A Look at Casey’s General Stores (CASY) Valuation Following Strong Earnings, 2026 Guidance, and Expansion Moves

Casey’s General Stores (CASY) just delivered its first-quarter results, showcasing a solid jump in both sales and net income compared to last year. The upbeat earnings were accompanied by another confidence-inducing move; management reaffirmed its full-year outlook for 2026. Add in a fresh round of store openings, continued share buybacks, and a quarterly dividend confirmation, and it is clear the company wants to signal strength to investors weighing their next move.

Looking at the bigger picture, this positive earnings report and the series of shareholder-friendly actions arrive after a year of impressive momentum for Casey’s. The stock has moved up nearly 49% in the past twelve months and is up 39% year-to-date. The combination of strong results and steady expansion, plus an ongoing buyback program, has drawn attention from those tracking whether recent gains can continue or if growth is already priced in.

With share prices riding high and management doubling down on their growth plans, investors may be evaluating whether this is a new opportunity for Casey’s, or if the market has already factored in the next stage of growth.

Most Popular Narrative: 3.1% Undervalued

According to the most widely followed narrative, Casey’s General Stores is currently trading below its estimated fair value. This suggests the stock may offer modest upside based on analysts’ consensus forecasts.

“Strategic investments in digital platforms (nearly 9.5 million Rewards members, personalized promotions), analytics, and targeted guest engagement lay the groundwork for higher frequency, bigger basket sizes, and incremental revenue, as digital adoption rises in convenience retail.”

Curious how a convenience store chain’s latest transformation could justify a premium valuation? The story hinges on a new wave of digital innovation, expanding store footprints, and some bold financial predictions that could surprise even seasoned retail investors. Want to see the numbers behind this calculated optimism? Delve into the full narrative to uncover the ambitious roadmap supporting this fair value call.

Result: Fair Value of $564.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including slower gains from store acquisitions and the ongoing threat of weakening fuel demand. These factors could challenge Casey’s bullish outlook.

Find out about the key risks to this Casey's General Stores narrative.Another View: What About Market-Based Valuation?

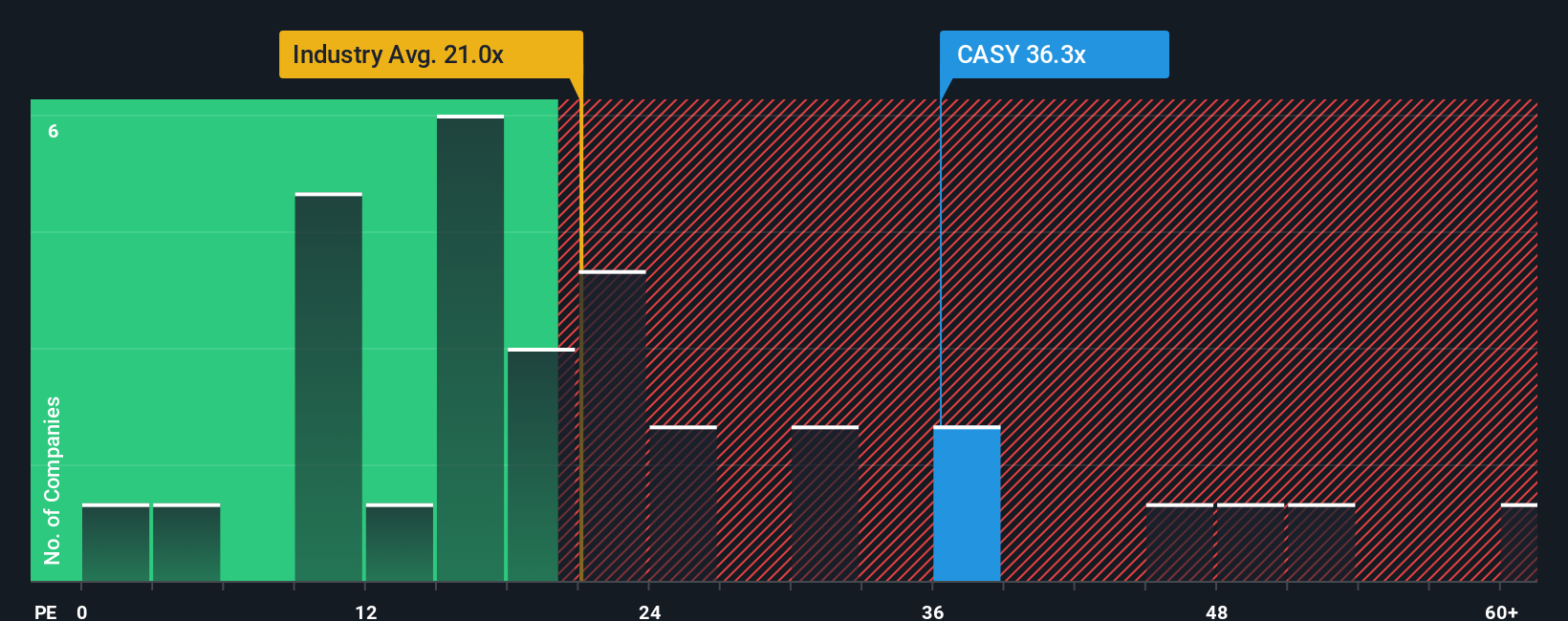

While the analyst consensus points to fair value, a look at Casey’s current earnings multiple compared to industry standards shows the stock is trading above what is typical for similar companies. Is investor enthusiasm running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casey's General Stores Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft a personalized story in just a few minutes. Do it your way.

A great starting point for your Casey's General Stores research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Moves?

Why stop with just one great pick? Power up your portfolio by searching sectors with big potential, hidden value, or game-changing technology right now.

- Spot high-yield opportunities and give your income a boost by checking out select dividend stocks with yields > 3% delivering over 3% returns.

- Ride the innovation wave and get in early on AI penny stocks that are fueling the next era of artificial intelligence advancements.

- Unlock hidden value by tracking down undervalued stocks based on cash flows that the market may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal