Texas Pacific Land (TPL): Assessing Valuation as Dual Listing on NYSE Texas Boosts Investor Attention

Texas Pacific Land (TPL) is making headlines after announcing plans to dual list its common stock on the newly launched NYSE Texas exchange, while maintaining its primary listing on the New York Stock Exchange. For investors considering the next move, this kind of event can stand out. It could mean greater liquidity, a broader pool of buyers, and possibly increased visibility for the company’s shares. Along with a minor insider purchase and a board member stepping down for routine reasons, the listing news is top of mind for market watchers.

Taking a step back, Texas Pacific Land’s shares have faced challenges this year, with a sharp slide coming into focus. Over the past year, the stock is down approximately 7%, and it has declined about 26% year-to-date. Its remarkable five-year gain of 514% reminds investors of its longer-term growth engine. While some recent developments have captured attention, momentum has softened and the dual listing marks a potential turning point.

With shares under pressure and a major listing change at play, is Texas Pacific Land a value opportunity for patient investors or does the market already reflect its growth outlook?

Most Popular Narrative: 4.9% Undervalued

The prevailing narrative sees Texas Pacific Land as marginally undervalued based on future earnings growth and profit margin expansion projected over the next three years.

Expansion and diversification of the water services segment, with consistent double-digit revenue growth, increasing volume gains, and structural demand tailwinds from rising produced water volumes due to deeper drilling, suggest durable, high-margin revenue streams beyond oil/gas royalties. This could help mitigate earnings volatility and support long-term cash flow.

Curious about the numbers behind this attractive valuation? There’s a striking story hidden in the way future margins and revenue growth are expected to interact. Want to see what bold expectations set this stock apart in the eyes of analysts? Find out how the outlook for this unique business is reshaping the price target debate.

Result: Fair Value of $921.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent oil royalty growth and reliable water segment expansion could quickly challenge any thesis that Texas Pacific Land faces long-term vulnerability.

Find out about the key risks to this Texas Pacific Land narrative.Another View: What About Its Market Valuation?

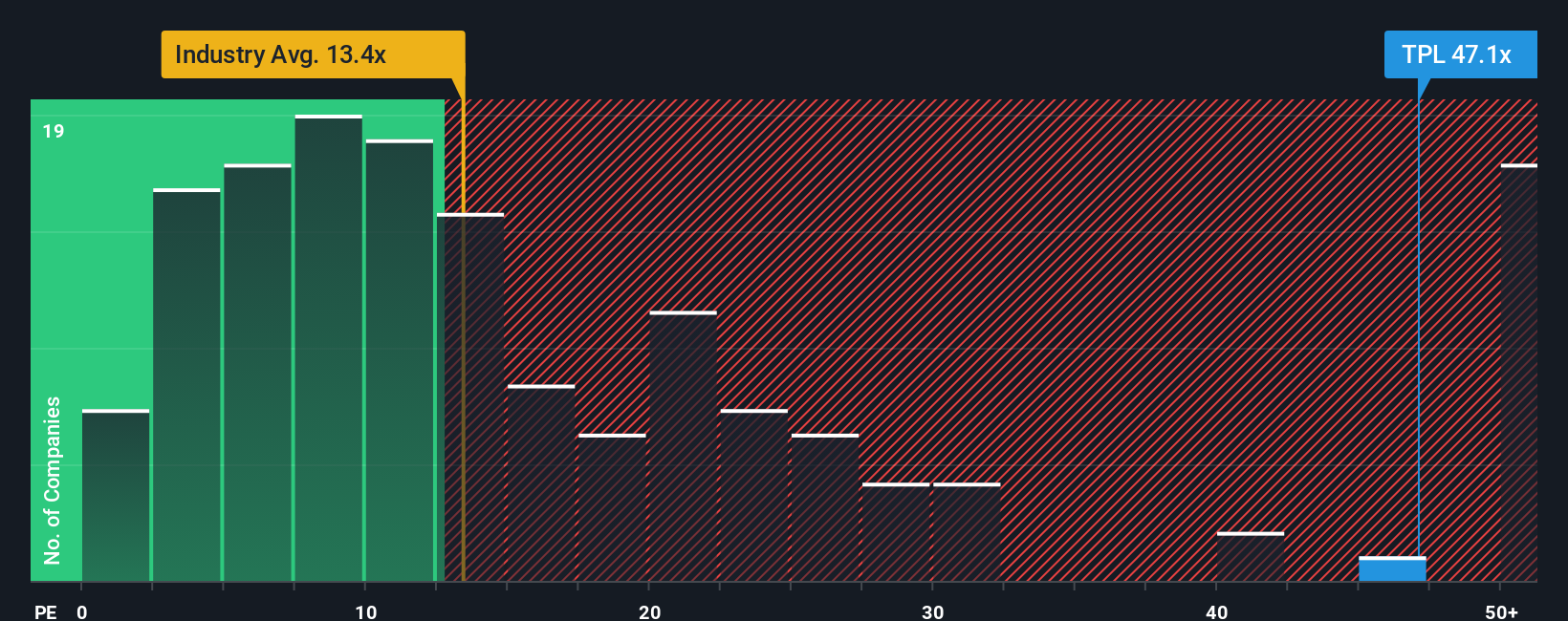

While analyst projections suggest Texas Pacific Land is slightly undervalued, a look at its share price in relation to earnings presents a different perspective. Compared to the rest of its industry, the shares appear expensive. Does the market see something analysts are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Texas Pacific Land Narrative

If you see things differently or want to dig into the details yourself, you can craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Texas Pacific Land research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let exciting opportunities pass you by just because your watchlist is full. These standout themes are packed with fresh potential. See what you could be missing today.

- Grow your potential income by tracking stocks known for reliable payouts with dividend stocks with yields > 3%.

- Spot tomorrow's leaders in medical innovation and transformative diagnostics through healthcare AI stocks.

- Capture market bargains before the crowd by targeting undervalued companies using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal