Hess Midstream (HESM): Valuation Insights Following Guidance Cuts and Analyst Downgrades

Hess Midstream (HESM) just put out a string of updates that may catch investors off guard. The company revised its third quarter and full-year 2025 net income guidance to the lower end of its prior range, attributing the change to adverse weather, maintenance, and softer third-party volumes. Longer term, Hess Midstream also signaled earnings growth will likely pause in 2026, with a return to increases not expected until 2027. Capital spending is set to trend lower over the next two years. In response, several analysts, including Wells Fargo, moved to downgrade the stock, reflecting concerns about the company’s near-term earnings and growth trajectory.

It is not hard to see why markets reacted. Shares of Hess Midstream sank nearly 10% on the news, extending a trend that has persisted most of this year. For context, the stock is down roughly 15% over the past month and 8% across the past three months. Even so, looking further out, Hess Midstream's long-term trajectory remains much more impressive. The stock is up 5% in the past year and has more than tripled over five years. Despite some recent caution from Wall Street and a loss of momentum, investors may be weighing whether the dip signals shifting fundamentals or just a temporary reset after a long period of steady gains.

With near-term expectations reset and the stock well off recent highs, is this a rare buying window for Hess Midstream, or is the market already factoring in a slower growth runway?

Most Popular Narrative: 20.4% Undervalued

According to the most widely followed valuation narrative, Hess Midstream is trading at a notable discount to its estimated fair value, with analysts projecting material upside from current levels.

Multi-year minimum volume contracts with Hess Corp (now under Chevron) provide highly predictable, inflation-resistant fee-based revenue streams through the late 2030s, which supports stable adjusted EBITDA and consistent dividend/distribution growth. Large, strategic, and largely irreplaceable infrastructure footprint in the core Bakken shale combined with ongoing investments (like compressor stations and the Capa gas plant) enables Hess Midstream to capture incremental volume growth as domestic and export energy needs remain high. This further supports margin and EBITDA expansion.

Curious what drives such a bullish valuation? The answer lies in some bold growth projections and eye-catching profit assumptions from analysts. Unpack the underlying numbers and discover the secret sauce behind Hess Midstream's potential upside. If these forecasts play out, it could be a gamechanger for long-term investors.

Result: Fair Value of $44.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained growth depends on Chevron's Bakken activity and regional production trends. Both factors could sharply impact Hess Midstream's long-term outlook.

Find out about the key risks to this Hess Midstream narrative.Another View: What Do the Market Multiples Say?

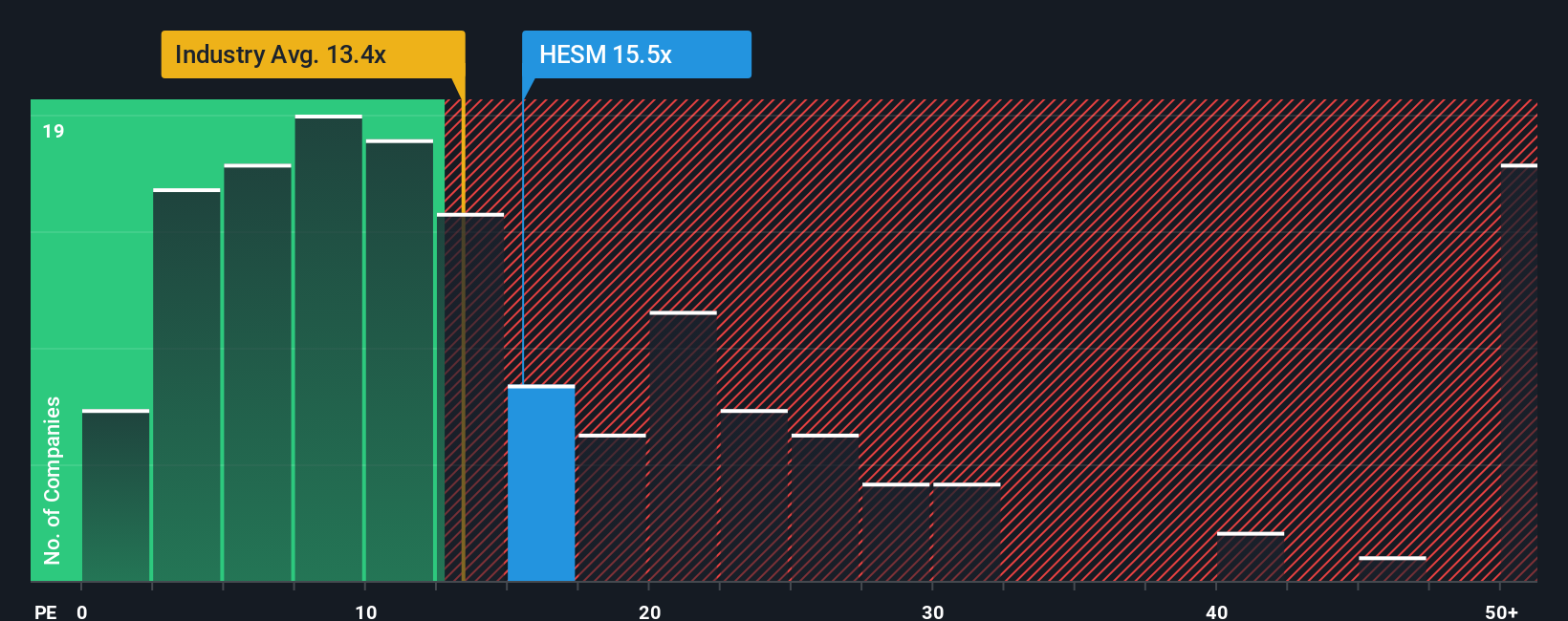

While our DCF model points to Hess Midstream trading well below estimate of fair value, a look at its price-to-earnings ratio versus the industry suggests the shares could actually be more expensive than their peers. Could the optimism already be priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hess Midstream Narrative

If the story laid out above does not align with your view, dive into the data yourself and craft your own perspective in just a few minutes. Do it your way

A great starting point for your Hess Midstream research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors seize every opportunity. Don’t just wait and watch Hess Midstream. Power up your portfolio by finding other promising stocks with strong fundamentals, rapid tech growth, or standout income potential using the Simply Wall Street Screener.

- Supercharge your portfolio with fast-growing contenders by tapping into AI penny stocks shaping tomorrow’s technology landscape.

- Uncover overlooked gems trading below intrinsic value by starting with our handpicked list of undervalued stocks based on cash flows.

- Boost your regular income streams and lock in financial stability through our proven selection of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal