Toll Brothers Shares Climb 12% in 2025 Amid Resilient Earnings and Market Rotation

If you have been following Toll Brothers lately, you might be wondering whether to stick with your investment, jump in, or take profits off the table. This stock has been anything but dull, catching the eye of both long-term holders and those scanning for new value opportunities. Over the past year, Toll Brothers’ share price has dipped by 8.3% even after posting robust gains over the last five years. The stock is up a massive 199.4% over that period. That kind of long-term performance naturally attracts attention, especially since year-to-date returns are still in positive territory at 12.1%, while the most recent 30 days have shown a slight 0.4% uptick.

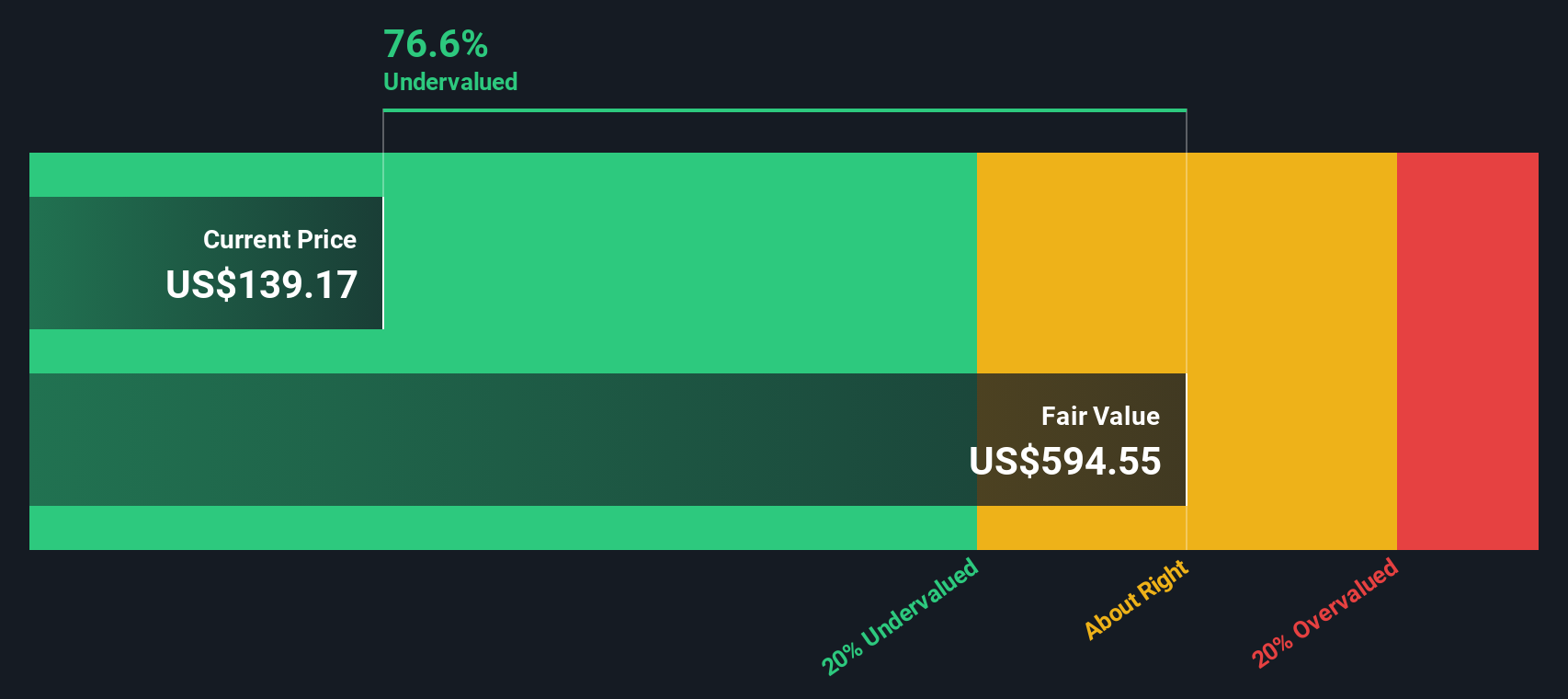

Shorter-term moves, such as the modest 1.4% dip in the last week, may be a result of shifting market sentiment and broader industry developments rather than fundamental changes at the company. In the bigger picture, investors seem to be re-evaluating risk in the homebuilding sector, but Toll Brothers’ long-term trajectory hints at the underlying strength in its business. If you are trying to make sense of where this stock could head next, it is worth knowing that, according to the latest scoring, Toll Brothers rates a 5 out of 6 for undervaluation. This is one of the highest marks in the sector and is a clear sign that the current price could represent an opportunity.

Of course, not all valuation approaches tell the same story, and in the sections ahead, we will break down the checklist in detail. Stick around, because we will also reveal an even better way of understanding the company’s true value beyond traditional scores.

Why Toll Brothers is lagging behind its peersApproach 1: Toll Brothers Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those amounts back to their present value. This approach provides a forward-looking view, focusing on the company's ability to generate free cash in the coming years.

For Toll Brothers, the current Free Cash Flow (FCF) stands at $920 Million. Looking toward the future, analyst estimates suggest that by 2027, annual FCF could reach $1.5 Billion. While analysts provide projections up to five years out, additional years are extrapolated to complete a ten-year view.

Based on this two-stage DCF model using Free Cash Flow to Equity, the estimated intrinsic value of Toll Brothers is $194.74 per share. This figure is notably higher than the current market price, suggesting the stock is 28.3% undervalued.

If you are seeking value, this DCF analysis points to a clear opportunity. Toll Brothers appears attractively priced based on its projected ability to generate cash.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Toll Brothers.

Approach 2: Toll Brothers Price vs Earnings

For profitable companies like Toll Brothers, the Price-to-Earnings (PE) ratio is one of the most widely used valuation tools. It helps investors assess how much they are paying for each dollar of the company's earnings, making it especially useful when the business is stable and consistently profitable.

The appropriate PE ratio for a company depends on the market’s growth expectations and how risky those earnings are. Companies expected to grow rapidly or with stable, predictable profits often command higher PE ratios. More cyclical or riskier businesses may trade at lower multiples relative to their earnings.

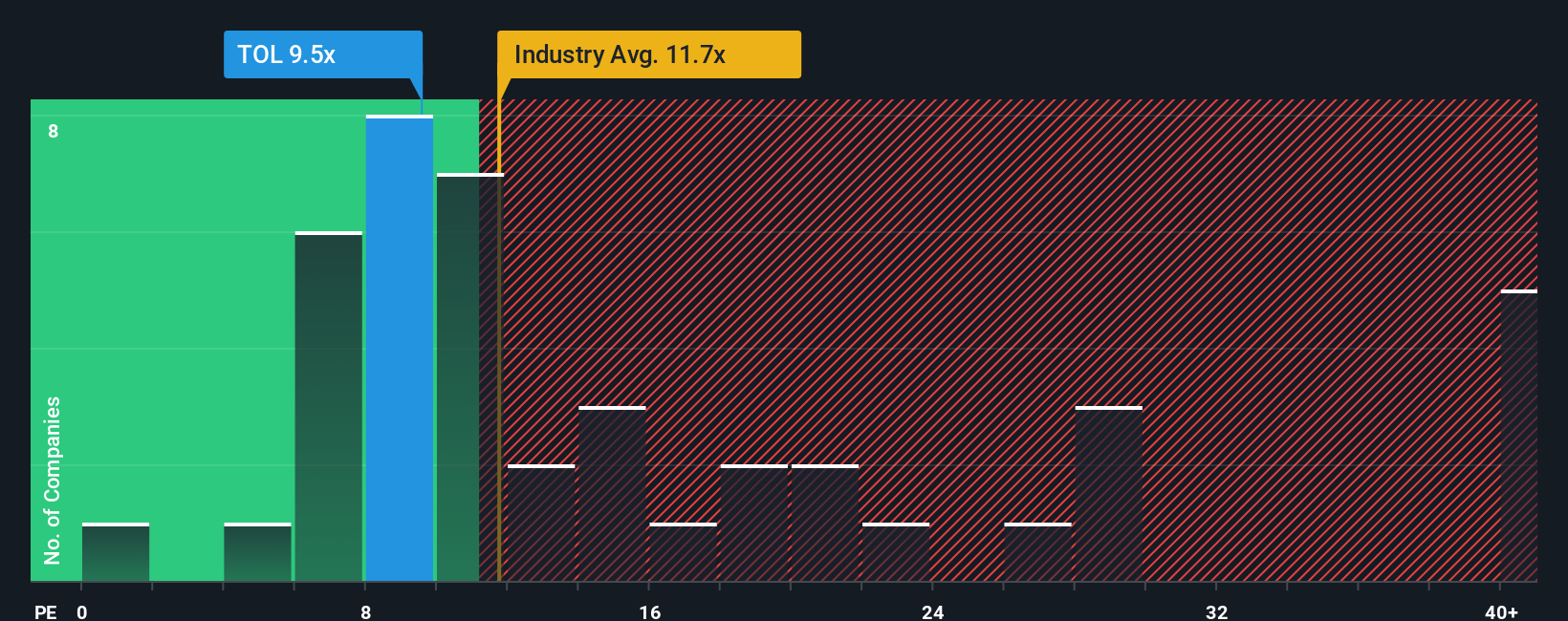

Currently, Toll Brothers trades at a PE ratio of 9.8x, which is below both the Consumer Durables industry average of 11.6x and the peer average of 18.1x. While these comparisons offer helpful context, they do not always account for a company’s unique prospects, risk profile, and financial quality.

That is where the Simply Wall St “Fair Ratio” becomes valuable. This proprietary metric estimates the PE ratio Toll Brothers deserves, factoring in elements like its earnings growth rate, profit margins, industry context, market capitalization, and associated risks. It aims to pinpoint a more tailored benchmark than what peers or sector averages alone can provide.

For Toll Brothers, the Fair Ratio is 17.8x. Since the current PE ratio of 9.8x is well below this, it suggests that the market is undervaluing Toll Brothers based on its earnings outlook and qualitative characteristics.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Toll Brothers Narrative

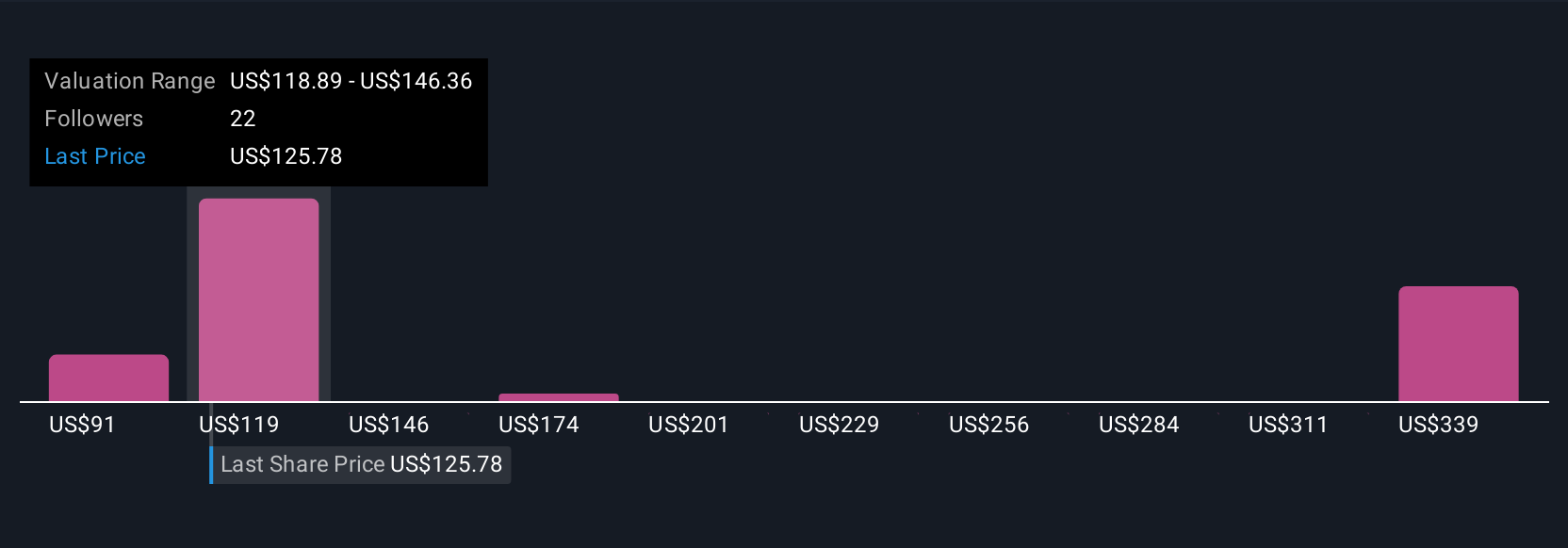

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a story you create about a company that connects your view of its business drivers, such as growth, margin, and risk, to a financial forecast and a fair value estimate. Narratives bridge the gap between numbers and real-world expectations, making it easier for any investor to frame their outlook and see how changes might impact price targets.

With Narratives, available right on the Simply Wall St Community page, millions of investors can build, share, and update their perspectives as new facts emerge, such as updated earnings or industry news. Narratives dynamically refresh when new information arrives, helping you stay in tune with the latest company outlook.

By comparing the Fair Value you or others have calculated in a Narrative to the current market price, you will quickly see whether your story suggests “buy,” “hold,” or “sell.” Take Toll Brothers as an example: some investors believe revenue will reach $13.1 billion and set a Fair Value around $183.0 per share, while others think risks outweigh potential, projecting a more conservative $92.0. Narratives empower you to decide which story and price you trust most.

Do you think there's more to the story for Toll Brothers? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal