What FinVolution Group (FINV)'s Sustained EPS Growth and High Insider Ownership Mean For Shareholders

- In the past week, FinVolution Group reported a 9.5% annual growth in earnings per share over three years and achieved 7.8% revenue growth in the last year, although EBIT margins declined.

- Insiders now hold a substantial 48% stake in the company, signaling strong alignment with shareholders and management's confidence in FinVolution's future direction.

- We'll explore how sustained earnings per share growth and high insider ownership could influence FinVolution's investment narrative and future prospects.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 31 companies in the world exploring or producing it. Find the list for free.

FinVolution Group Investment Narrative Recap

To be a shareholder in FinVolution Group, you likely need faith in the company’s ability to deliver steady earnings and revenue growth, even with margin pressure or regulatory headwinds in China’s consumer finance sector. The recent earnings update shows sustained growth in EPS and revenue, but with a drop in EBIT margins, the most important near-term catalyst remains ongoing execution in international markets, while the main risk is any shift in regulation or funding availability; this news doesn’t materially change either dynamic.

FinVolution’s August 2025 buyback update stands out, as the company repurchased 1.3% of its shares last quarter (and over 10% since 2023), reinforcing management’s confidence in the business. This move adds to the investment case by supporting capital returns just as the firm's revenue momentum and resilience in top-line guidance provide some cushioning against regulatory and market risks.

By contrast, investors should be aware that any meaningful change in China’s funding environment or regulatory approach could quickly...

Read the full narrative on FinVolution Group (it's free!)

FinVolution Group's narrative projects CN¥18.1 billion revenue and CN¥3.7 billion earnings by 2028. This requires 9.5% yearly revenue growth and a CN¥0.9 billion earnings increase from CN¥2.8 billion today.

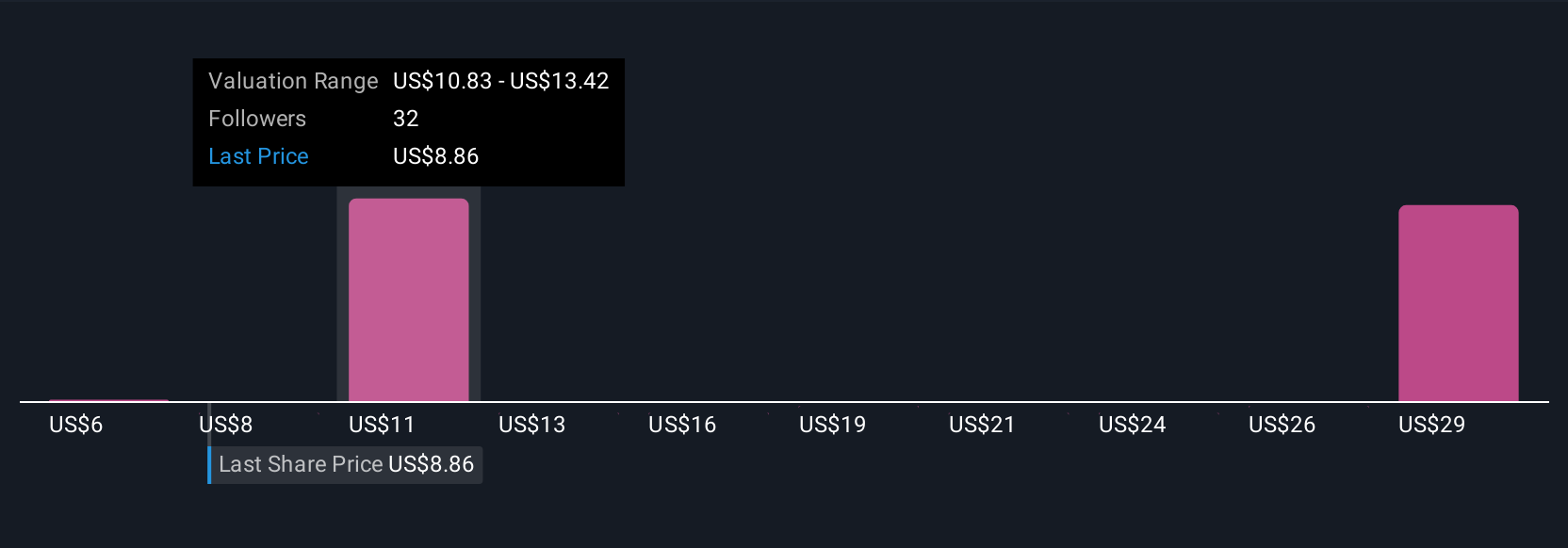

Uncover how FinVolution Group's forecasts yield a $11.34 fair value, a 48% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provide 11 fair value estimates for FinVolution, ranging from US$8.91 to US$27.79 per share. While international expansion remains a key growth factor, opinions differ widely so take time to review those alternative viewpoints.

Explore 11 other fair value estimates on FinVolution Group - why the stock might be worth over 3x more than the current price!

Build Your Own FinVolution Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FinVolution Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FinVolution Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FinVolution Group's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal