How TD Cowen’s Regulatory Upgrade Could Reshape Delek US Holdings’ (DK) Risk Profile

- TD Cowen recently upgraded Delek US Holdings from 'Sell' to 'Hold,' citing increased confidence in its regulatory standing after being granted key small refinery exemptions.

- This upgrade reflects growing optimism among analysts, who view regulatory support as a material factor influencing perceptions about the company's future prospects.

- We'll explore how TD Cowen's increased confidence in regulatory exemptions could influence Delek's overall investment outlook and risk profile.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Delek US Holdings Investment Narrative Recap

Owning shares in Delek US Holdings means believing in the ongoing importance of U.S. hydrocarbon refining and the company’s ability to maintain financial flexibility despite a challenging earnings environment. The recent TD Cowen upgrade, driven by renewed confidence in small refinery exemptions, may alleviate near-term regulatory risk, a key catalyst for Delek, but persistent net losses and declining revenues remain the most material risks and may outweigh any short-term boosts to sentiment.

The most relevant recent announcement is Delek’s persistent share buybacks, with over 3 million shares repurchased since the start of 2025 despite reporting significant net losses. While these buybacks may bolster near-term shareholder returns, ongoing operating losses and elevated capital requirements raise important questions about the sustainability of such capital allocation decisions.

However, investors should also be aware that, even with favorable regulatory shifts, continued losses and cash flow pressures could...

Read the full narrative on Delek US Holdings (it's free!)

Delek US Holdings' outlook suggests revenues of $10.3 billion and earnings of $1.5 billion by 2028. This projection is based on a 1.5% annual revenue decline and a $2.36 billion increase in earnings from the current $-863.6 million.

Uncover how Delek US Holdings' forecasts yield a $28.46 fair value, a 14% downside to its current price.

Exploring Other Perspectives

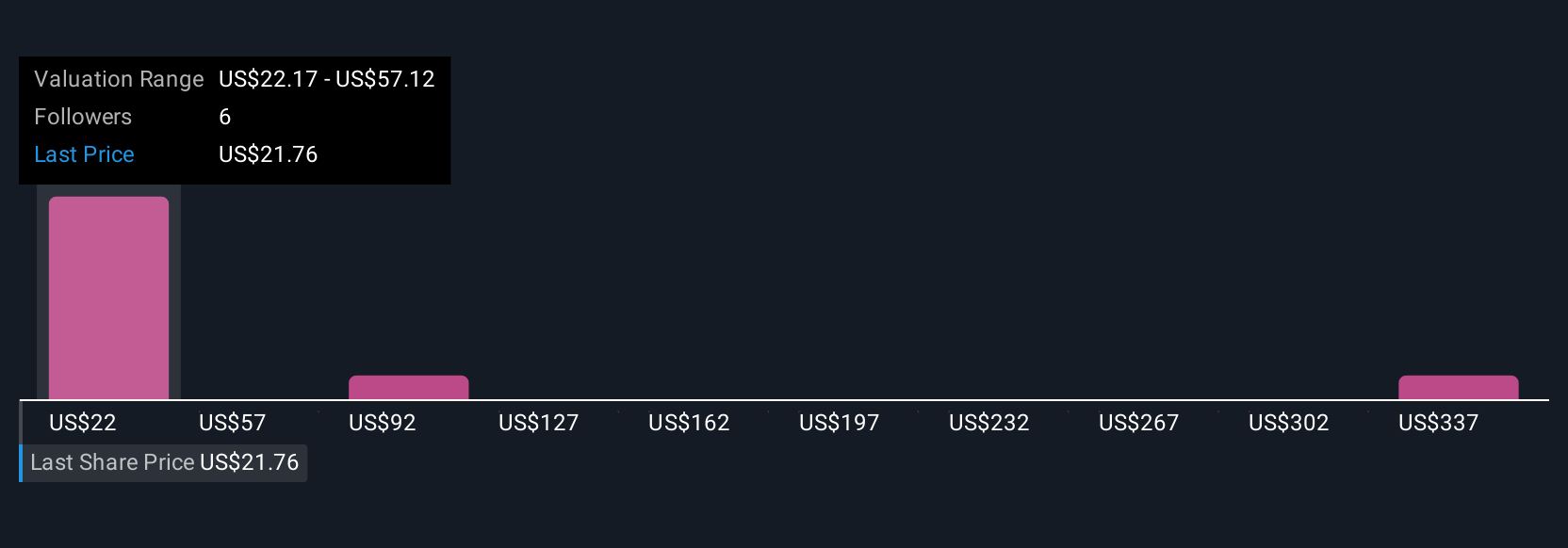

Four fair value estimates from the Simply Wall St Community put Delek’s worth between US$9.71 and US$371.71 per share, reflecting wide disagreement. Several community members may be weighing the evolving regulatory picture, but operational losses and balance sheet constraints still present immediate challenges for performance.

Explore 4 other fair value estimates on Delek US Holdings - why the stock might be worth less than half the current price!

Build Your Own Delek US Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delek US Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Delek US Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delek US Holdings' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal