How Will Stefan Burch’s Leadership in Dubai Shape Newmark Group’s (NMRK) Global Strategy?

- Earlier this month, Newmark Group appointed Stefan Burch as Senior Managing Director to head its Middle East operations, establishing a new office in Dubai Hills Business Park.

- This move highlights Newmark's intent to broaden its global presence by leveraging Burch's two decades of regional expertise across corporate real estate and advisory services.

- Now, we'll look at how Stefan Burch's arrival to spearhead Middle East expansion could influence Newmark's broader investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Newmark Group Investment Narrative Recap

To be a shareholder in Newmark Group, investors must believe in the long-term growth potential offered by global expansion and diversification across major commercial real estate markets. The appointment of Stefan Burch to drive Middle East operations deepens Newmark’s presence in an important region, but the near-term impact on the company’s biggest catalyst, growing its alternative asset class business, such as data centers, remains limited. The main risk continues to be higher operational and integration complexity as the firm scales new markets, heightening cost and execution challenges.

Among recent announcements, Newmark’s role in advising a US$4 billion joint venture to develop an AI data center campus in Lancaster, PA, stands out. This initiative aligns closely with the company's effort to capitalize on demand in alternative asset classes, a key growth driver that could be influenced by the success or setbacks of its global expansion strategy.

Conversely, with rapid expansion into multiple new markets, investors should be mindful of...

Read the full narrative on Newmark Group (it's free!)

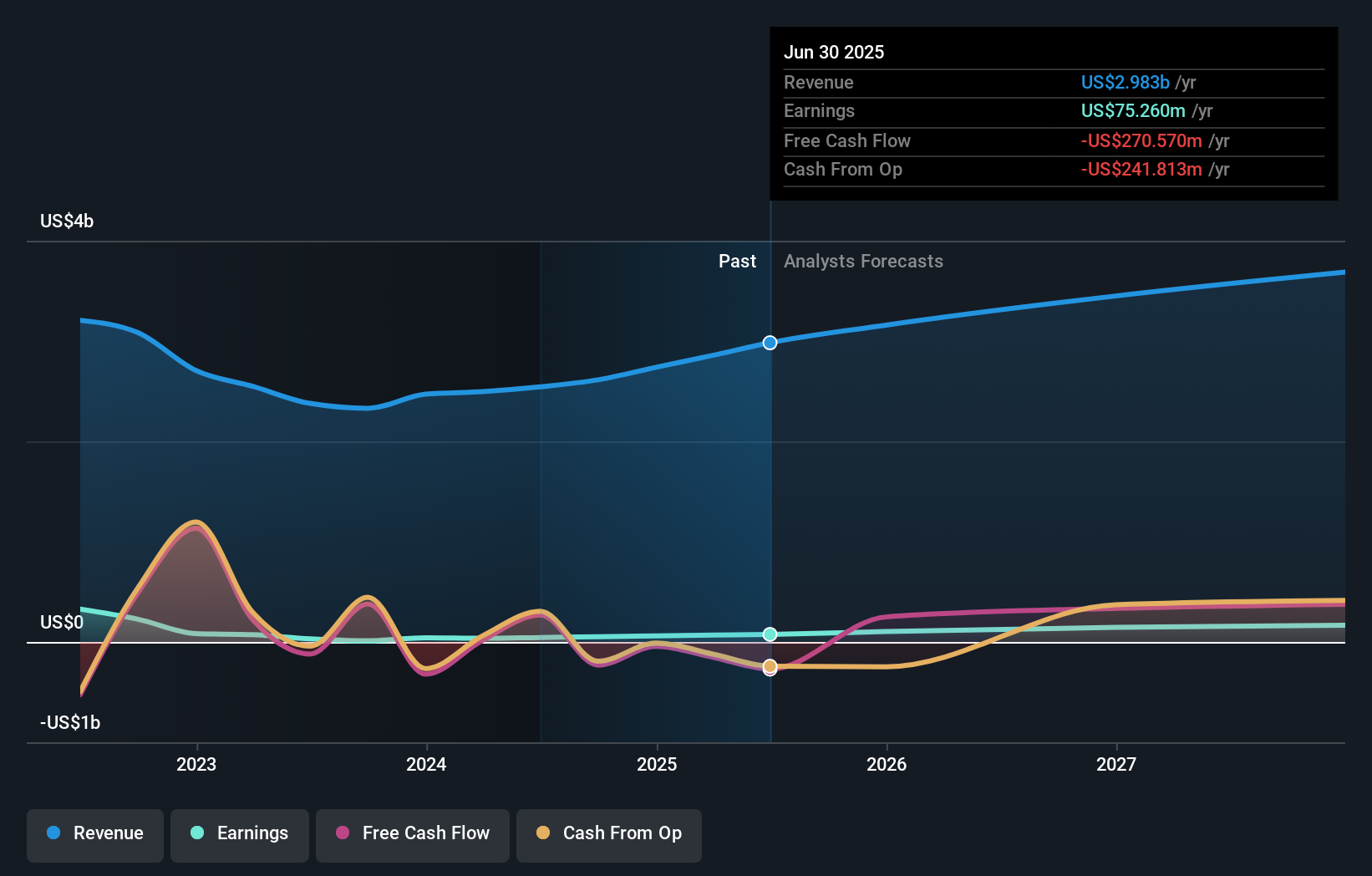

Newmark Group's narrative projects $3.8 billion in revenue and $201.7 million in earnings by 2028. This requires 8.2% yearly revenue growth and a $126.4 million increase in earnings from $75.3 million today.

Uncover how Newmark Group's forecasts yield a $18.45 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members suggest fair values for Newmark Group ranging from US$11.81 to US$25.84, with three independent estimates represented. While views on valuation vary substantially, the company’s increased focus on scaling across regions surfaces complex risks that could affect margins and earnings in the years ahead.

Explore 3 other fair value estimates on Newmark Group - why the stock might be worth 39% less than the current price!

Build Your Own Newmark Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newmark Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Newmark Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newmark Group's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal