Coeur Mining (CDE): Evaluating Valuation After High-Grade Discoveries, Share Surge, and Upgraded Earnings Outlook

If you’ve got Coeur Mining (CDE) on your radar, you’re not alone. The company’s announcement of high-grade drill results at its Las Chispas and Kensington mines landed just as gold and silver prices are trending higher, fueling a flurry of trading activity. Momentum built quickly, sending shares up 7% in the last session as optimism grew around both the company’s operational success and macro tailwinds such as expectations for more Fed rate cuts. Improved earnings estimates have only added to the sense that something is stirring here.

This burst of good news fits into a broader story for Coeur Mining this year. Investors had already seen the stock gain ground in recent months, with shares more than doubling year-to-date and up over 160% in the past 12 months, far outpacing most mining peers. The company has also benefitted from a steady stream of upbeat updates and shifting sentiment around precious metals, which has reinforced bullish expectations amid upward-trending financial performance.

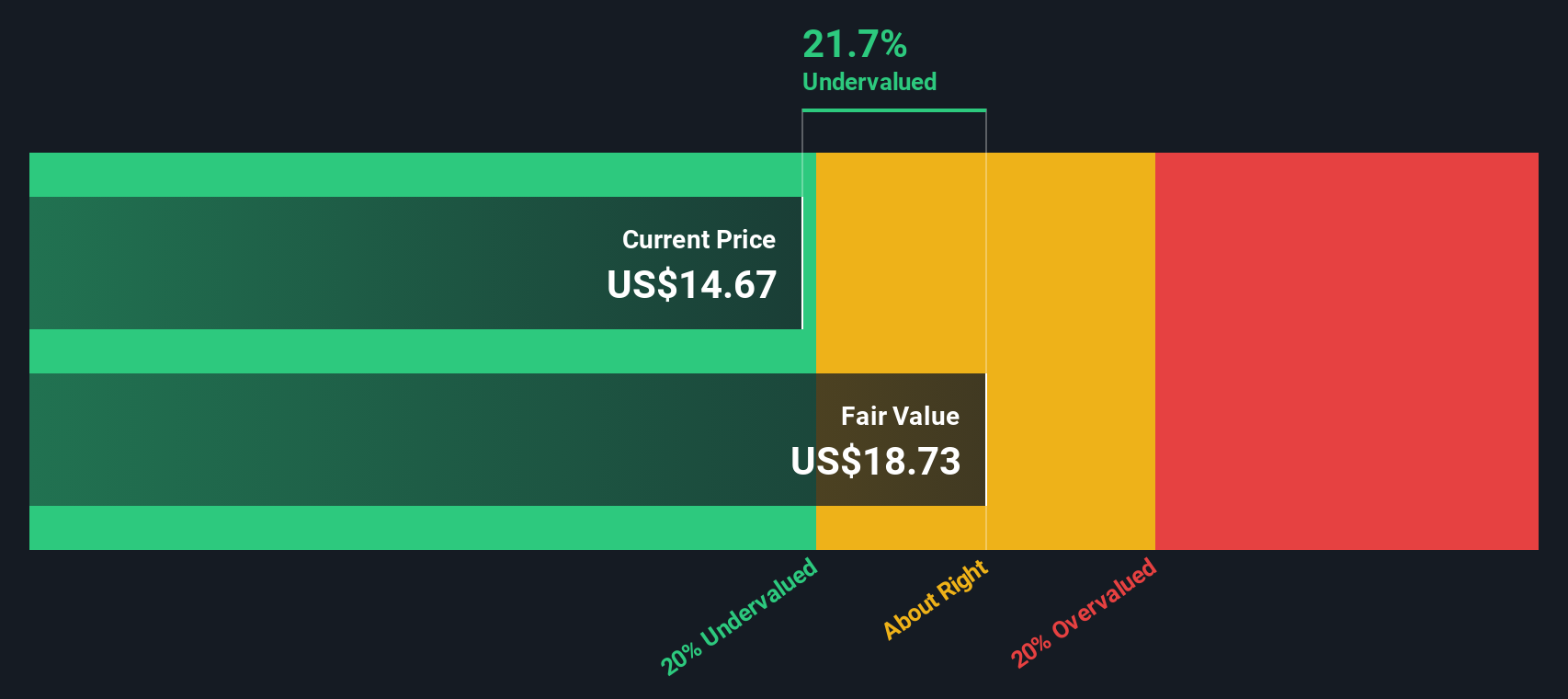

But after such a surge, investors are left wondering if this is a fresh opportunity to get in, or whether the market has raced ahead and already priced in all the good news.

Most Popular Narrative: 31% Overvalued

The consensus view holds that Coeur Mining is currently trading at a premium relative to its fair value, as projected by the most widely followed analyst narrative. This assessment incorporates a blend of ambitious financial projections and underlying market dynamics.

The successful ramp-up and integration of the Rochester expansion and Las Chispas asset are driving significant increases in silver and gold production. This is positioning Coeur for robust revenue and earnings growth in the near to medium term. Strengthened operational efficiencies, reflected in declining cost applicable to sales per ounce and process improvements at key mines, are improving operating leverage and could further support margin expansion and cash generation.

Curious why analysts are expecting such explosive performance? There is one core driver behind this eye-catching valuation call. The real story lies in the blend of growth forecasts and margin bets that could surprise even seasoned investors. What is the bold assumption at the heart of this projection? The full narrative has all the details on the engine powering Coeur’s current premium.

Result: Fair Value of $13.64 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the outlook could shift if regulatory hurdles delay new projects or if exploration falls short of replenishing key mine reserves.

Find out about the key risks to this Coeur Mining narrative.Another View: SWS DCF Model Offers a Different Take

Looking at Coeur Mining through our SWS DCF model tells a different story. This approach suggests the stock is overvalued as well, reinforcing the cautious stance from the analyst consensus. However, does this agreement mean both views are correct, or could important factors still be missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Coeur Mining Narrative

If the story so far doesn’t line up with your own view, or you want to sift through the data in your own way, it's easy to create your personal take on Coeur Mining in just a few minutes. Do it your way

A great starting point for your Coeur Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move count by checking out powerful stock picks tailored to the opportunities shaping tomorrow’s markets. Find standout opportunities and don’t let smart plays pass you by.

- Spot hidden value: jump straight into bargains by using undervalued stocks based on cash flows for companies generating real cash flow and trading below their potential.

- Target income growth: bolster your returns with dividend stocks with yields > 3% featuring resilient stocks delivering dividends above 3% and robust payouts that can strengthen your portfolio.

- Tap into disruptive technology: ride the momentum of AI penny stocks driving breakthroughs in artificial intelligence, automation, and the future of digital innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal