What Universal Health Services (UHS)'s Removal From the FTSE All-World Index Means For Shareholders

- Universal Health Services, Inc. (NYSE:UHS) was recently removed from the FTSE All-World Index, a development that can influence investor flows due to its effect on index-tracking funds and portfolio allocations.

- This change in index inclusion may impact the company's shareholder profile, as passive investment strategies often adjust their holdings when constituents shift within widely tracked benchmarks.

- We will now explore how Universal Health Services' removal from a major global index could affect its long-term investment outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Universal Health Services Investment Narrative Recap

To be a shareholder in Universal Health Services means believing in the long-term demand for healthcare and behavioral health services, as well as the company’s ability to adapt to sector changes. The recent removal from the FTSE All-World Index may briefly affect trading volumes and short-term sentiment tied to passive investment flows, but it does not appear to materially alter the company’s most important near-term opportunity, growth fueled by expanding outpatient behavioral health care, or the largest outstanding risk from regulatory uncertainty around Medicaid payments.

Among recent company announcements, the appointment of Darren Lehrich as Vice President of Investor Relations stands out. While unrelated to index status, this move could enhance the company’s engagement with institutional investors and analysts, a factor that may support communication and transparency as investors continue to focus on key catalysts like the outpatient behavioral health expansion and persistent risks from evolving regulation.

By contrast, the possibility of significant reductions in Medicaid supplemental payments remains a risk investors should be aware of, as these could...

Read the full narrative on Universal Health Services (it's free!)

Universal Health Services' outlook projects $19.0 billion in revenue and $1.5 billion in earnings by 2028. This reflects an annual revenue growth rate of 5.0% and an earnings increase of $0.2 billion from the current earnings of $1.3 billion.

Uncover how Universal Health Services' forecasts yield a $218.31 fair value, a 12% upside to its current price.

Exploring Other Perspectives

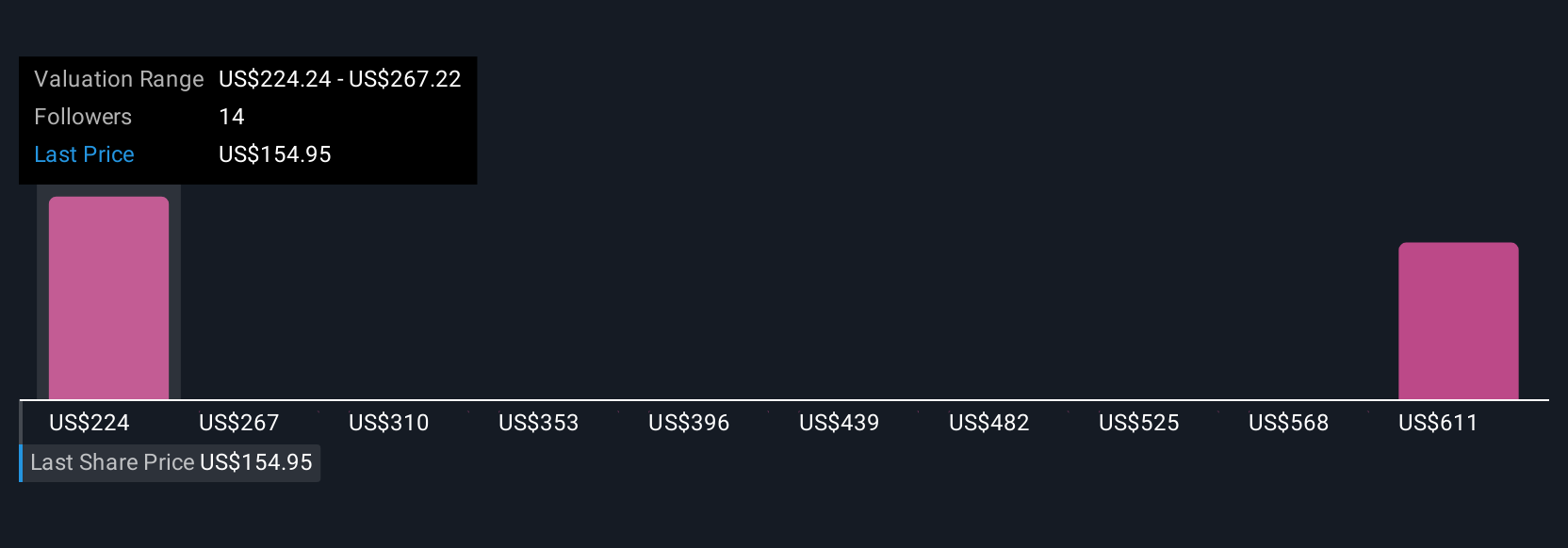

Three fair value estimates from the Simply Wall St Community currently span US$218 to US$644 per share. Considering this wide range, keep in mind that regulatory headwinds around Medicaid payments may shape future results quite differently and it helps to compare several viewpoints before deciding.

Explore 3 other fair value estimates on Universal Health Services - why the stock might be worth over 3x more than the current price!

Build Your Own Universal Health Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Health Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Universal Health Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Health Services' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal