The Bull Case for QuidelOrtho (QDEL) Could Change Following Launch of Rapid Triple Virus Point-of-Care Test

- QuidelOrtho Corporation recently expanded its QUICKVUE portfolio with the launch of the QUICKVUE Influenza + SARS Test, a CLIA-waived, 510(k)-cleared rapid immunoassay that differentiates between influenza A/B and SARS-CoV-2 antigens in as fast as 10 minutes for professional healthcare settings in the United States.

- This product introduction enables clinicians to quickly distinguish between COVID-19 and seasonal flu infections from a single patient sample, potentially streamlining diagnostic workflows and improving treatment decisions at the point of care.

- We'll explore how the introduction of a triple detection rapid test could shape QuidelOrtho’s relevance in the point-of-care diagnostics market.

Find companies with promising cash flow potential yet trading below their fair value.

QuidelOrtho Investment Narrative Recap

For QuidelOrtho shareholders, the core thesis rests on the company's ability to offset falling COVID-related revenue and navigate post-pandemic normalization by expanding its diagnostic portfolio and maintaining relevance in point-of-care testing. The launch of the QUICKVUE Influenza + SARS Test directly addresses the current demand for rapid respiratory diagnostics, but alone may not be enough to counteract the significant decline in high-margin COVID testing revenue in the short term. Execution risk from integration projects and future margin pressure remain central considerations.

Of the recent corporate updates, QuidelOrtho's August credit agreement, securing US$1.15 billion in term loans and a US$700 million revolving credit facility, is most relevant, given the need for stable funding as legacy COVID revenue recedes. This financial move highlights the company's focus on liquidity and operational flexibility, supporting investment in new products such as the QUICKVUE Influenza + SARS Test at a critical transitional period.

However, investors should be aware that despite product expansion, persistent margin and revenue drag from declining COVID test demand means...

Read the full narrative on QuidelOrtho (it's free!)

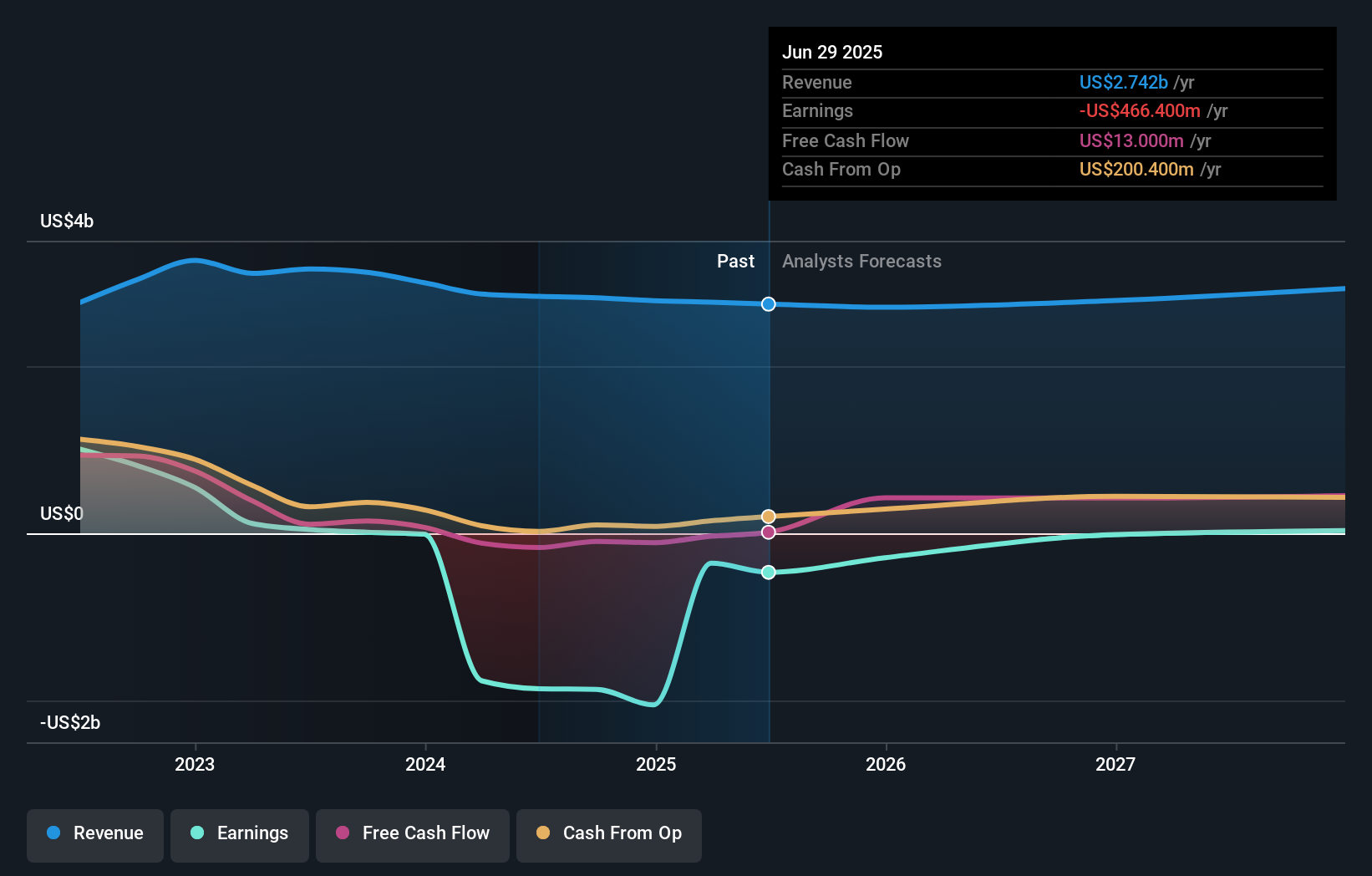

QuidelOrtho's outlook anticipates $3.0 billion in revenue and $17.2 million in earnings by 2028. This is based on 2.6% annual revenue growth and an earnings increase of $483.6 million from the current loss of $-466.4 million.

Uncover how QuidelOrtho's forecasts yield a $43.43 fair value, a 53% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for QuidelOrtho range widely from US$43.43 up to US$86.18 per share. With such breadth in outlooks and post-pandemic margin pressure still weighing on results, explore how other investors are factoring these challenges and opportunities into their views.

Explore 3 other fair value estimates on QuidelOrtho - why the stock might be worth over 3x more than the current price!

Build Your Own QuidelOrtho Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QuidelOrtho research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QuidelOrtho research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QuidelOrtho's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal