What Genworth Financial (GNW)'s New $350 Million Share Buyback Means for Shareholders

- Genworth Financial announced in September 2025 that its Board of Directors had authorized a new share repurchase program of up to US$350 million, with funding from holding company capital and no expiration date.

- This latest buyback plan follows the near completion of a prior US$700 million program, reflecting continued management confidence in the company’s financial position and capital allocation strategy.

- We'll explore how Genworth’s decision to authorize another substantial share repurchase program shapes its current investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Genworth Financial's Investment Narrative?

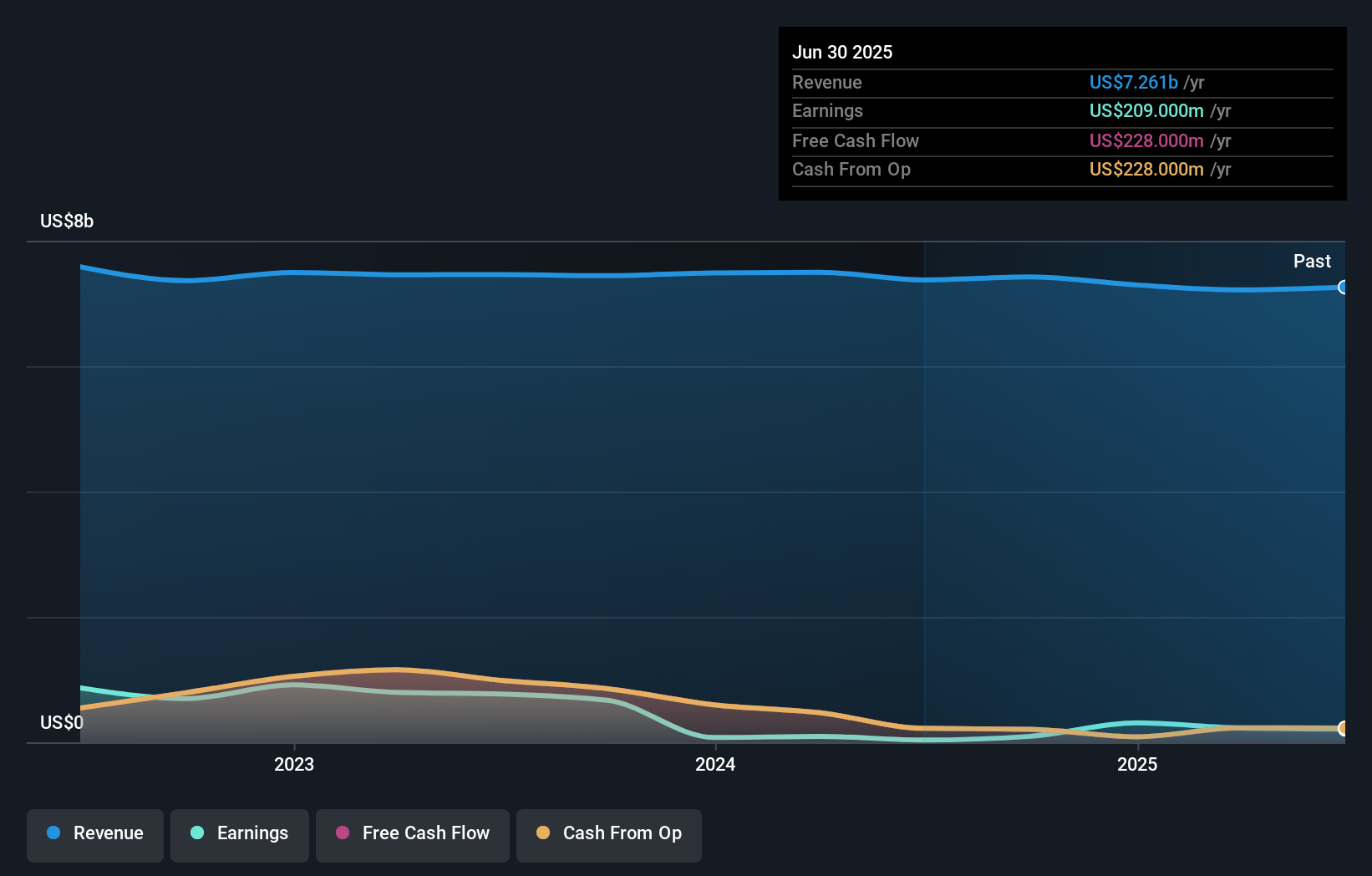

Being a Genworth Financial shareholder means believing in management’s ability to balance capital returns with operational challenges, especially as the company tackles competitive pressures and variable earnings. The recent US$350 million buyback authorization arrives just as Genworth completes a large prior repurchase, reinforcing management’s focus on shareholder value. However, the new buyback, while a positive sign of internal confidence, may not materially shift the company’s short-term catalysts, which still hinge on consistent earnings, industry trends, and ongoing shareholder activism pushing for structural changes. Recent price gains suggest renewed optimism, but key risks remain: questions about valuation linger given Genworth’s higher price-to-earnings ratio compared to industry peers, and persistent earnings volatility continues to loom large. For now, the buyback tells part of the story but does little to fundamentally change Genworth’s risk and reward equation.

On the other hand, lingering concerns about earnings stability remain important to watch.

Exploring Other Perspectives

Explore 2 other fair value estimates on Genworth Financial - why the stock might be worth as much as $7.11!

Build Your Own Genworth Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genworth Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Genworth Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genworth Financial's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal