What Recent Earnings and Price Surge Mean for Chewy’s Stock in 2025

Let’s be honest. Deciding what to do with Chewy’s stock can feel like you’re caught between the opinions of optimists and skeptics. The last few weeks have been a bit of a rollercoaster. Chewy shares surged by 11.1% just over the past week, helping erase some of the sting from a 2.7% dip the month before. Take a step back and the picture looks even more interesting. The stock is up 13.6% since the start of the year and has posted an impressive 29.4% gain over the past twelve months. Still, if you look further out, the stock is down more than 30% compared to five years ago. This highlights just how much volatility investors have navigated.

Much of this price movement has been tied to broader market sentiment shifting toward growth stocks and evolving expectations around the pet retail sector as a whole. There have also been some headline moments in e-commerce and pet health, sparking fresh interest in companies like Chewy. Depending on your outlook, these moves can either look like a new growth phase or a recalibration of risk for the business.

Of course, momentum is only part of the story. When it comes to deciding whether Chewy is undervalued, things get a bit more analytical. Out of six different valuation checks, Chewy scores a 2, which means it passes two checks suggesting the stock is undervalued. So how do these valuation approaches really work, and is there a smarter way to cut through the noise? Let’s break it down and, by the end, you might just have a clearer answer than any single metric can offer.

Chewy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Chewy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future cash flows and then discounting those cash flows back to today’s value. This approach helps investors look beyond near-term price swings and focus on long-term earning power.

For Chewy, analysts report the company generated $447 million in free cash flow over the last twelve months. Based on consensus growth estimates, free cash flow is expected to steadily rise, reaching $1.25 billion by 2030 according to Simply Wall St’s extrapolated projections. The DCF model in this case uses a 2 Stage Free Cash Flow to Equity approach, incorporating both analyst estimates for the next five years as well as longer-term growth assumptions for subsequent years.

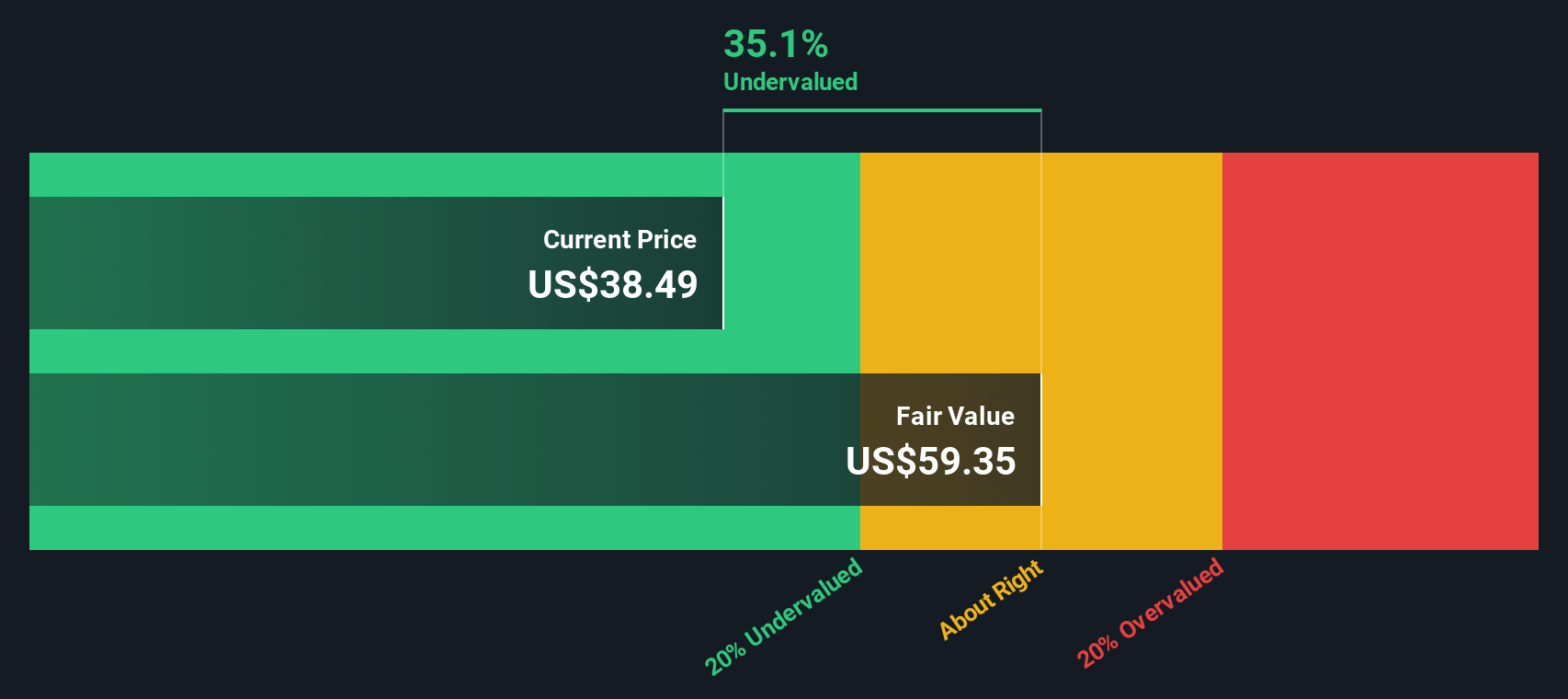

After discounting these projected cash flows to their present value, Chewy’s intrinsic value is estimated at $59.35 per share. This implies the stock is trading at a 35.1% discount compared to its DCF-based fair value, suggesting a significant margin of undervaluation.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Chewy.

Approach 2: Chewy Price vs Earnings (PE Ratio)

For companies that are profitable, the price-to-earnings (PE) ratio is often a go-to metric for investors. The PE ratio lets you see how much you are paying for each dollar of earnings, offering a simple way to compare valuations across companies. This ratio is particularly meaningful when a business is consistently earning profits, as is the case with Chewy.

What counts as a “normal” PE ratio isn’t always straightforward, however. Higher growth companies usually command higher PE ratios, while those seen as more risky or with slower expected growth generally trade at lower multiples. So, it’s important not just to look at the number itself, but to consider the context: Chewy’s growth outlook, the risks in its niche, and investor confidence all play a part.

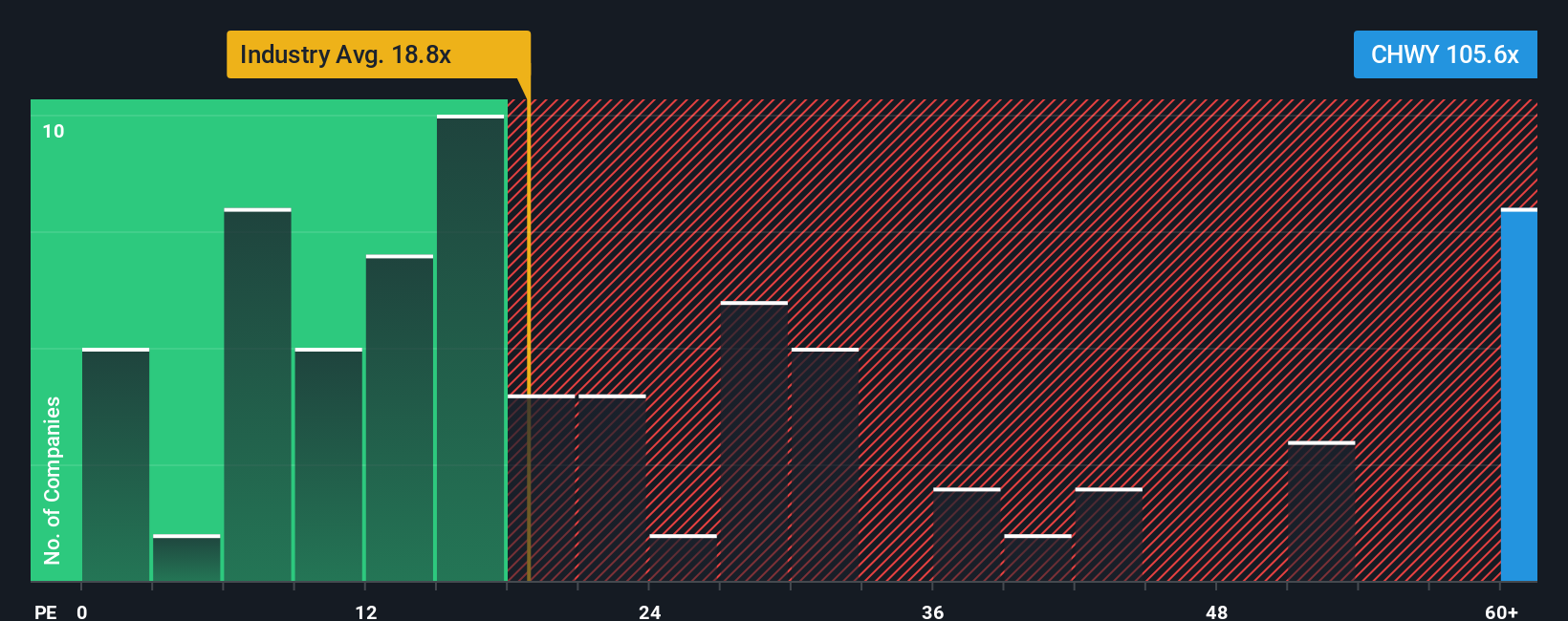

Currently, Chewy trades at a PE ratio of 105.6x. For context, the specialty retail industry average PE is 18.8x, while the average among Chewy’s peers is 23.6x. However, Simply Wall St’s proprietary “Fair Ratio” for Chewy is calculated at 30.8x. The Fair Ratio improves on simple peer or industry comparisons because it factors in Chewy’s unique earnings growth, margins, industry placement, market cap, and company-specific risks. This means it adjusts expectations to suit Chewy’s circumstances instead of assuming every company deserves the same multiple.

Chewy’s current PE multiple is substantially higher than what the Fair Ratio suggests. With a PE ratio of 105.6x compared to a Fair Ratio of 30.8x, the stock appears overvalued on this basis.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Chewy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story behind the numbers, your perspective on where a company is headed, combined with your own assumptions for fair value, future revenues, earnings, and margins. Narratives connect a company’s business story to a financial forecast, helping you translate your outlook into a clear estimated fair value.

With Narratives, available directly on the Simply Wall St Community page and used by millions of investors, you can easily build, track, and refine your view by deciding when to buy or sell through comparing your Narrative’s fair value to the actual share price. These Narratives update automatically when new earnings or news emerge, so your view stays relevant and aligned with the latest facts.

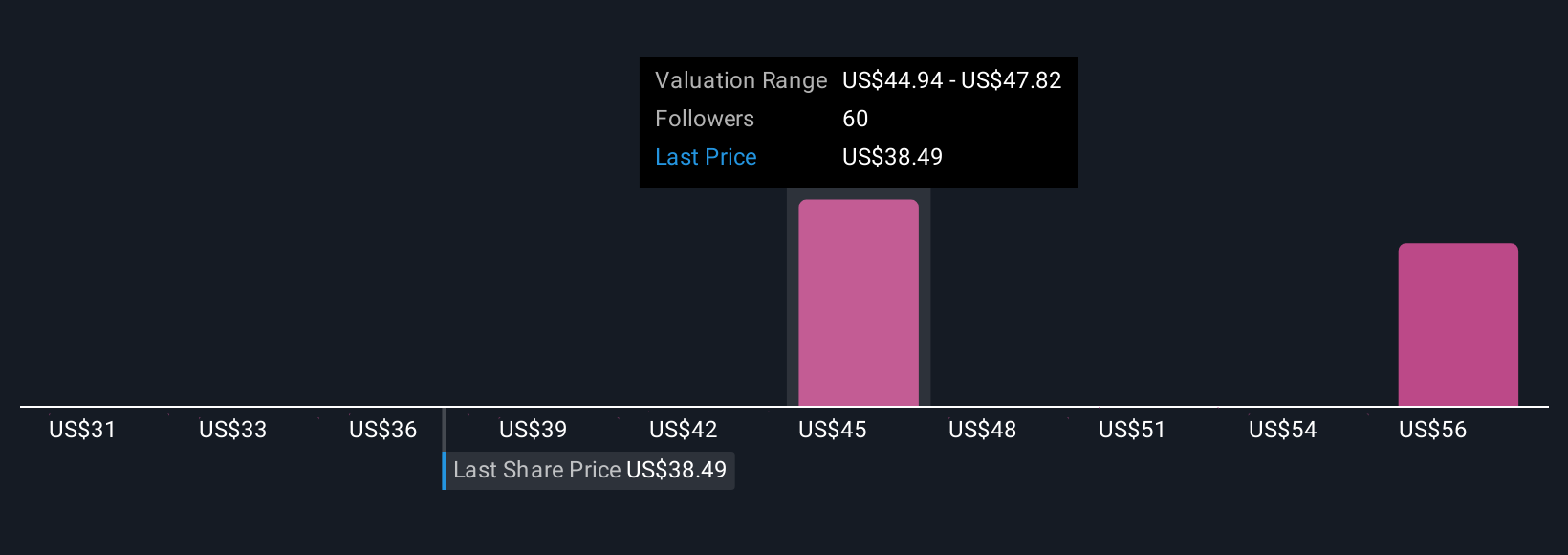

For example, the most optimistic Chewy Narrative currently projects a fair value of $52.00 per share, expecting strong impact from new vet care clinics and advertising growth. The most cautious Narrative values Chewy at just $33.00, focusing on slow customer gains and margin pressures. Which story matches your view?

Do you think there's more to the story for Chewy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal