Pediatrix Medical Group (MD): Examining Valuation as Revenue Outlook Weakens and Growth Signals Deteriorate

With the latest outlook on Pediatrix Medical Group (NYSE:MD) turning cautious, investors might be wondering if the current headlines signal a new direction for the stock. Wall Street expects the company’s revenue to slip 1.5% over the next year, pointing to slowing same-store sales and declining return on invested capital. These headwinds could reshape market sentiment and make this a critical moment for anyone tracking the company.

Taking a step back, Pediatrix Medical Group has notched a 55% total return over the past year. However, that follows a multi-year stretch of underwhelming results, with the three-year return just under flat. Short-term trading has also been weak this month and has broken a year-to-date uptrend that had seen strong double-digit gains. While revenue and net income continue to grow at a modest pace, the question is whether momentum is fading or simply taking a breather in light of the mixed signals on the horizon.

So is this recent pause in Pediatrix Medical Group’s stock an opportunity to buy at a discount, or is the market simply baking in weaker growth ahead?

Most Popular Narrative: 2.7% Undervalued

The latest and most widely cited narrative views Pediatrix Medical Group as slightly undervalued, balancing future earnings potential with a cautious outlook on sector pressures.

Sustained governmental and societal prioritization on maternal and child health, including legislative focus and funding for neonatal care, is expected to boost demand for Pediatrix's services. This supports long-term revenue visibility and reimbursement stability. Pediatric and neonatal care volumes are benefitting from stable or improving reimbursement and payer mix, which is anticipated to support both revenue growth and net margin expansion.

Curious about the numbers behind Pediatrix Medical Group’s valuation edge? The narrative hinges on solid earnings expansion, careful margin growth, and a future profit multiple that differs from current sector averages. Want to see what drives their status as an undervalued opportunity? Read on to discover the calculations that set this target price apart.

Result: Fair Value of $16.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, portfolio restructuring and challenges in hospital partner negotiations may put pressure on revenue growth and margin stability in the coming years.

Find out about the key risks to this Pediatrix Medical Group narrative.Another View: SWS DCF Model

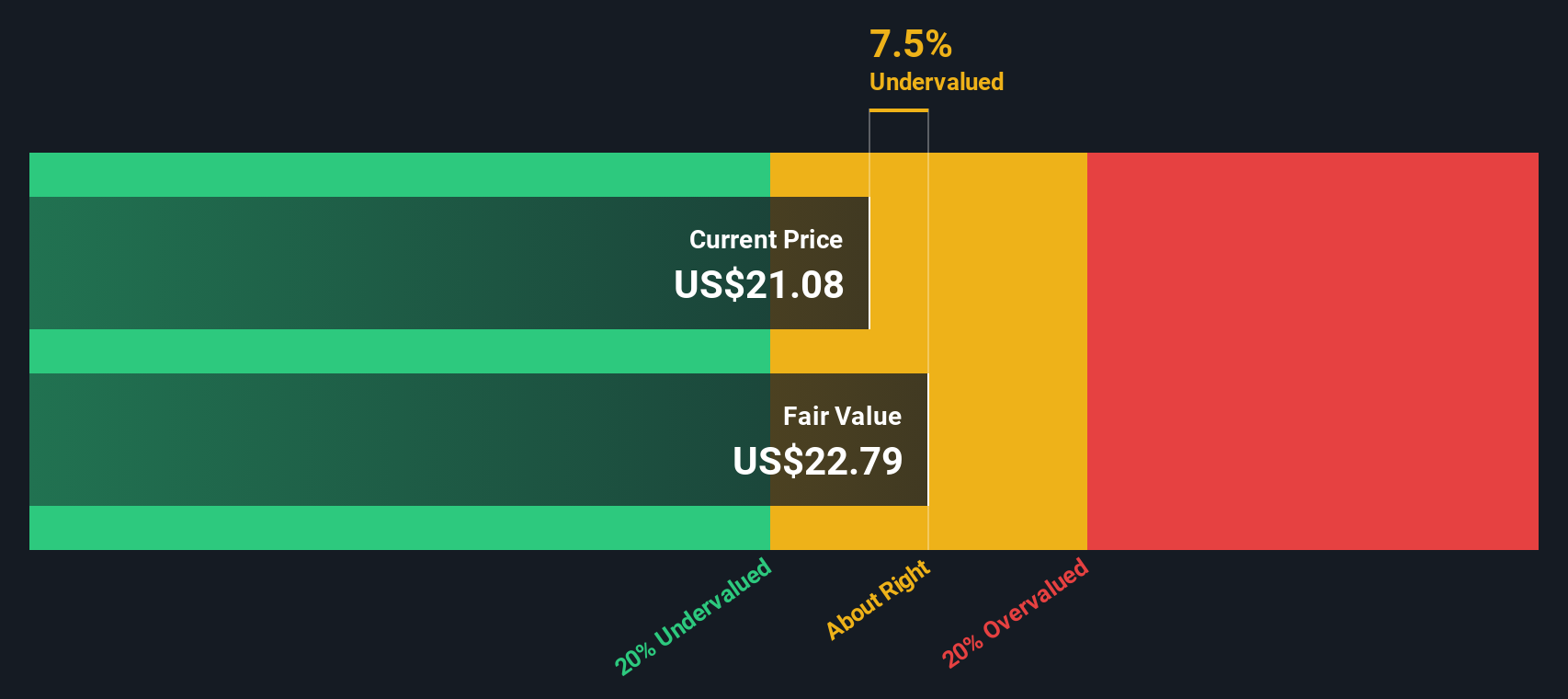

Stepping aside from the analyst consensus, our DCF model suggests a very different outcome. It points to an even larger gap between price and fair value. When cash flows are front and center, does this method change your perspective?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pediatrix Medical Group Narrative

If you have your own take or want to dig deeper into the numbers, you can put together your own narrative in just a few minutes. Do it your way

A great starting point for your Pediatrix Medical Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Why limit yourself to just one stock? Uncover unique companies and untapped growth stories by putting the Simply Wall Street stock screener to work for your next move.

- Unleash your potential returns by targeting undervalued stocks based on cash flows hiding in plain sight. These are chosen for their strong fundamental value and overlooked market pricing.

- Capture income now and future-proof your portfolio with dividend stocks with yields > 3% that offer reliable yields above 3% for consistent cash flow.

- Ride the innovation boom by tapping into AI penny stocks redefining industries with breakthroughs in automation, machine learning, and AI-powered disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal