Corteva (CTVA) Valuation Spotlight as Breakup Speculation and Earnings Upgrades Shape Investor Debate

Corteva (NYSE:CTVA) is in the spotlight after news broke about a possible breakup of its seed and crop protection businesses, shaking up conversations across the investing world. This speculation is fueling debate on whether such a split would unlock hidden value or introduce new risks for shareholders. All of this is happening as Corteva continues to report solid operational gains, with positive momentum in its core markets and a notable bump in its earnings outlook. The company appears to be performing well in several areas as analysts and investors consider its next move.

The backdrop to this speculation is a year of outperformance. Corteva shares have climbed about 24% so far this year, outpacing the broader Consumer Staples sector. Alongside discussions about a potential breakup, recent months have brought improved earnings guidance and operational strength in both Seed and Crop Protection segments. However, this mix of optimism and uncertainty is keeping investors alert, especially as debate about Corteva’s long-term strategic direction intensifies.

With the stock gaining ground and its outlook improving, some investors are considering whether this could be an opportunity before potential further gains, or if the company’s next chapter is already reflected in the share price.

Most Popular Narrative: 12% Undervalued

According to the most widely followed valuation narrative, Corteva is currently trading below its estimated fair value. This suggests potential upside in the stock if company forecasts materialize.

Accelerated adoption of sustainable and eco-friendly agricultural inputs, supported by favorable policy shifts in gene editing and biofuels, positions Corteva for outsized growth as regulatory and consumer preferences move toward biological and reduced-chemical solutions. This can expand both revenue and addressable market over the long term.

Curious about the math behind this bullish price target? This popular narrative hinges on a mix of bold revenue growth forecasts, margin gains, and a future valuation multiple rarely seen outside high-growth sectors. Interested in learning which smart financial bets and market trends form the backbone of this fair value calculation? Explore the full narrative to uncover which assumptions might power the next big move in Corteva shares.

Result: Fair Value of $80.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing price competition in crop protection and currency fluctuations in key markets could pose challenges to Corteva’s optimistic outlook and margin expansion narrative.

Find out about the key risks to this Corteva narrative.Another View: Peeling Back the Price Tag

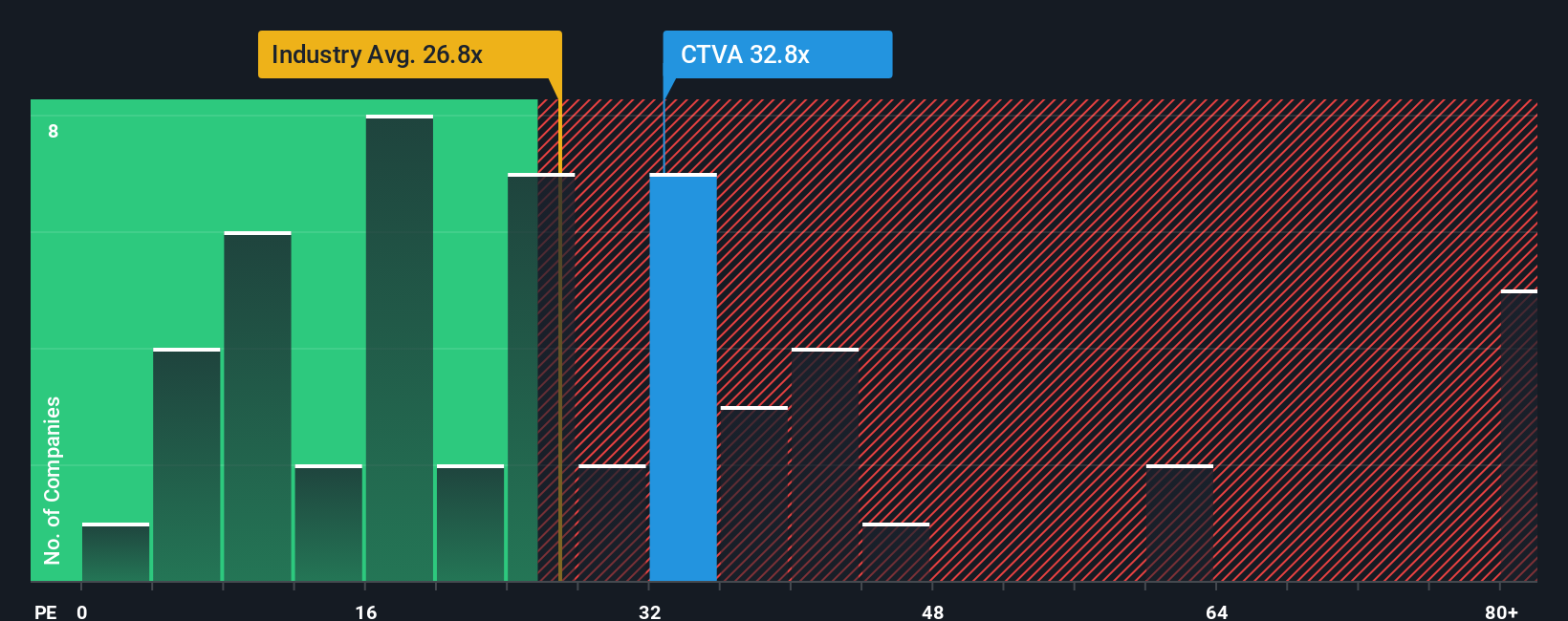

While the most popular narrative sees Corteva as attractively valued, a traditional valuation approach suggests the stock is actually expensive compared to the wider industry. Could the optimism be overshadowing real pricing concerns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corteva Narrative

If the consensus view does not align with your perspective or you would rather dive into the data firsthand, it only takes a few minutes to craft your own take on Corteva’s story. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Corteva.

Looking for more investment ideas?

Level up your investing game by checking out stock selections that stand out for growth, innovation, and strong fundamentals. Don’t miss your chance to find tomorrow’s market leaders today. Put these insightful opportunities on your radar now.

- Power up your search for reliable income streams and growing wealth with our handpicked list of dividend stocks with yields > 3%.

- Uncover overlooked gems as you scan for shares trading below their real value by using our essential resource for undervalued stocks based on cash flows.

- Ride the wave of artificial intelligence by exploring visionary companies in the AI space with our tailored selection of AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal