Sysco (SYY): Evaluating Valuation After Securing $388 Million U.S. Navy Supply Deal

Most Popular Narrative: 3.7% Undervalued

According to the most widely followed narrative, Sysco is currently undervalued by a margin of 3.7% based on future earnings, profit margins, and risks discounted at a rate of 7.37%. Analysts see the company as trading below its fair value, which could indicate potential for further upside.

"Sysco is focused on improving its sales consultant workforce, with new hires becoming more productive and a strategic shift in compensation model. This is expected to enhance revenue and earnings starting in fiscal 2026."

Curious why the market might be missing Sysco’s full potential? Bold targets for revenue and profit growth are at the heart of this thesis. Analysts are betting on a transformation behind the scenes, but what are the specific projections reshaping this stock’s narrative? The answer may surprise you.

Result: Fair Value of $85.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent adverse weather or prolonged low consumer confidence could undermine Sysco’s growth story and challenge even the most optimistic forecasts.

Find out about the key risks to this Sysco narrative.Another View: What Does Our DCF Model Suggest?

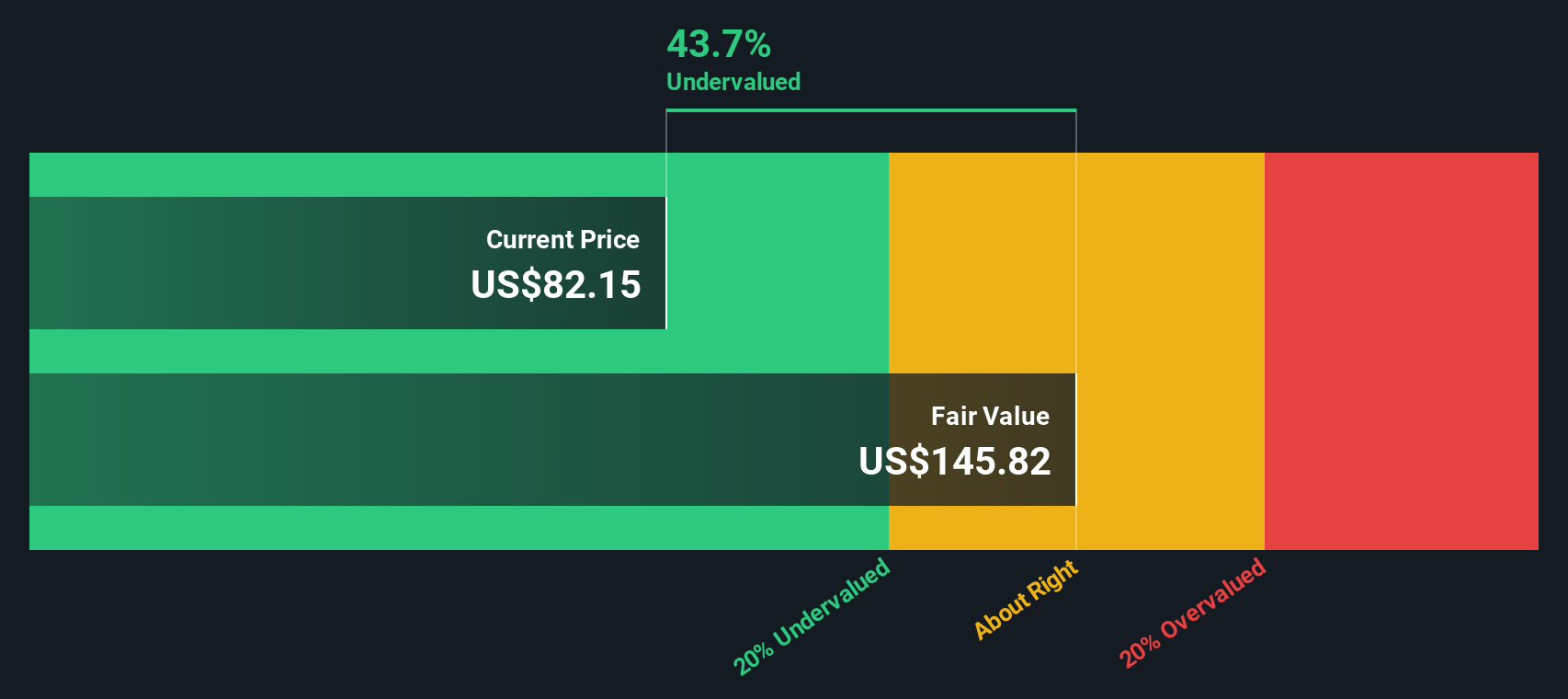

Looking from a different angle, our SWS DCF model tells a story that diverges from the traditional market multiples approach. This method points to Sysco being undervalued based on its future cash flows. Are market expectations missing something? Is there more to unpack?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sysco Narrative

If you see things differently, or want to dive deeper into the numbers, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Sysco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by searching beyond the obvious. Don’t miss your chance to uncover opportunities that others overlook using these focused stock strategies.

- Tap into the potential of high-growth tech by finding AI companies at the forefront of innovation. Explore our AI penny stocks.

- Maximize your returns and target strong yields with our exclusive list of dividend stocks with yields > 3%.

- Seize value before the crowd catches on by browsing stocks currently priced below their cash flow fundamentals in our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal