Assessing Select Medical Holdings’s Valuation Following Fresh Profitability Concerns and Analyst Caution

If you’ve been watching Select Medical Holdings (SEM), you probably felt a jolt recently as fresh concerns surfaced over the company’s future path. Reports of falling admissions and tough analyst commentary, pointing to possible revenue and earnings declines ahead, are making headlines. It’s not just a blip either; these changes hint at deeper shifts in the competitive landscape and may signal that the easy growth years could be in the rearview mirror.

This tension has played out in the share price, which has tumbled over the past year and is down roughly 34% year to date. Even though Select Medical’s revenue managed a slight uptick, net income per share didn’t keep pace, which is another clue that profitability may be under pressure. While three- and five-year numbers show patient, long-term investors in the green, recent momentum is squarely on the downside.

So here’s the real question: after such a swift drop, is SEM now a bargain, or is the market simply pricing in the risks of a tougher road ahead?

Most Popular Narrative: 30.7% Undervalued

The current market sentiment, according to the most widely followed narrative, pegs Select Medical Holdings as significantly undervalued relative to its projected fair value. This view hinges on assumptions about future earnings growth, margin expansion, and multiple catalysts set to reshape the company’s outlook.

"Increased consolidation of smaller providers and successful execution of joint venture strategies with large health systems position the company to grow market share and network density, leading to improved bargaining power, reduced referral source dependency, and more resilient earnings."

Curious why analysts see such a steep upside? There’s one key behind-the-scenes metric in this narrative that could shift the entire earnings landscape. Bold projections, a recalibrated profit margin, and a forecasted future earnings level all combine to support this sharply higher fair value. Find out which assumptions could power an outsized move in SEM’s valuation. Will it all play out as expected?

Result: Fair Value of $17.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory pressures and rising debt costs could challenge Select Medical’s rebound narrative if these headwinds persist or intensify in the coming quarters.

Find out about the key risks to this Select Medical Holdings narrative.Another View: Our DCF Model Suggests Further Upside

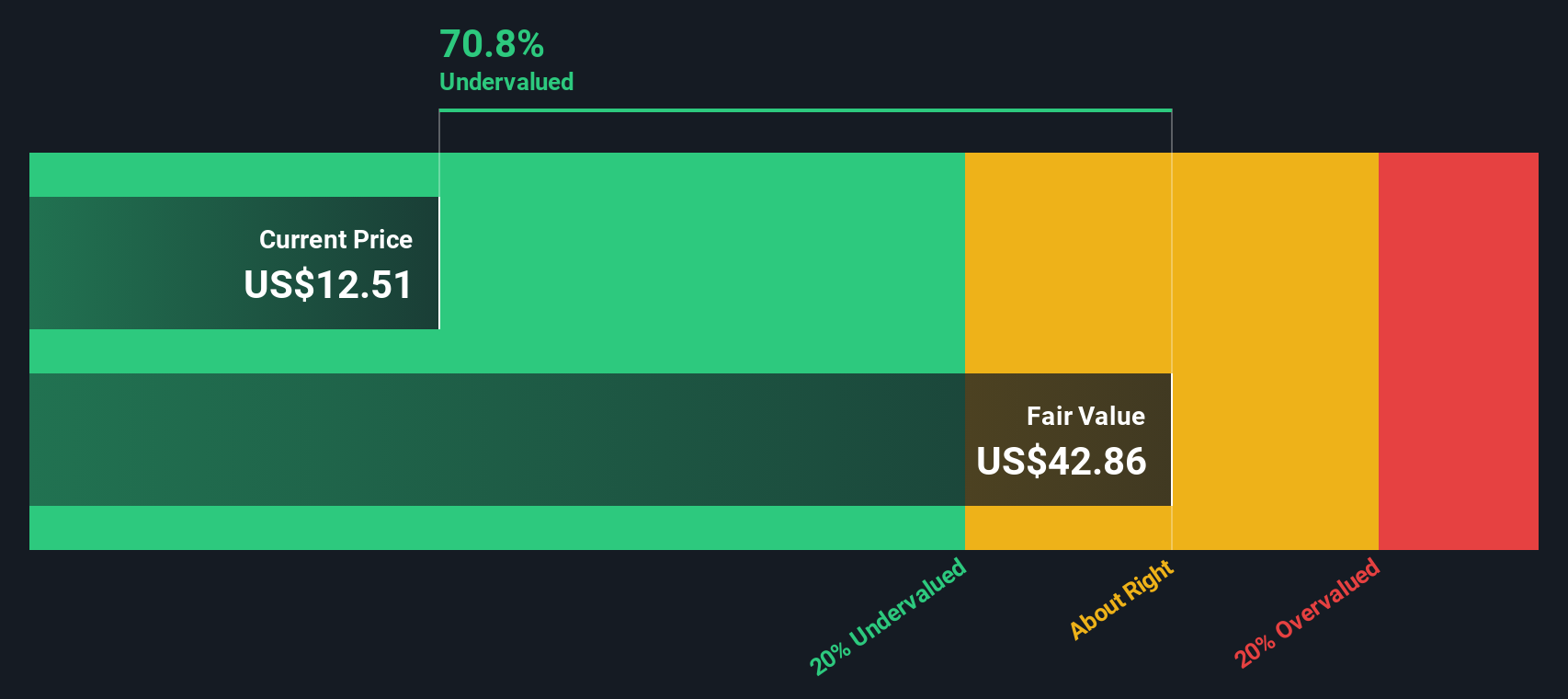

Looking from a different angle, the Simply Wall St DCF model also concludes the shares appear undervalued based on future cash flows. However, it is important to consider whether this approach accounts for all the challenges and unknowns facing Select Medical.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Select Medical Holdings Narrative

If you see things differently or want to dig deeper on your own, you can quickly put together your own Select Medical Holdings thesis in just a few minutes. Do it your way.

A great starting point for your Select Medical Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never put all their eggs in one basket. Make sure you catch the next big trend or hidden gem before everyone else does. The Simply Wall Street Screener gives you an edge to find opportunities others might miss.

- Target unstoppable growth by scanning for AI-focused companies that are reshaping entire industries with cutting-edge innovation, starting with AI penny stocks.

- Power up your income by finding high-yield opportunities among established firms, all highlighted in our list of dividend stocks with yields > 3%.

- Spot tomorrow’s standout value stocks with our tailored screen for shares trading well below their intrinsic worth, featured in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal