How Investors May Respond To Korn Ferry (KFY) Expanding Share Repurchase Program After Q1 Earnings

- Korn Ferry’s Board of Directors recently approved a US$250 million increase to its existing share repurchase program, raising the remaining buyback capacity to US$331.4 million, alongside reporting first-quarter revenue of US$715.54 million and net income of US$66.64 million for the period ended July 31, 2025.

- This expanded share repurchase authorization highlights management’s confidence in the company’s business outlook and ongoing commitment to delivering value to shareholders.

- We’ll examine how this substantial share buyback expansion could influence Korn Ferry’s investment narrative and shareholder value proposition.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Korn Ferry Investment Narrative Recap

To be a Korn Ferry shareholder, you need conviction in the company's ability to grow earnings despite persistent macroeconomic pressures on consulting. The recent expansion of the share buyback program, while a positive indicator of management’s confidence, does not significantly change the short-term catalyst, which remains the pace of conversion from new business wins to recognized revenue; it also doesn’t materially alter the risk that economic uncertainty could limit pricing power and margin improvement.

The latest earnings announcement, reflecting first-quarter revenue growth to US$715.54 million and an increase in net income, shows Korn Ferry generating positive momentum in an otherwise challenging market. This result underscores the importance of maintaining demand for transformation and workforce solutions, which is essential for driving both future revenue and sustaining the company’s value proposition through cycles of economic uncertainty.

Yet, in contrast to management’s confidence, investors should consider what happens if pricing power weakens in a slower market environment and...

Read the full narrative on Korn Ferry (it's free!)

Korn Ferry's narrative projects $3.1 billion in revenue and $331.4 million in earnings by 2028. This requires 4.3% yearly revenue growth and a $88.6 million earnings increase from the current earnings of $242.8 million.

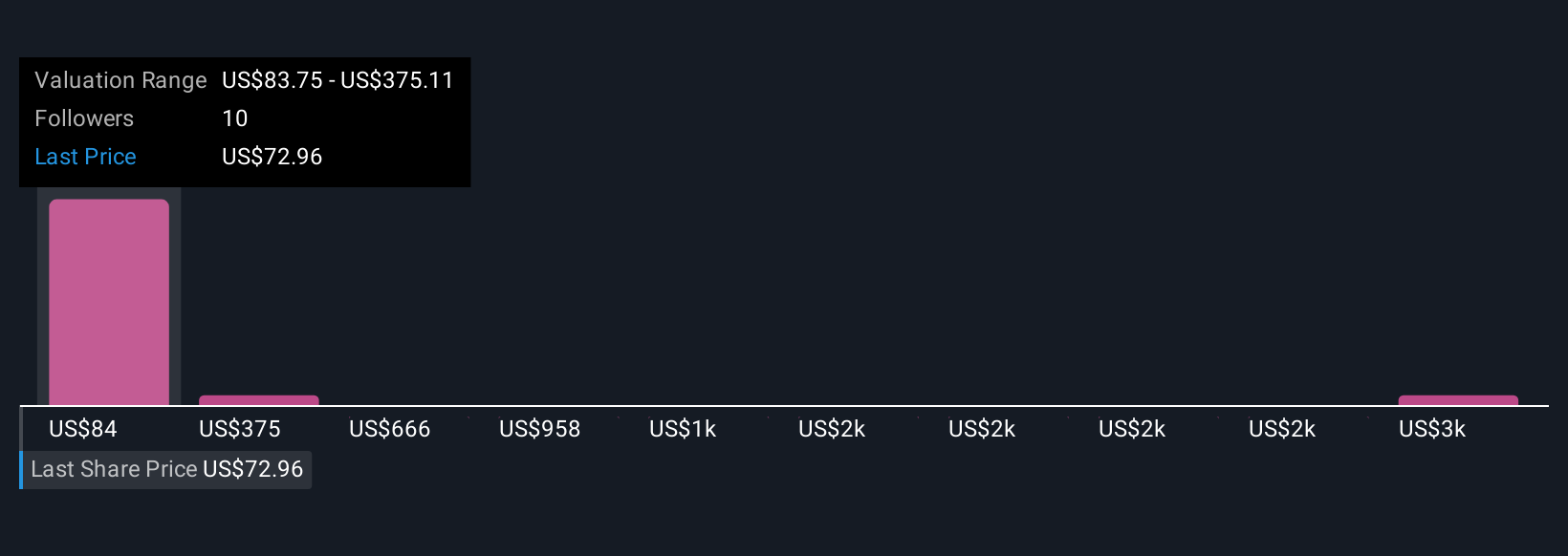

Uncover how Korn Ferry's forecasts yield a $83.75 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Four private investors in the Simply Wall St Community estimated Korn Ferry’s fair value from US$83.75 up to an outlier at US$2,997.37. While such diverse views exist, remember that continued pressure on revenue from economic conditions can shape how these opinions play out over time.

Explore 4 other fair value estimates on Korn Ferry - why the stock might be worth just $83.75!

Build Your Own Korn Ferry Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Korn Ferry research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Korn Ferry research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Korn Ferry's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 31 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal