Daqo New Energy (NYSE:DQ): Evaluating Valuation After Goldman Sachs Downgrade Signals Investor Caution

Most Popular Narrative: 7% Overvalued

According to the most widely followed narrative, Daqo New Energy is currently viewed as slightly overvalued, with analysts projecting a fair value below the present share price.

Analysts have a consensus price target of $24.434 for Daqo New Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.54 and the most bearish reporting a price target of just $14.0.

Curious what numbers are fueling this verdict? There is a bold outlook behind the valuation as analysts are staking their case on rapid recoveries, significant margin expansion, and a leap in profitability, all crunched with a discount rate that sets the playing field. Want to know the financial leaps being forecast to justify this share price? The answer is waiting in the details of this narrative.

Result: Fair Value of $25.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a prolonged industry glut or unexpected policy changes could challenge Daqo's recovery and could also undermine the upbeat analyst outlook.

Find out about the key risks to this Daqo New Energy narrative.Another View: Cash Flow Reality Paints a Different Story

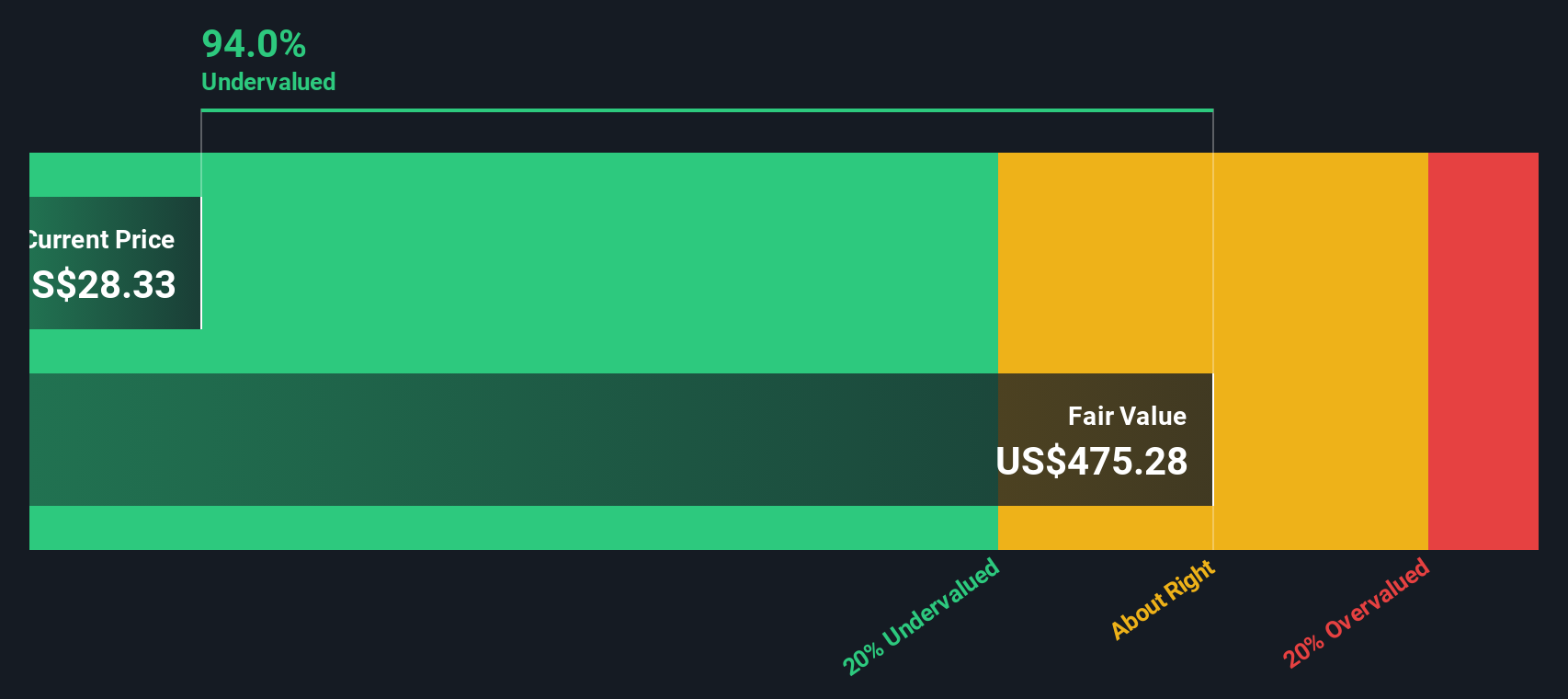

While most analysts rely on price targets and earnings multiples, our DCF model indicates Daqo New Energy could be trading well below its fair value. Could market sentiment be overlooking something important in this case?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Daqo New Energy Narrative

If the conclusions above do not match your own view or you prefer to take a hands-on approach, it is easy to build your own perspective in just a few minutes. Do it your way.

A great starting point for your Daqo New Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Sharpen your portfolio with some of the market’s most promising trends. If you want to catch tomorrow’s winners before the crowd, make your next move now using these handpicked screeners from Simply Wall Street:

- Find fast-growing businesses at the forefront of artificial intelligence by checking out the latest in AI penny stocks, and see which companies are putting technology to work in bold new ways.

- Boost your income potential and stability by spotting companies that offer reliably high yields. Get started with dividend stocks with yields > 3% for a stream of opportunity.

- Accelerate your wealth-building journey by tapping into stocks trading below their intrinsic worth. Let undervalued stocks based on cash flows guide you to hidden bargains with real upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal