undervalued.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Casey's General Stores.

Approach 2: Casey's General Stores Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies, as it reflects how much investors are willing to pay for each dollar of current earnings. This makes it especially effective for assessing mature, consistently profit-generating businesses like Casey's General Stores.

A "normal" or "fair" PE ratio for a stock depends on a number of factors, including expected earnings growth, risk, profit margins, and broader industry conditions. Higher expected growth and lower risk typically justify higher PE ratios, while slower growth or more uncertainty tend to lower the fair range.

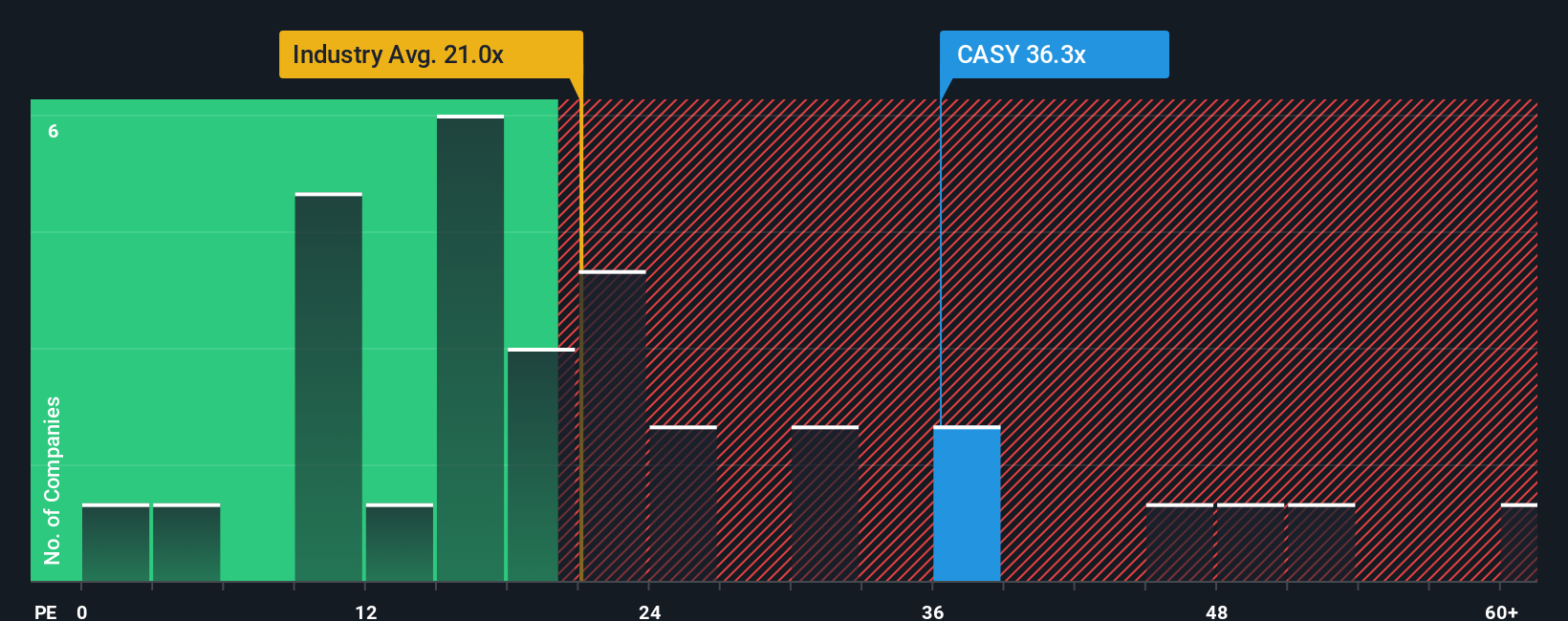

Currently, Casey's trades at a PE ratio of 35.2x. This is significantly above the average for other Consumer Retailing companies at 21.1x, and also above the peer group average of 18.4x. Instead of relying solely on these benchmarks, Simply Wall St calculates a proprietary "Fair Ratio," taking into account Casey's growth profile, profitability, industry, and market cap to arrive at a more nuanced valuation. For Casey's, the Fair Ratio is 23.1x.

The Fair Ratio provides a more comprehensive gauge than just looking at peer or industry averages, as it incorporates both company-specific dynamics such as growth potential and risk, as well as how these compare within the context of its sector and overall market size.

With a PE of 35.2x compared to a fair value of 23.1x, Casey's appears overvalued based on this metric.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Casey's General Stores Narrative

Earlier we mentioned that there is an even better way to cut through the noise of traditional valuation. Let's introduce you to Narratives. A Narrative is simply your story about a company, connecting what you believe about its future to the numbers, like fair value estimates, projected revenue, and margin assumptions. By using Narratives, you tie together Casey's actual business drivers, your expectations, and industry changes to create a personalized, evidence-based fair value.

Narratives are a straightforward, accessible tool available on the Simply Wall St platform within the Community page, where millions of investors share their perspectives. They help you decide when to buy or sell by showing you how your fair value estimate compares to the current price, and they automatically update as new information such as earnings or news comes in.

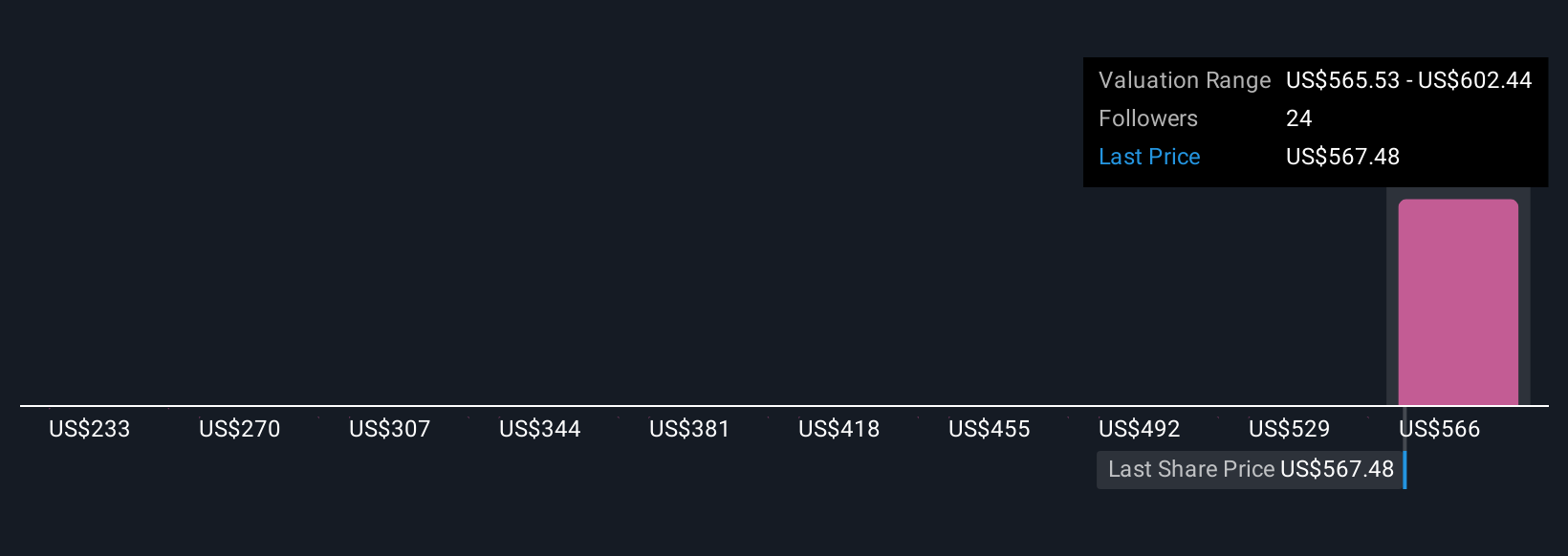

For example, one investor might build a Narrative focused on Casey’s aggressive store expansion and digital upgrades, resulting in a high fair value near $600 per share. Another might emphasize margin risks and slowing growth, seeing a fair value closer to $490. Your own Narrative can help you make clearer, more confident investment decisions, supported by both your insights and up-to-date financial data.

Do you think there's more to the story for Casey's General Stores? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal