NetApp (NTAP) Valuation in Focus After StorageGRID 12.0 Launch Targeting AI-Driven Data Growth

Most Popular Narrative: 5.8% Overvalued

According to the most widely followed narrative, NetApp is currently considered modestly overvalued, with the current share price sitting above the consensus fair value estimate.

"Accelerating adoption of AI and analytics workloads across industries is driving demand for unified, high-performance, and scalable data infrastructure. NetApp secured over 125 AI wins in Q1 (more than doubling year-over-year), and this trend is expected to drive revenue and earnings growth as AI deployments move from proofs-of-concept to large-scale production."

Curious how analysts arrive at this near-fair price? The secrets lie in bold growth forecasts, shifting profit margins, and a valuation multiple anchored below today's tech average. Wondering if future AI momentum and concentrated global revenue can reshape NetApp's place in the market? The full narrative uncovers which numbers sit at the heart of the current valuation call.

Result: Fair Value of $118.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing declines in traditional product revenue and heavy reliance on partnerships with hyperscalers could disrupt NetApp’s current growth trajectory.

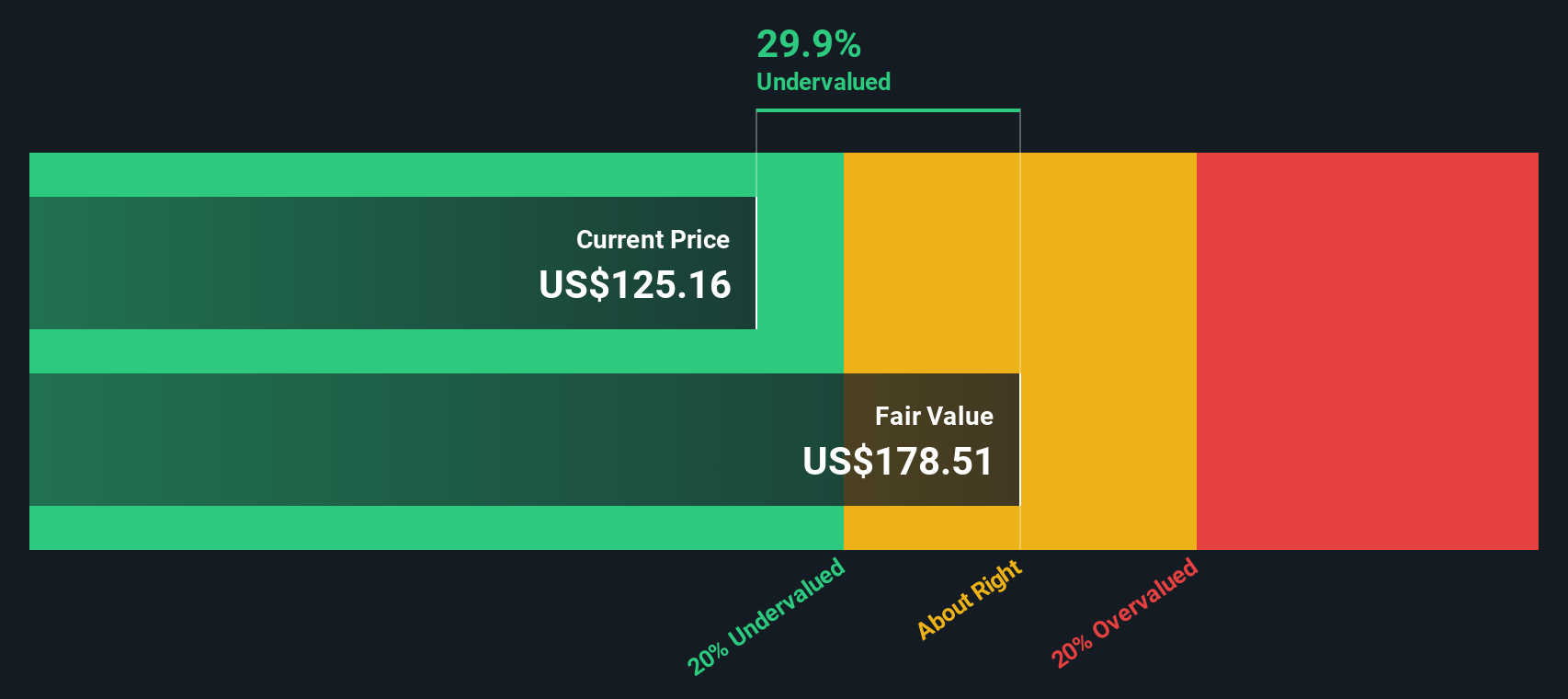

Find out about the key risks to this NetApp narrative.Another View: SWS DCF Model Indicates Undervaluation

While the consensus multiple-based valuations point to NetApp being modestly overvalued, our SWS DCF model tells a different story. It arrives at a noticeably more optimistic outcome. Could the market be too focused on near-term multiples and missing bigger upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NetApp Narrative

If the numbers above don’t fit your perspective, or you’d rather crunch the data yourself, it’s easy to craft your own take on NetApp in under three minutes. Do it your way

A great starting point for your NetApp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Opportunities?

The smartest investors never stop seeking fresh trends and hidden standouts. Make your next move by tapping into thematic screens and watch your portfolio stay ahead.

- Target steady returns and resilient cash flow by reviewing standout companies that excel in dividend stocks with yields > 3%.

- Chase technology’s next leap forward and spot pioneers revolutionizing the field through quantum computing stocks.

- Uncover overlooked gems trading below their intrinsic value and seize the edge with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal