Encore Capital Group (ECPG): Assessing Valuation After a Standout Earnings Beat and Revenue Surge

Encore Capital Group (ECPG) just delivered a Q2 earnings report that is turning heads. The company posted a hefty 24% boost in revenue year over year, trouncing analyst expectations by more than 15%. For investors, an earnings beat of this size does more than cheer up a quarter; it often signals that operational momentum is firmly in play. That is precisely what seems to have attracted renewed attention to the stock.

This latest result comes after a stretch when Encore Capital Group’s performance has been in flux. Over the past year, shares are down nearly 6%, even though the last three months saw a strong rebound with a 16% gain. The recent pop stands out against a longer backdrop: returns over the past three years remain negative, yet the five-year picture is notably brighter. These swings highlight how investor sentiment can quickly shift as the outlook changes, especially when a company manages to flip to double-digit annual revenue growth and deliver a major quarterly surprise like this.

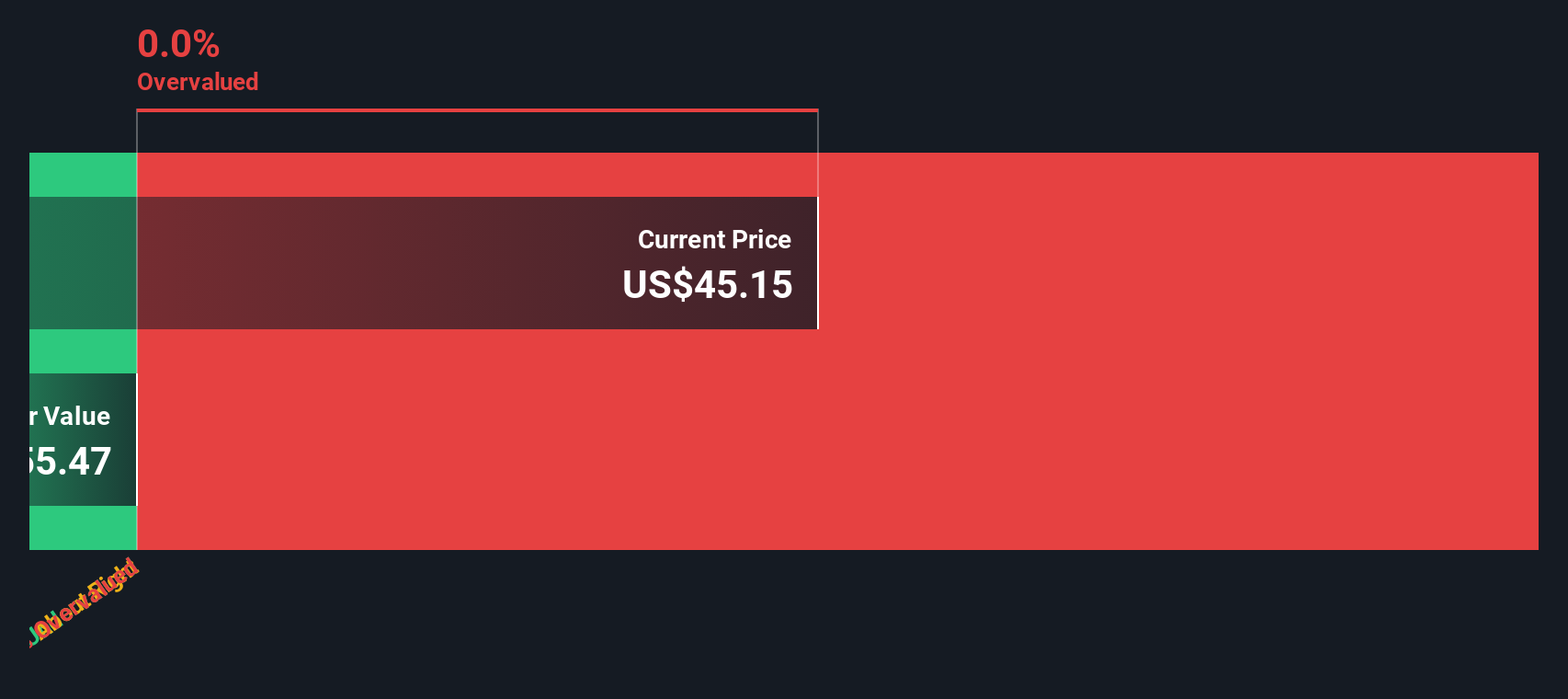

After a strong quarterly report and a renewed surge in the stock, is Encore Capital Group still trading at a bargain, or has the market already factored in another leg of growth?

Most Popular Narrative: 21% Undervalued

The current widely followed narrative sees Encore Capital Group as significantly undervalued, projecting strong upside due to a combination of favorable market conditions and digital innovation that could drive future financial performance.

“The combination of rising U.S. consumer credit card balances and elevated charge-off rates is fueling a sustained increase in the supply of non-performing loans available for purchase at attractive prices. This is expected to drive continued record levels of portfolio purchases and revenue growth. Increased investment in digital collections channels and operational innovation is delivering higher-than-forecast collection rates, with actual recoveries exceeding estimates, supporting improvements to both net margins and earnings.”

Curious how Encore could leap from unprofitable to massive future earnings? Analysts behind this narrative are betting on eye-popping financial turns, powered by bold forecasts and aggressive margin expansion. Eager to uncover which key levers drive that big price target? The answers lie in the transformative assumptions inside this valuation story.

Result: Fair Value of $57.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Encore’s reliance on the U.S. market and rising funding costs could quickly dampen this optimistic outlook if conditions shift unexpectedly.

Find out about the key risks to this Encore Capital Group narrative.Another View: What Does Our DCF Model Say?

While the market sees Encore as undervalued based on current market ratios, our SWS DCF model provides additional support and suggests a similar conclusion using projected future cash flows. Could both methods be highlighting a real opportunity, or is there a potential risk that has not been considered?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Encore Capital Group Narrative

If you see things from a different angle or want to follow your own deep dive, shaping your personal valuation story is fast and straightforward. You can do it in under three minutes. Do it your way

A great starting point for your Encore Capital Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Why stop with Encore Capital Group? Find untapped stocks using tailored tools that match your interests. Miss out, and you could leave gains behind!

- Catch stocks trading below their true value by using our undervalued stocks based on cash flows, which helps pinpoint companies set for potential upside.

- Uncover those rare companies making headlines in artificial intelligence and shape tomorrow’s tech landscape with our AI penny stocks.

- Tap into steady income by checking out our dividend stocks with yields > 3%, featuring shares with robust dividend payouts and yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal