DaVita (DVA): Exploring Valuation Following FTSE All-World Index Exit and Short-Term Volatility

DaVita (DVA) just made headlines after being dropped from the FTSE All-World Index, a move that rarely goes unnoticed by investors. This development can spark forced selling by index-tracking funds and inject some short-term volatility into the market. Whenever this kind of index reshuffling happens, it is natural to wonder whether the market is sending a signal about the company’s fundamentals or if this is simply mechanical noise unrelated to DaVita’s long-term health.

Looking at the bigger picture, DaVita’s stock has struggled this year despite the company posting positive annual revenue and net income growth. The shares are down over 17% in the last twelve months, trailing both the broader healthcare sector and the overall market. While this year’s performance has lacked the momentum seen in prior years, DaVita’s track record over a three- and five-year period remains strong, reflecting stable operational execution and consistent demand for its critical healthcare services.

After this year’s slide and the recent index exclusion, is DaVita suddenly a value opportunity, or is the market just adjusting its expectations for future growth?

Most Popular Narrative: 13.5% Undervalued

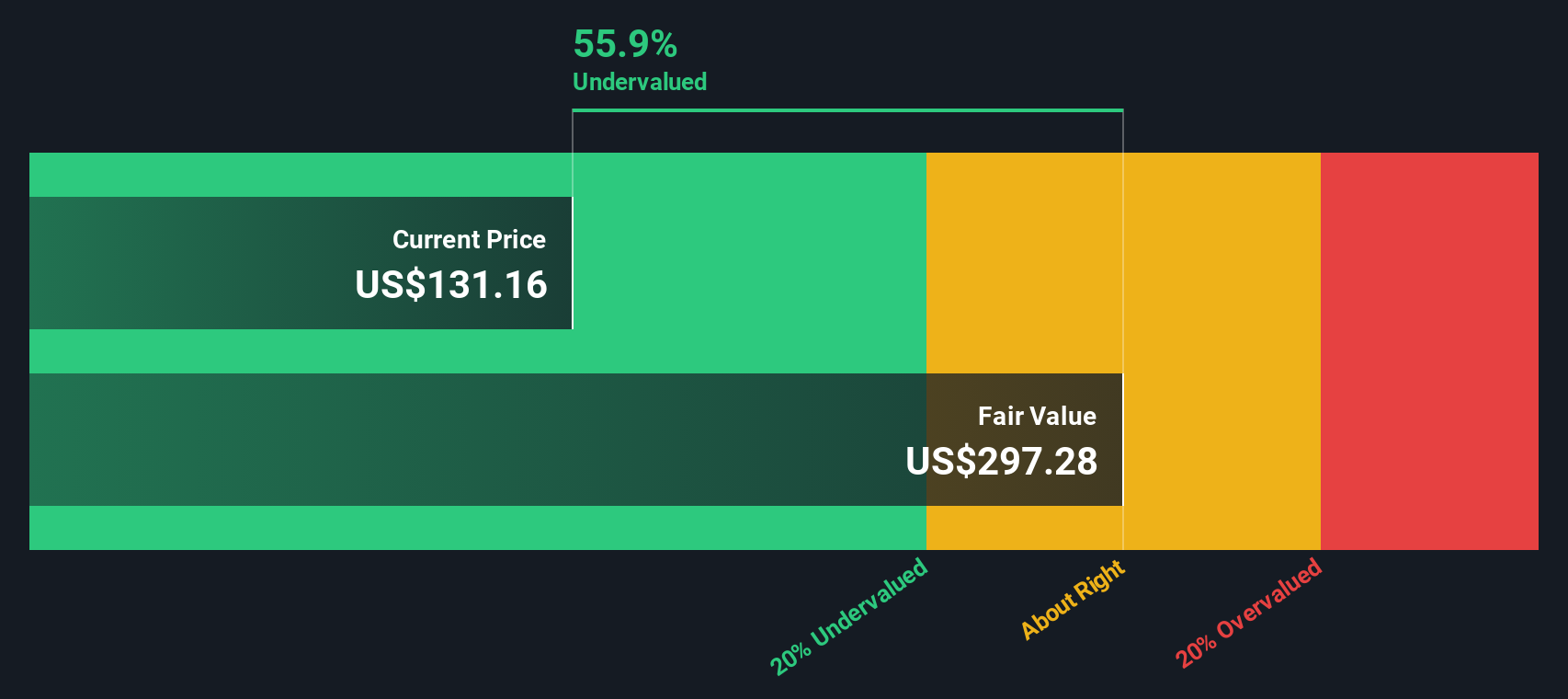

The currently dominant narrative values DaVita as undervalued compared to its estimated fair value. This perspective hinges on favorable long-term business drivers and ambitious efficiency goals, which analysts believe are not fully reflected in today's price.

Ongoing investments in technology, AI, and data analytics are driving structural cost reductions through improved operational efficiency and enhanced clinical outcomes. Management expects these initiatives to support margin improvement even in periods of flat or negative volume growth.

Want a real look at what powers this bullish view? There is one quantitative forecast built into the fair value that could reset your expectations. Are these financial assumptions bold or cautious? Discover which crucial metrics are behind the analysts’ confidence that DaVita is worth more. This is the kind of research top investors use to get ahead.

Result: Fair Value of $153.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistently high patient mortality rates or slow adoption of clinical innovation could disrupt DaVita’s growth trajectory and weaken the bullish outlook.

Find out about the key risks to this DaVita narrative.Another View: Our DCF Model

To check the story from another angle, we looked at DaVita using the SWS DCF model. This approach also points to the stock being undervalued, but it is built on different assumptions about future cash flows. Which method do you trust, and why?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DaVita Narrative

If you see things differently or prefer digging into the numbers yourself, crafting a personal narrative takes less than three minutes. Do it your way

A great starting point for your DaVita research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Angles?

Don’t just stop at DaVita. The market is filled with overlooked gems, trailblazers, and steady income payers ready for your next move. Make your watchlist matter with these standout ideas.

- Tap into dynamic growth by targeting AI penny stocks. This is home to companies at the forefront of artificial intelligence advancements and disruptive digital innovation.

- Lock in reliable cash flow potential with dividend stocks with yields > 3%. Here, you’ll find established businesses offering consistently high yields above 3%.

- Spot under-the-radar value opportunities by focusing on undervalued stocks based on cash flows. This is a curated set of stocks trading well below intrinsic cash flow estimates for strong bargain potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal