EnerSys (ENS): Gauging Valuation as Industrial and Renewable Growth Fuels Fresh Investor Interest

EnerSys (NYSE:ENS) has been on investors’ radar lately after hitting a 52-week high of $107.50 on September 12, 2025. The big news is that the rally is being fueled by surging demand for the company’s Energy Systems and Motive Power segments. As EnerSys expands its reach in industrial and renewable applications, momentum is building and more eyes are turning to this global leader in stored energy solutions.

This climb comes at a time when EnerSys is putting up solid numbers over the past year, with the stock advancing nearly 14%. The company has not only gained traction in sectors like telecom and data centers, but it has also managed steady revenue and net income growth. The impressive 32% jump in the past three months speaks to building enthusiasm and shows a shift in sentiment from earlier in the year toward optimism about the company’s long-term prospects.

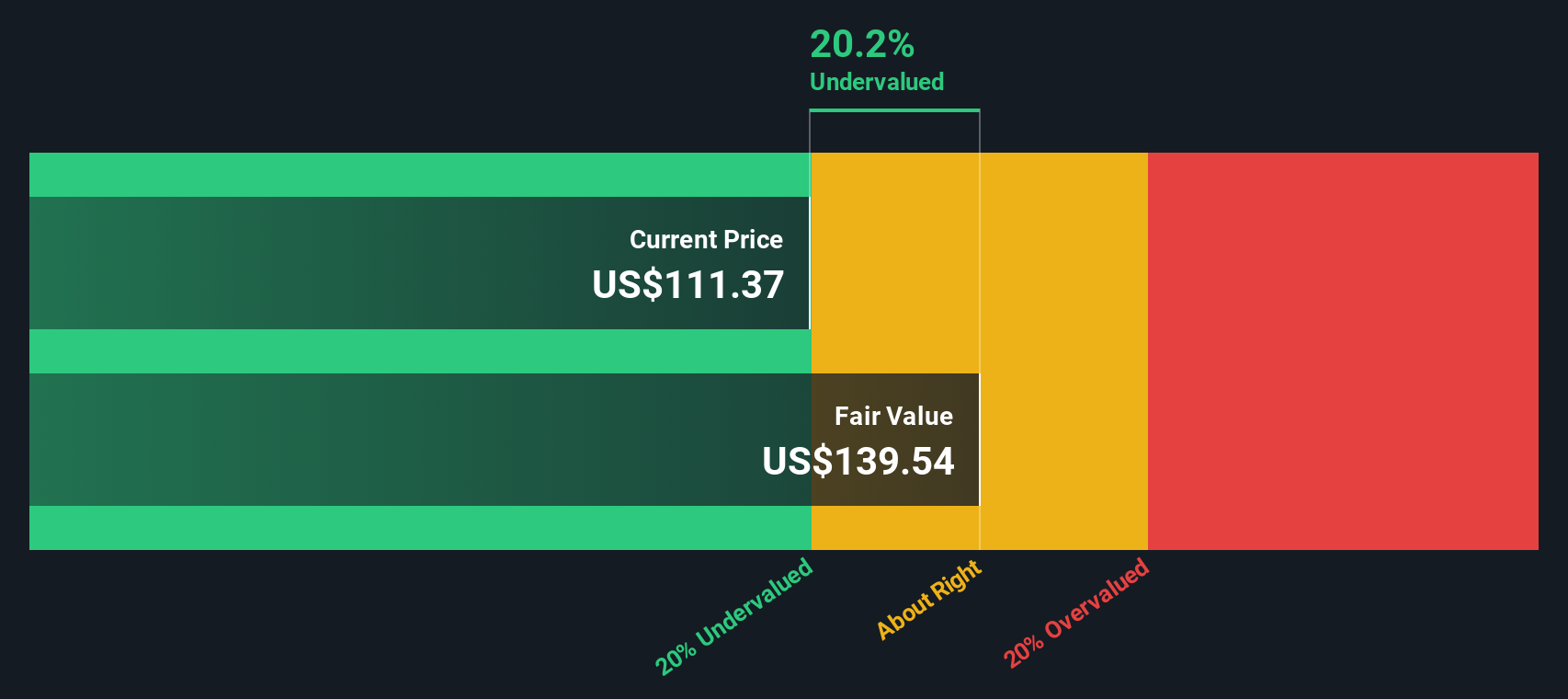

So, does this recent rally mean EnerSys is still trading at a discount, or is the market already looking ahead and pricing in future growth potential?

Most Popular Narrative: 6.7% Undervalued

According to the most widely followed narrative, EnerSys is trading below its estimated fair value, signaling that there could be meaningful upside based on current financial forecasts and market assumptions.

Ongoing recovery in U.S. communications and robust growth in Data Center deployments, both driven by upgrades to broadband and expansion of digital infrastructure, are expected to fuel accelerating demand for EnerSys' energy storage solutions and support multi-year revenue growth.

Curious how analysts land on this bullish valuation? There is one bold set of forward-looking financial targets propelling the narrative, from expectations around earnings momentum to a profit multiple that challenges industry norms. Want to see which key assumptions could be the tipping point for a fair value upgrade, and what could happen if they are missed? This outlook hinges on some surprising numbers underpinning the latest price target.

Result: Fair Value of $120.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, policy uncertainty and overreliance on acquisitions remain key risks that could quickly shift sentiment and challenge current growth expectations for EnerSys.

Find out about the key risks to this EnerSys narrative.Another View: SWS DCF Model Says Undervalued

Looking from a different angle, our DCF model also finds EnerSys to be undervalued, which supports the optimism from traditional valuation. But does the future really align with the forecasts built into these models?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own EnerSys Narrative

If you have your own perspective on EnerSys, or want to dig deeper into the data for a personal take, you can easily put together your own story in just minutes. Do it your way

A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stand still. If you want an edge in today’s market, check out these unique opportunities that could reshape your watchlist and help you spot tomorrow’s winners before the crowd.

- Tap into the explosive rise of artificial intelligence with picks focused on breakthrough AI innovation by checking out the latest in AI penny stocks.

- Secure your portfolio's future with strong, steady income by exploring stocks offering compelling yields and solid track records using our dividend stocks with yields > 3%.

- Catch early-stage disruptors with solid fundamentals and significant growth upside by scanning today’s most promising hidden gems through penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal