Himax Technologies (NasdaqGS:HIMX): Evaluating Valuation After Advanced Imaging and AI Unveilings at Taipei Showcase

If you have been watching Himax Technologies (NasdaqGS:HIMX) lately, there is a good chance this week’s big event at the Taipei Aerospace & Defense Technology Exhibition caught your attention. The company, alongside Liqxtal Technology, rolled out a lineup of next-generation imaging and AI-powered biometric solutions aimed squarely at aerospace and defense. With the spotlight on immersive virtual displays, advanced drone vision, and intelligent biometrics, the showcase signals an ongoing push into high-value markets that could shape Himax Technologies’ future footprint.

This burst of product innovation comes as the stock has already delivered strong gains, up 13% over the past month and more than 70% in the past year, even as broader earnings growth has lagged behind industry peers. The company’s active agenda, including several conference presentations in Asia this month, seems to be fueling renewed interest. Whether this momentum has staying power may come down to how investors weigh near-term product news against the complexities of long-term earnings performance.

After another rally and a series of new tech announcements, the question remains: Is the market giving Himax Technologies credit for its potential, or is there room for upside if growth materializes?

Most Popular Narrative: 4.8% Undervalued

The current valuation narrative sees Himax Technologies trading below its consensus fair value, reflecting optimism in its earnings outlook and business strategy.

Himax's leading position and rapid expansion in automotive display ICs, including TDDI, traditional DDIC, Tcon, and a growing pipeline of OLED projects, position it at the heart of automotive digital cockpit upgrades and EV/autonomous vehicle adoption. These trends are expected to drive higher ASPs and gross margins in the coming years and accelerate revenue growth from 2027 onwards as mass production ramps up.

Curious which financial drivers power this price target? The narrative banks on aggressive growth, strategic expansion, and margin transformation to redraw Himax’s future. Wondering just how ambitious those projections are compared to the status quo? You’ll want to see the underlying assumptions that make this story tick.

Result: Fair Value of $9.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent trade tensions and weak demand visibility across major segments remain top concerns and could quickly challenge the current optimism underpinning Himax’s outlook.

Find out about the key risks to this Himax Technologies narrative.Another View: Discounted Cash Flow Puts Value in Doubt

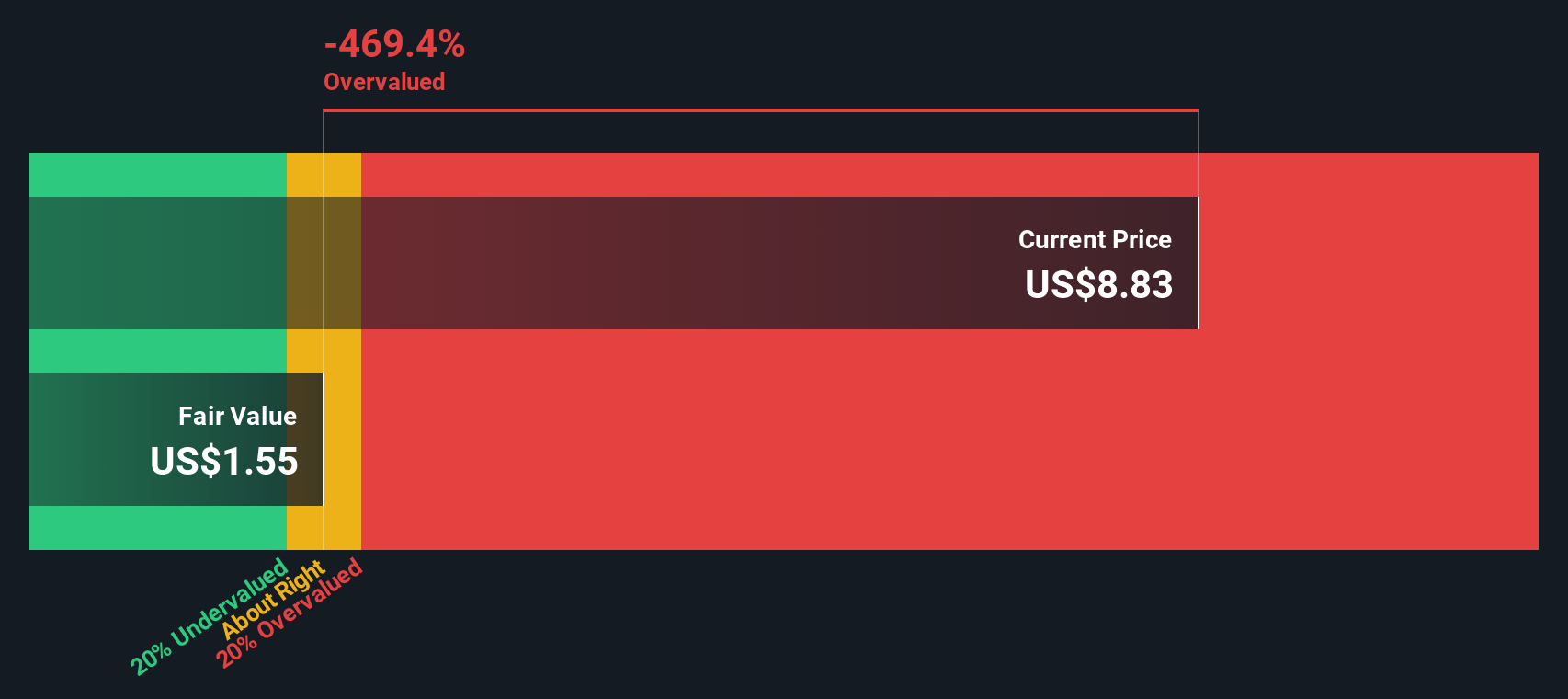

While the market sees Himax Technologies as undervalued based on its future earnings growth, our DCF model arrives at a very different conclusion, suggesting the current price might be stretched. Could this challenge the bullish outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Himax Technologies Narrative

If you’d rather test your own theories or dive deeper into the numbers, you have the tools to build your case in just minutes with Do it your way.

A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Stock Ideas?

Don’t settle for the obvious. Step ahead of the market and lock in fresh opportunities with the Simply Wall Street Screener. Right now, there are smart investments across trending sectors that you don’t want to overlook.

- Supercharge your watchlist by backing innovation. Boost your portfolio with potential standouts among AI penny stocks.

- Secure steady returns by tapping into a handpicked group of companies offering dividend stocks with yields > 3%, perfect for building consistent income.

- Catch the market’s next bargain before others do. Zero in on undervalued gems powered by undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal