Does US Foods’ Expanded Exclusive Menu Lineup Mark a New Competitive Phase for USFD?

- Earlier this month, US Foods Holding Corp. unveiled its Fall 2025 Scoop™ lineup, introducing 18 new, versatile Exclusive Brands products aimed at helping operators elevate profitability and streamline menu operations.

- This rollout directly targets the ongoing profitability challenges faced by foodservice operators, emphasizing product flexibility, waste reduction, and enhanced menu innovation amid persistent cost pressures.

- Now, we'll examine how the broadened exclusive offerings may reshape US Foods' investment narrative and influence future growth drivers.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 31 companies in the world exploring or producing it. Find the list for free.

US Foods Holding Investment Narrative Recap

To believe in US Foods as a shareholder, you need to see continued growth in away-from-home dining and margin expansion from private label innovations. The recent Fall 2025 Scoop™ rollout aligns with these themes but is unlikely to materially shift the short-term catalyst, which remains the broader recovery in case volume, or the main risk, persistent industry softness weighing on both top-line growth and profitability.

Among recent updates, the reaffirmation on September 10, 2025, of 4% to 6% net sales growth for this fiscal year is particularly relevant. This guidance lends continuity to US Foods' investment case amid ongoing menu and operational initiative launches meant to support revenue, but it does not reduce the underlying risk if industry demand fails to rebound as expected. However, investors should also consider the impact of industry-wide dining trends on the company's future profitability and...

Read the full narrative on US Foods Holding (it's free!)

US Foods Holding's outlook anticipates $45.1 billion in revenue and $1.1 billion in earnings by 2028. This scenario assumes a 5.3% annual revenue growth rate and a $547 million increase in earnings from the current $553 million.

Uncover how US Foods Holding's forecasts yield a $91.33 fair value, a 17% upside to its current price.

Exploring Other Perspectives

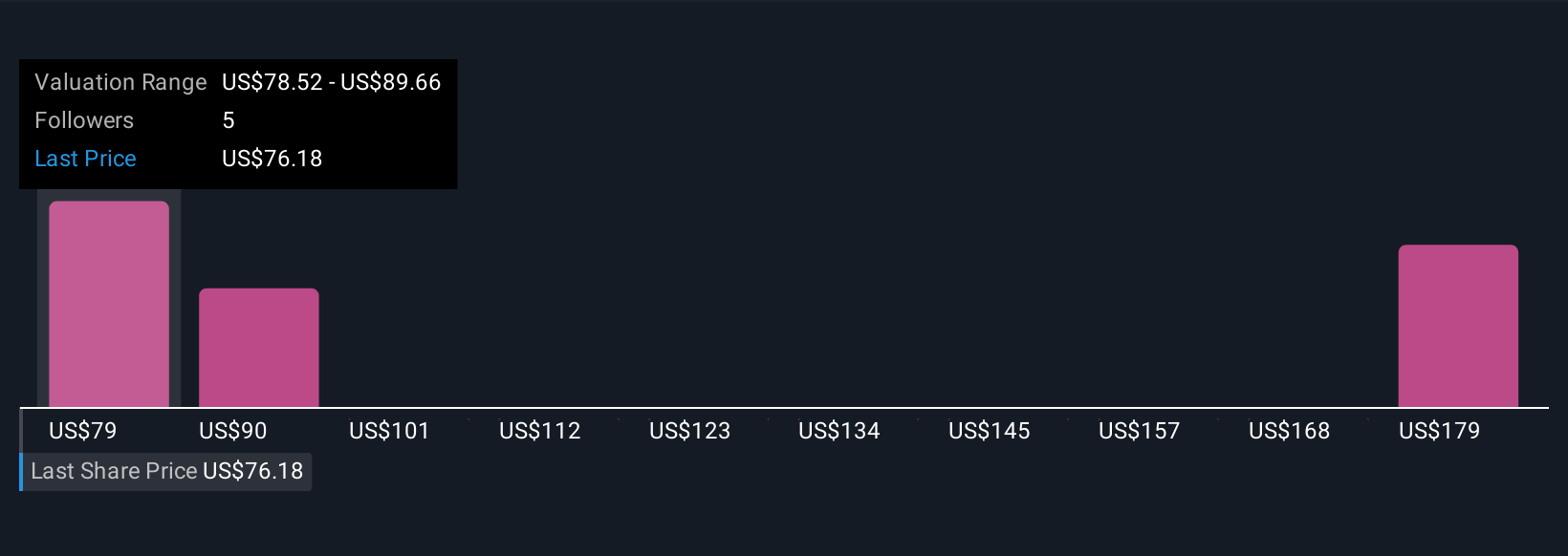

Simply Wall St Community members have produced a wide spectrum of fair value estimates for US Foods, from US$78.52 to US$192.39, across seven viewpoints. While some expect industry volume recovery to support further gains, a range of opinions suggests it's important to consider several perspectives before making any decision.

Explore 7 other fair value estimates on US Foods Holding - why the stock might be worth just $78.52!

Build Your Own US Foods Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your US Foods Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free US Foods Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate US Foods Holding's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal