Northern Oil and Gas (NOG): A Fresh Valuation in Light of $725 Million Debt Restructuring

Northern Oil and Gas (NOG) has made a move that is sparking conversations: the company is raising $725 million through a private offering of 7.875% senior notes due 2033 while launching a cash tender offer for its existing 8.125% senior notes due 2028. This kind of restructuring is a clear signal that Northern Oil and Gas is taking its capital structure seriously. For investors, news like this typically raises questions about what comes next and how these changes could impact both risk and reward over the coming years.

Thinking about the big picture, Northern Oil and Gas has had a mixed run. The company’s share price has drifted down over the past year and remains in negative territory for 2025, but its long-term return over the past five years is positive, hinting at underlying growth potential. While debt management moves like this can shift perceptions of risk or spark momentum, they follow a year of mostly muted performance relative to the broader market.

After a year of lackluster returns, is this restructuring setting up Northern Oil and Gas for a rebound, or has the market already factored in future gains from these debt moves?

Most Popular Narrative: 24.9% Undervalued

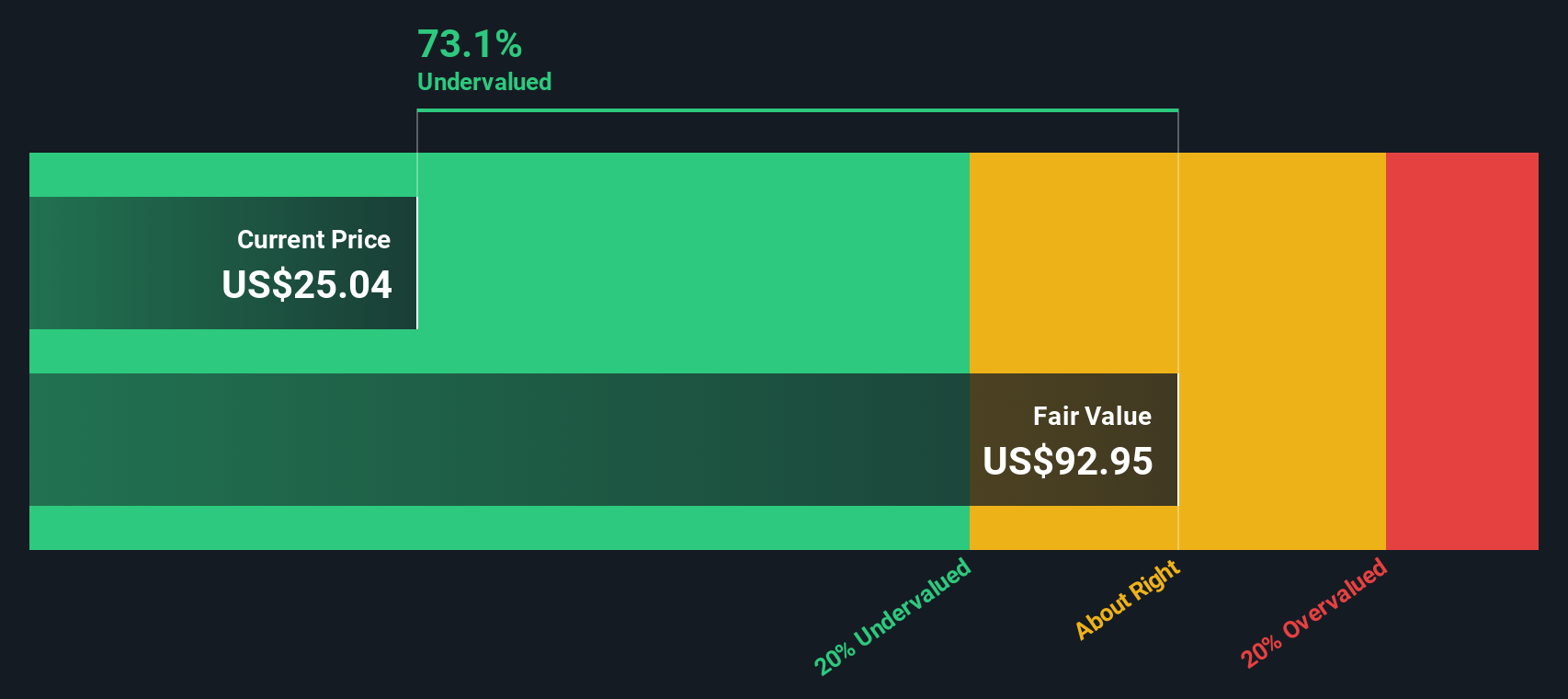

According to the consensus narrative, Northern Oil and Gas is seen as significantly undervalued with analysts putting its fair value well above the current market price. This outlook is driven by a forward-looking assessment of the company’s earnings power and the expectation that recent strategic moves will secure future resilience despite a complex industry landscape.

The company's disciplined shift toward acquisitions of long-dated, stable production assets amid a volatile commodity environment positions NOG to benefit from continued global energy demand and the ongoing importance of energy security. This supports more resilient long-term revenue and less volatile cash flows.

Curious why some insiders believe the real value of Northern Oil and Gas remains hidden from the market? There’s a financial formula at play, one that hinges on bold projections for revenue and profit margins, and an ambitious profit multiple that turns heads even among seasoned analysts. If you want to see exactly which assumptions and future milestones drive this sizeable gap to fair value, you’ll want to dig deeper into the details behind the optimism.

Result: Fair Value of $33.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent commodity price swings or rising operating costs could undermine Northern Oil and Gas’s path to realizing projected value gains.

Find out about the key risks to this Northern Oil and Gas narrative.Another View: Discounted Cash Flow Model

While the analyst consensus says Northern Oil and Gas is notably undervalued, our DCF model paints a picture of even greater disconnect between price and fair value. Why do these two methods reach such different conclusions?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Northern Oil and Gas Narrative

If these perspectives do not quite fit your view, why not dive into the numbers and assemble your own narrative in just a few minutes? Do it your way

A great starting point for your Northern Oil and Gas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Picks?

Why stop your search now when there are so many compelling opportunities? Make your next move by looking at some of the most talked-about trends and value plays on Simply Wall Street.

- Snap up high yields by checking out stocks that offer consistent income streams and robust payouts with the help of our dividend stocks with yields > 3%.

- Tap into the future of AI innovation by browsing handpicked companies that are redefining technology through artificial intelligence advancements using our AI penny stocks.

- Seize on overlooked bargains and maximize portfolio potential by scanning for shares that are trading below intrinsic value with our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal