A Look at Addus HomeCare's Valuation Following Strong Q2 Results and Gentiva Acquisition Success

Addus HomeCare (ADUS) just delivered an upbeat surprise with its second quarter results, reporting a 21.8% jump in revenue year-over-year and beating Wall Street’s earnings estimates. The market move appears driven by the successful integration of Gentiva's personal care operations, which helped boost both top and bottom lines. For anyone watching this space, the latest report puts Addus in the spotlight and could shift sentiment for investors weighing what’s next for the stock.

While today’s headlines highlight strong quarterly momentum, it is worth noting the longer story. Addus HomeCare’s stock is down nearly 14% over the past year and year-to-date performance is softer as well. Compared to some peers, recent months have been challenging; however, looking further back, the three-year return remains a healthy 25%. The recent performance, combined with robust double-digit annual revenue and profit growth, sets up an interesting backdrop for investors as they consider valuation.

With these fresh results and recent price moves, the question remains whether the market is offering an opportunity or if the stock is already pricing in all its future growth.

Most Popular Narrative: 27.6% Undervalued

The most widely followed narrative concludes that Addus HomeCare stock is trading at a considerable discount to fair value, highlighting potential for strong future returns as market sentiment shifts.

The long-term demographic trend of an aging population in the U.S. continues to create a powerful tailwind for in-home care services. This trend is expected to ensure a sustained and growing demand for Addus's services. As one of the largest players, the company is particularly well-positioned to capitalize on this development.

Curious about what’s fueling this bullish outlook? The narrative incorporates a disciplined roadmap for revenue growth, profit margins, and future profits to support the fair value estimate. Wondering how earnings could rise to meet these ambitious targets? Unlock the full story to see how these numbers add up behind the valuation.

Result: Fair Value of $154.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent labor shortages or potential changes in federal reimbursement could quickly challenge the current outlook and investor enthusiasm.

Find out about the key risks to this Addus HomeCare narrative.Another View: A Look at Market Comparisons

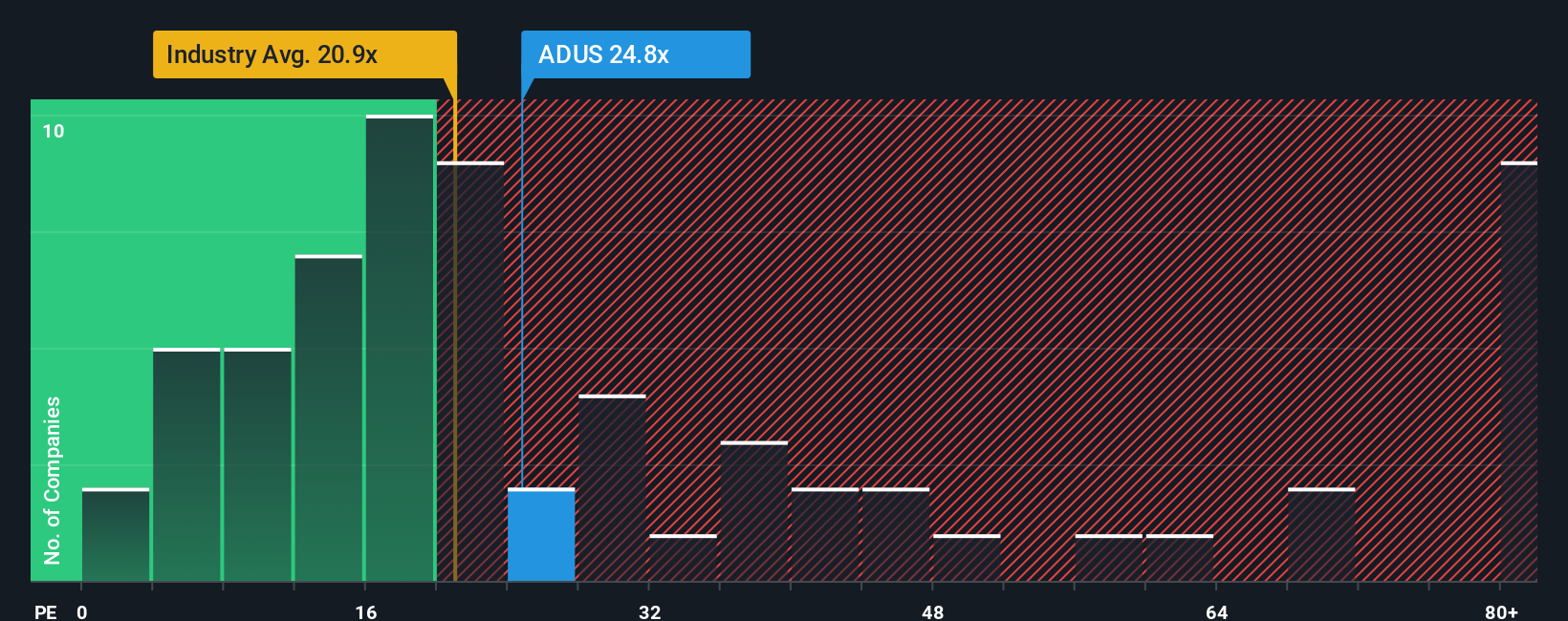

Shifting from narrative-driven fair value to a comparison against other healthcare companies, the market suggests Addus HomeCare’s shares are trading at a higher valuation than the industry average. Is the premium justified, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Addus HomeCare Narrative

If you see things differently or want to draw your own conclusions from the numbers, you can easily create your personal interpretation in just a few minutes. Do it your way

A great starting point for your Addus HomeCare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Why limit your portfolio to a single story? Uncover stocks shaking up markets, riding innovation, or rewarding investors with powerful fundamentals and ongoing growth potential using the best of Simply Wall Street’s tools.

- Spot emerging value by scanning for companies currently priced below their intrinsic worth with our undervalued stocks based on cash flows.

- Tap into artificial intelligence breakthroughs by following promising innovators pushing healthcare forward. Let healthcare AI stocks guide you to tomorrow’s leaders.

- Enhance your search for steady returns by targeting businesses known for higher yields with our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal