Zimmer Biomet (ZBH): Examining Valuation After Upbeat Q2 Earnings and Upgraded Full-Year Guidance

If you’ve been watching Zimmer Biomet Holdings (ZBH) lately, the latest quarterly update may have caught your eye. The company just reported Q2 results that topped expectations, prompting leadership to boost full-year adjusted EPS guidance and trim anticipated tariff headwinds. For investors weighing what to do next, this combination of stronger profits, improving outlook and lighter cost worries is sparking fresh optimism that Zimmer Biomet could be turning a new corner.

This upbeat momentum is not happening in isolation. Over recent months, Zimmer Biomet’s stock has seen swings from renewed buying to temporary pullbacks. These latest analyst upgrades and management’s bullish moves have helped stem some of the longer-term stagnation since last year. While the share price has largely trended sideways over the past 12 months, this quarter finally injected positive sentiment, as the company’s margin recovery story gains traction even amid ongoing integration challenges and a shifting market landscape.

But with the market’s mood lifting, the real question is whether Zimmer Biomet has room to surprise further or if recent enthusiasm means most of the future growth is already priced in.

Most Popular Narrative: 8.3% Undervalued

The most-watched narrative sees Zimmer Biomet Holdings as trading below fair value, based on future earnings growth, margin improvement, and discounted cash flow analysis provided by analysts. This view suggests upside potential if the company delivers on its operational targets and growth roadmap.

The company's focused investment in digital health, robotics, and data-driven surgical solutions (including the ROSA and upcoming Monogram platforms) is increasing adoption of premium offerings. This strategy enables margin expansion due to product mix and drives recurring revenues through connected care ecosystems, supporting higher net margins and earnings predictability.

What’s really fueling this bullish valuation? There are pivotal financial assumptions hidden behind the forecast that could radically shift the company’s future worth. Curious about which numbers are powering the optimism and how a handful of growth drivers could shape returns? The full narrative spills the details that could change your perspective on Zimmer Biomet’s true value.

Result: Fair Value of $110.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing pricing pressures and integration execution issues still loom. Any stumble here could quickly challenge the optimism around Zimmer Biomet’s valuation.

Find out about the key risks to this Zimmer Biomet Holdings narrative.Another View: Discounted Cash Flow Check

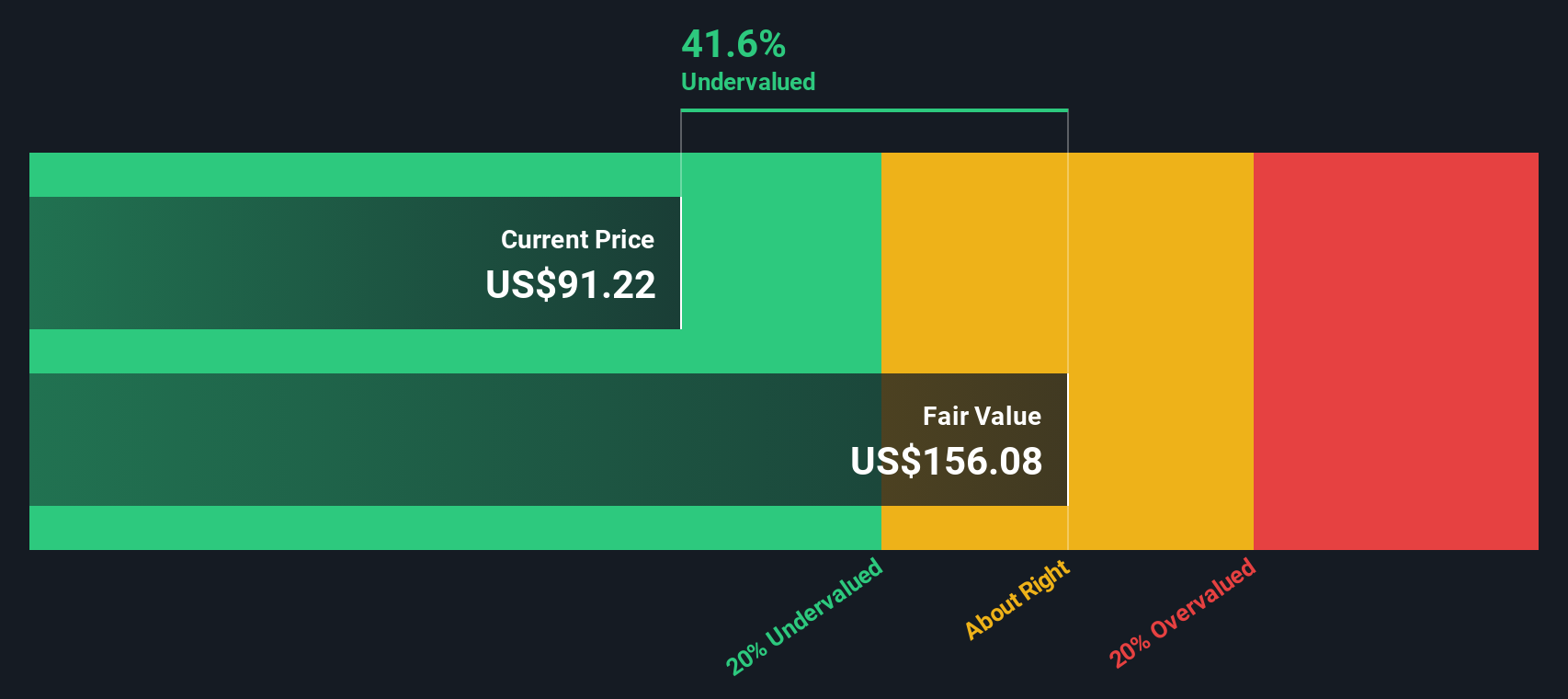

While analyst price targets suggest Zimmer Biomet is slightly undervalued, our DCF model paints a far bigger gap to fair value. This approach emphasizes future cash flows, not just earnings multiples. Could the real opportunity be even greater, or are both missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Zimmer Biomet Holdings Narrative

If you’re inclined to dive deeper or want to shape your own perspective, it’s quick and simple to run the numbers for yourself. Do it your way

A great starting point for your Zimmer Biomet Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for yesterday’s winners when they can capture tomorrow’s growth stories. Unearth hot, data-backed stock ideas in just minutes with these handpicked opportunities from Simply Wall Street’s screener:

- Unlock potential gains by scouting for overlooked gems among penny stocks with strong financials that might be flying under most investors’ radar.

- Capitalize on the next AI boom by spotting innovative healthcare companies at the intersection of medicine and technology with healthcare AI stocks.

- Secure steady income streams by targeting top performers that offer strong, sustainable payouts through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal