Delek US Holdings (DK): Assessing Valuation After Securing Key Small Refinery Exemptions and Analyst Upgrade

Most Popular Narrative: 10% Overvalued

The prevailing narrative flags Delek US Holdings as trading above its fair value, reflecting recent optimism and strong sentiment around its financial trajectory and operational upgrades.

Delek's sustained operational improvements, driven by its enterprise optimization program (EOP), which targets structural changes in refinery operations, procurement, and product sales, are expected to deliver $130 to $170 million of annualized cash flow enhancements, with much of the benefit expected to flow through to net margins and free cash flow starting in the second half of 2025.

Wondering what’s fueling this valuation debate? The projection rests on bold financial assumptions and dramatic profitability shifts, hinting at a transformation story just beneath the surface. Curious about the precise forecasts and margin expectations that power this fair value call? Dive in and uncover the ambitious numbers driving this most popular viewpoint.

Result: Fair Value of $28.46 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the bullish outlook could unravel if regulatory headwinds intensify or if Delek’s reliance on traditional refining limits growth in a changing energy landscape.

Find out about the key risks to this Delek US Holdings narrative.Another View: Our DCF Model Weighs In

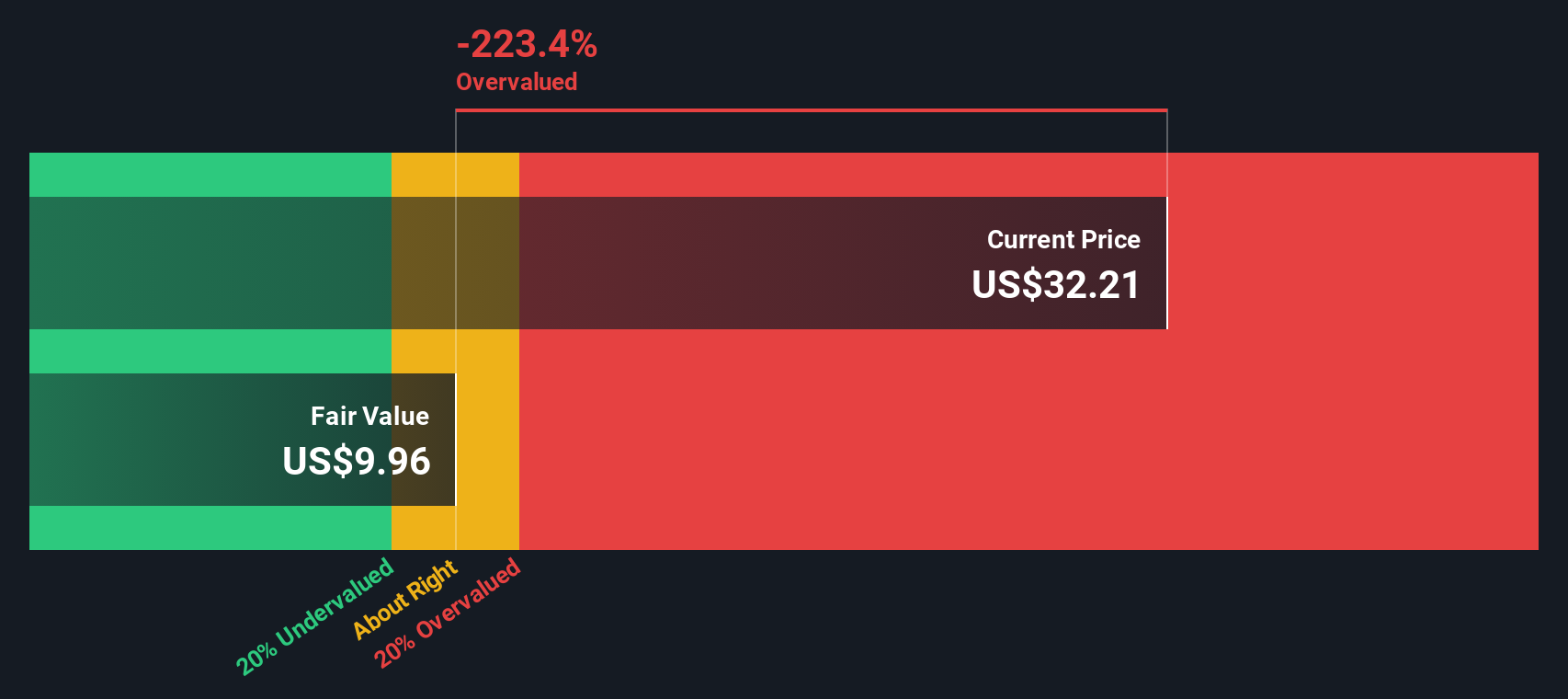

While some point to trading levels that look attractive compared to industry averages, the SWS DCF model delivers a much more cautious assessment and sees Delek as trading above what its underlying cash flows support. The reality could potentially fall somewhere in the middle.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Delek US Holdings Narrative

If you see the numbers differently or want to dig into the details yourself, you can shape your own perspective on Delek in just a few minutes. Do it your way

A great starting point for your Delek US Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your horizons and secure your spot among smart investors using Simply Wall Street’s powerful tools. Relying on the right insights could bring you closer to your next portfolio win, so why wait?

- Capture high potential with the latest AI penny stocks and spot companies harnessing artificial intelligence to shape entire industries.

- Uncover hidden bargains by using our undervalued stocks based on cash flows resource, which is designed to lead you straight to stocks whose cash flows signal opportunity.

- Boost your income stream with picks from the dividend stocks with yields > 3% selection. These highlights focus on shares delivering strong, consistent dividends above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal