Hecla Mining (HL): Evaluating Valuation Following S&P 1000 Index Inclusion

Hecla Mining (HL) just got the call-up to the S&P 1000, a move that has more than a few investors taking notice. When a company joins a major index like this, it frequently brings a wave of institutional demand as funds tracking the index adjust their holdings. This kind of event often means elevated trading volumes and can mark a pivotal step in a company’s market journey, shining a brighter spotlight on Hecla’s prospects and putting questions of valuation front and center.

The timing for this development is interesting as well. While the past week saw a minor pullback, Hecla’s year-to-date and recent three-month gains have been substantial, hinting at shifting perceptions around risk and growth potential. Recent months have seen more attention on gold and silver miners overall. Now, with this index addition, Hecla finds itself in the path of new capital flows and possibly new expectations about its future trajectory.

So where does this leave investors? Is this a true buying window, or has the market’s enthusiasm already priced in Hecla’s next chapter?

Most Popular Narrative: 25% Overvalued

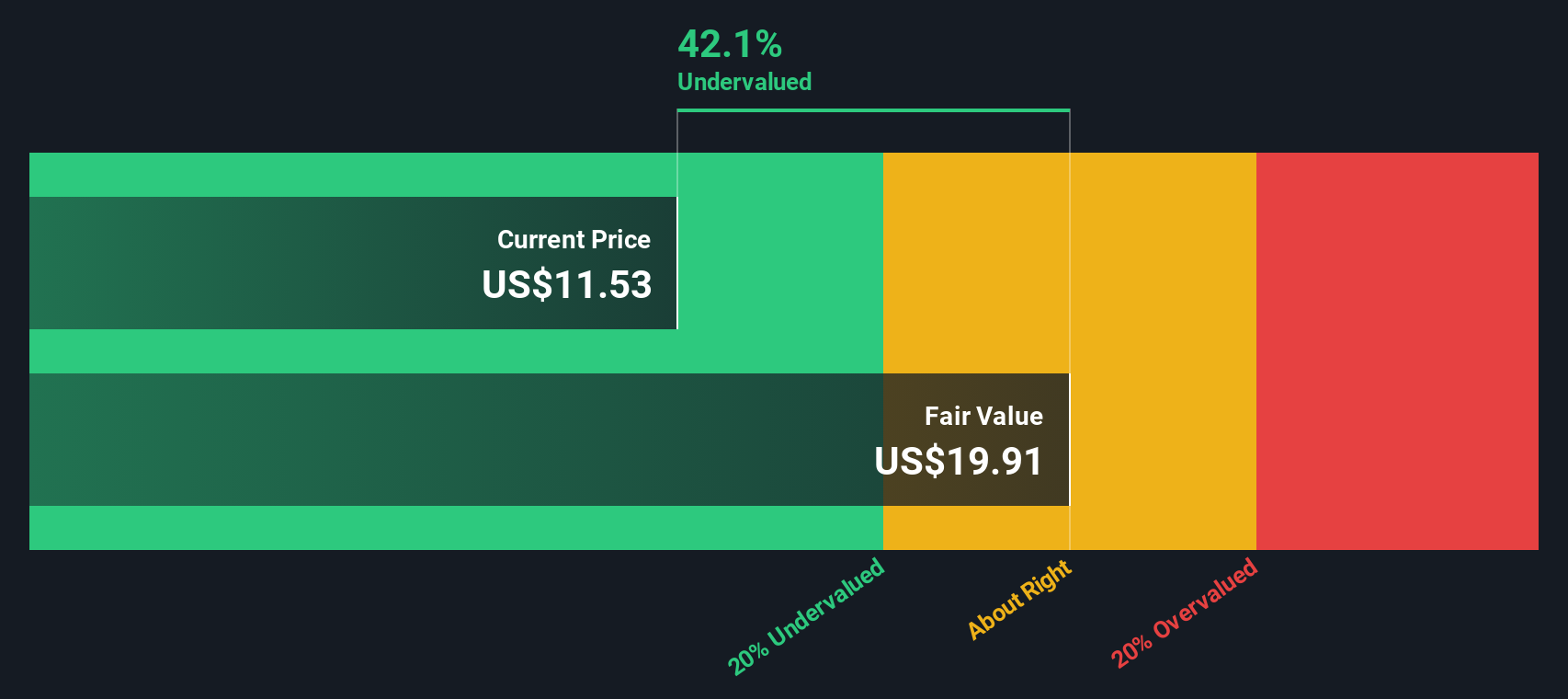

The most widely followed valuation narrative suggests that Hecla Mining’s current share price is trading well above its calculated fair value. This perspective draws on improved revenue growth forecasts and rising profit margin projections but ultimately sees the market price as too rich.

Enhanced operational efficiency through automation, advanced analytics, and mine planning improvements at Greens Creek and Lucky Friday is expected to lower all-in sustaining costs (AISC). This would contribute to healthier net margins and stronger bottom-line performance as silver markets improve.

Want to know why analysts think Hecla’s price is running hot? There is a surprising mix of upgraded growth expectations and ambitious margin targets fueling this call. The make-or-break factors behind this valuation might flip the narrative for good. Intrigued by what’s under the hood? Discover which aggressive assumptions power this bold fair value estimate.

Result: Fair Value of $8.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, steadily rising capital needs and potential permitting delays at projects like Keno Hill could challenge Hecla’s long-term profit outlook and expected growth.

Find out about the key risks to this Hecla Mining narrative.Another View: What Does Our DCF Model Say?

While the market is focused on traditional valuation multiples, our SWS DCF model tells a different story. It suggests Hecla may actually be worth far more based on future cash flows. Can earnings-driven optimism and model-based projections both be right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hecla Mining Narrative

If you see things differently, or want to dive deeper using your own methodology, it’s simple to craft your own take in minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Hecla Mining.

Looking for more investment ideas?

Don’t let great opportunities pass you by while everyone else moves ahead. Use the Simply Wall Street Screener to spot standout stocks with strong potential in today’s dynamic market.

- Tap into fast-emerging innovation by reviewing AI leaders shaking up entire industries with AI penny stocks.

- Maximize your growth potential with lesser-known companies that boast healthy balance sheets and compelling value using our penny stocks with strong financials.

- Secure passive income and long-term wealth by focusing on shares offering reliable yields of more than 3 percent through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal