Why Ameresco (AMRC) Is Up 11.6% After Its Green Hydrogen Deal With Kimberly-Clark UK

- In recent weeks, Ameresco announced several major contract wins, including its selection as the engineering service provider for Kimberly-Clark UK's green hydrogen program, development of a 100 MW AI-optimized data center at NAS Lemoore with the U.S. Navy and CyrusOne, and completion of key campus infrastructure projects with Ave Maria University in Florida.

- Ameresco's role in delivering the UK's first green hydrogen infrastructure in the consumer goods sector and advancing secure, high-performance energy solutions with major public and private partners showcases its expanding presence in the clean energy and critical infrastructure markets.

- We will explore how Ameresco's landmark green hydrogen contract with Kimberly-Clark UK supports its energy transition leadership and recurring project pipeline.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Ameresco Investment Narrative Recap

Owning Ameresco means buying into the growth of clean energy infrastructure, with an emphasis on turnkey projects for large public and private clients. The recent contract wins, including the Kimberly-Clark UK green hydrogen program, highlight Ameresco’s ability to secure complex, high-profile projects, but do not materially alter the main short-term catalyst: successful conversion and delivery of its project backlog amid potential supply chain delays. The primary risk remains margin pressure from execution setbacks or cost overruns in new regions, especially in Europe.

Of the recent announcements, Ameresco’s landmark contract with Kimberly-Clark UK stands out for its potential to deepen the project pipeline, reinforce credibility in hydrogen solutions, and support further European expansion. This aligns directly with the company’s stated catalyst of diversifying revenue streams through high-impact international projects, which may enhance stability and long-term growth if executed effectively.

However, in contrast to recent headlines, investors should be attentive to how supply chain constraints and execution in new markets might impact...

Read the full narrative on Ameresco (it's free!)

Ameresco's narrative projects $2.4 billion in revenue and $87.4 million in earnings by 2028. This requires 8.8% yearly revenue growth and a $25.4 million earnings increase from the current $62.0 million.

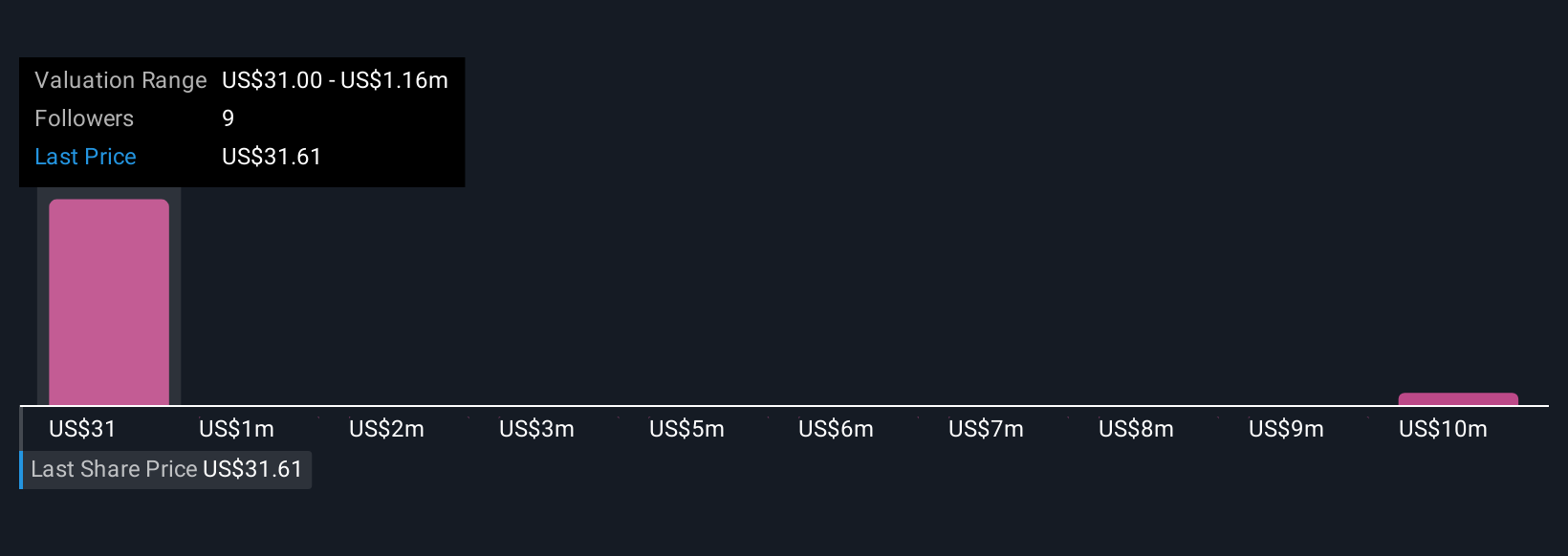

Uncover how Ameresco's forecasts yield a $31.00 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided four fair value estimates for Ameresco, ranging from US$31 to an outlier above US$11,587,000. While project wins capture headlines, persistent supply chain uncertainty could still challenge even the most optimistic outlooks, so consider these diverse viewpoints.

Explore 4 other fair value estimates on Ameresco - why the stock might be worth just $31.00!

Build Your Own Ameresco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ameresco research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ameresco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ameresco's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal