Barrett Business Services (BBSI): Assessing Valuation After Analyst Upgrade on Rising Earnings Forecasts

Most Popular Narrative: 10.4% Undervalued

The most widely followed narrative sees Barrett Business Services as undervalued, with its fair value estimated to be over 10% higher than the current share price. The discount rate used for this assessment is 7.0%.

Broader adoption of outsourced HR and payroll solutions by small and medium-sized businesses, driven by rising employment law and payroll/tax complexity, continues to expand BBSI's addressable market. This trend supports sustainable top-line revenue growth, as reflected in record client adds and worksite employee numbers.

Ready to uncover the real story behind this bullish valuation? Analysts are betting on growth that outpaces what you might expect from a company in this space. What hidden assumptions about revenue, margins, and market expansion are fueling that target price? The numbers behind this fair value might surprise you. There is more beneath the surface than meets the eye.

Result: Fair Value of $51.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in client hiring and ongoing geographic concentration could still challenge BBSI's long-term growth outlook, even with recent momentum.

Find out about the key risks to this Barrett Business Services narrative.Another View: What Does the SWS DCF Model Say?

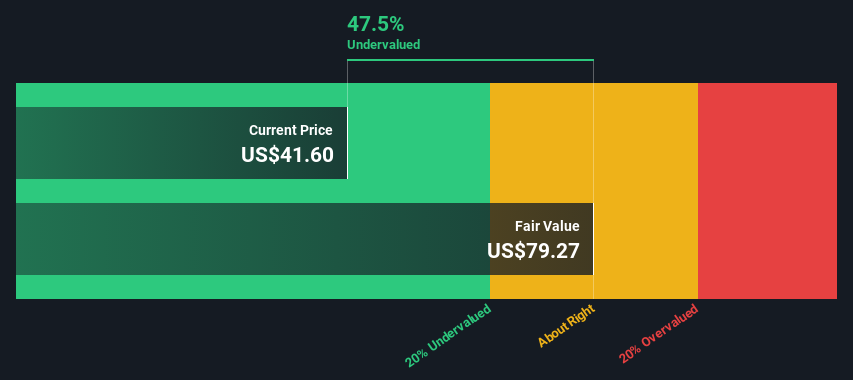

Our DCF model paints a very different picture, suggesting Barrett Business Services might be trading well below its intrinsic value. This estimate challenges the consensus and could indicate the market is overlooking hidden potential. Which approach will prove right in the end?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Barrett Business Services Narrative

If you see things differently or want to dig deeper, you can easily build your own data-driven view in just a few minutes. Do it your way

A great starting point for your Barrett Business Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

The market is full of overlooked gems ready for savvy investors like you. Don’t let standout possibilities pass you by. Boost your portfolio with these powerful trends:

- Target stable growth with high yield by checking out stocks offering generous payouts and steady performance through dividend stocks with yields > 3%.

- Uncover promising technology innovators tackling the next wave of artificial intelligence breakthroughs with the help of AI penny stocks.

- Grab undervalued companies that could be trading at a steep discount and positioned for a strong rebound using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal