How Agnico Eagle Mines’ (AEM) Stake in White Gold Could Shape Its Long-Term Growth Path

- Earlier this week, Agnico Eagle Mines participated in White Gold Corp.’s private placement to maintain its 19.8% stake, supporting ongoing exploration and development in the Yukon Territory’s White Gold District.

- This ongoing partnership highlights Agnico Eagle’s commitment to advancing high-potential exploration assets while strengthening its future project pipeline.

- We’ll now consider how Agnico Eagle Mines’ continued investment in exploration projects could influence its long-term growth outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Agnico Eagle Mines Investment Narrative Recap

To be a shareholder in Agnico Eagle Mines, you have to believe in the enduring value of gold as a store of wealth and Agnico Eagle’s ability to translate exploration upside into long-term production growth. The company's recent participation in White Gold Corp.'s private placement reinforces its commitment to deepening its exploration pipeline, but this move does not fundamentally shift the importance of gold prices as the primary near-term earnings driver, nor does it reduce the risk of operational disruptions or grade variability at key mines.

Among recent developments, Agnico Eagle’s solid Q2 2025 earnings, with net income of US$1,068.71 million and a declared quarterly dividend, remain most relevant. This outperformance reflects elevated gold prices and strong operational execution, both of which continue to shape investor sentiment much more than incremental exploration investments, reinforcing the prevailing focus on sustaining robust free cash flow and shareholder returns.

However, it is important to remember that if gold prices fall or stabilize lower, as can happen with changes in safe-haven demand, then...

Read the full narrative on Agnico Eagle Mines (it's free!)

Agnico Eagle Mines is projected to reach $11.0 billion in revenue and $3.4 billion in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 4.4% and a $0.4 billion increase in earnings from the current $3.0 billion.

Uncover how Agnico Eagle Mines' forecasts yield a $146.48 fair value, a 9% downside to its current price.

Exploring Other Perspectives

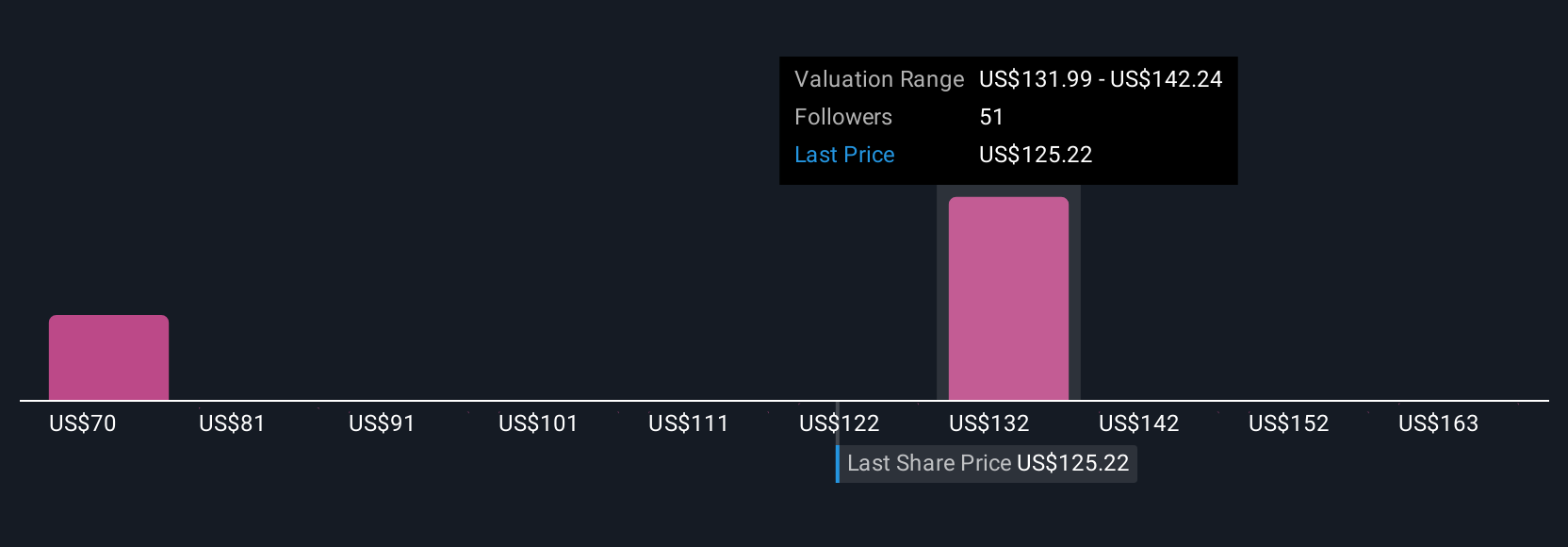

Simply Wall St Community members provided 10 fair value estimates for Agnico Eagle Mines that range from US$62.26 to US$207.22 per share. With ongoing dependence on high gold prices for earnings growth, these diverse perspectives highlight how views on future gold trends remain central to your investment outlook in this stock.

Explore 10 other fair value estimates on Agnico Eagle Mines - why the stock might be worth less than half the current price!

Build Your Own Agnico Eagle Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agnico Eagle Mines research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Agnico Eagle Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agnico Eagle Mines' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal