Butterfly Network (BFLY): Evaluating Valuation Following TIME Recognition and Key CTO Appointment

If you’re wondering whether Butterfly Network (BFLY) deserves a spot on your watchlist right now, you’re not alone. The company has just been named to TIME’s first-ever list of the World’s Top HealthTech Companies, an honor that instantly ramps up its visibility and validates its push to make point-of-care ultrasound more accessible. On top of that, Butterfly Network has appointed Victor Ku as Senior Vice President and CTO, bringing deep engineering and leadership experience to the table, which could be significant for its technology and innovation pipeline.

This combination of industry recognition and an experienced technology leader seems to have captured investor interest in a notable way. Shares jumped nearly 15% in after-hours trading following the TIME announcement, marking a sharp contrast to the more measured return of 25% over the past year. While the stock struggled earlier in the year, recent sentiment suggests growing confidence that Butterfly Network could be turning a corner, especially given its strengthened executive bench and ongoing efforts to rein in cash burn.

With a new CTO onboard and reputational momentum from TIME’s global list, the big question now is whether today’s price reflects Butterfly Network’s true value or if the market is already factoring in the company’s next leg of growth.

Most Popular Narrative: 31.5% Undervalued

The most widely followed narrative currently sees Butterfly Network as significantly undervalued, suggesting the market may be underappreciating its future potential.

Progress on the HomeCare pilot, targeting large populations of heart failure patients with portable, AI-assisted ultrasound and remote specialist diagnosis, validates Butterfly's unique position to capitalize on the healthcare trend toward preventive, decentralized care. This approach has the potential to generate significant new revenue and improve net margins as contracts expand at the state and national level.

Curious what’s powering this bullish outlook? The narrative hinges on expectations of transformative growth in both revenue and profit margins, betting big on Butterfly Network’s recurring digital revenues and its unique healthcare platform. Want to know which key metrics could make or break this valuation? Dive deeper to uncover the bold financial projections critics and supporters are debating right now.

Result: Fair Value of $3.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent executive turnover or delays in closing major enterprise deals could quickly erode confidence in Butterfly Network’s long-term growth story.

Find out about the key risks to this Butterfly Network narrative.Another View: Market Comparison Paints a Different Picture

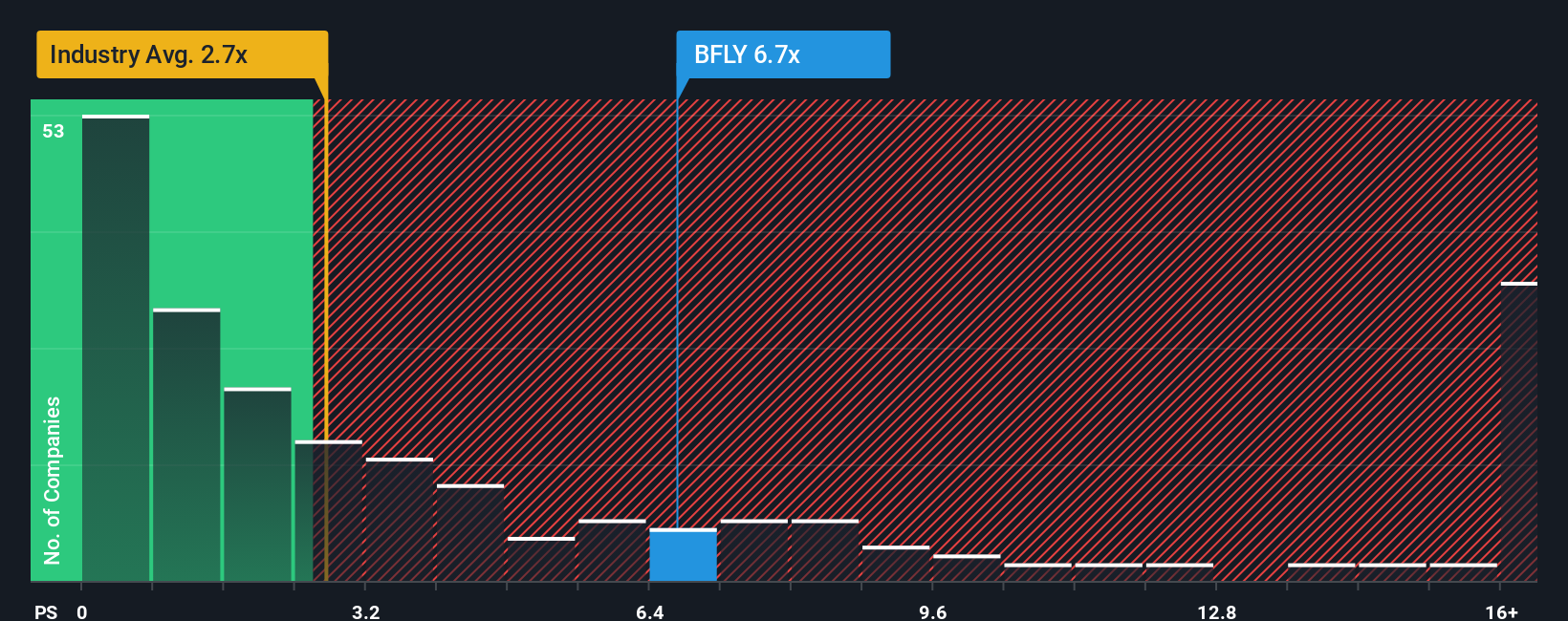

Looking at Butterfly Network's value using typical market metrics presents a very different story. By this measure, shares appear expensive compared to industry norms. Could this signal that the market is getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Butterfly Network Narrative

If you see the story unfolding differently or prefer to dig into the numbers on your own terms, start building your personal outlook in just minutes. Do it your way.

A great starting point for your Butterfly Network research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stick to just one opportunity? Make your next move by checking out other fast-moving sectors and unique value plays using the Simply Wall Street Screener.

- Uncover income potential with shares offering compelling yield opportunities using the dividend stocks with yields > 3%.

- Spot undervalued gems that the market may be overlooking by taking advantage of the undervalued stocks based on cash flows.

- Catch the innovators at the forefront of artificial intelligence trends and put your portfolio ahead of tomorrow’s breakthroughs through the AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal