Does Newmont’s (NEM) TSX Delisting Reveal a Sharper Focus on Efficiency and Cost Discipline?

- Newmont Corporation announced that it has voluntarily delisted its common shares from the Toronto Stock Exchange as of September 24, 2025, while retaining its primary listing on the New York Stock Exchange and supporting listings on the ASX and PNGX.

- The decision was driven by low trading volumes on the TSX and aims to improve administrative efficiency and reduce costs for shareholders.

- We'll explore how the streamlining of Newmont's exchange listings feeds into its ongoing focus on operational efficiency and cost discipline.

Find companies with promising cash flow potential yet trading below their fair value.

Newmont Investment Narrative Recap

Shareholders in Newmont generally need to believe in sustained global demand for gold, the company’s operational optimization efforts, and its ability to deliver shareholder returns. The voluntary delisting from the TSX is unlikely to materially impact the key near-term catalyst of achieving operating cost reductions through efficiency moves, nor does it add to the most immediate business risks such as higher sustaining capital expenditures or lower production from major assets. Of the company’s recent announcements, the ongoing tender offers and recent redemptions of debt, totaling as much as US$2,000,000,000, stand out. This financial maneuver supports management’s drive for cost efficiency, a recurring theme echoed by the TSX delisting, while feeding into the catalyst of margin enhancement through lower financing costs. In contrast, investors should also be aware of ongoing capital expenditure pressures, as these may present challenges if...

Read the full narrative on Newmont (it's free!)

Newmont's narrative projects $21.6 billion revenue and $6.4 billion earnings by 2028. This requires 1.6% yearly revenue growth and a $0.2 billion earnings increase from $6.2 billion currently.

Uncover how Newmont's forecasts yield a $74.75 fair value, a 9% downside to its current price.

Exploring Other Perspectives

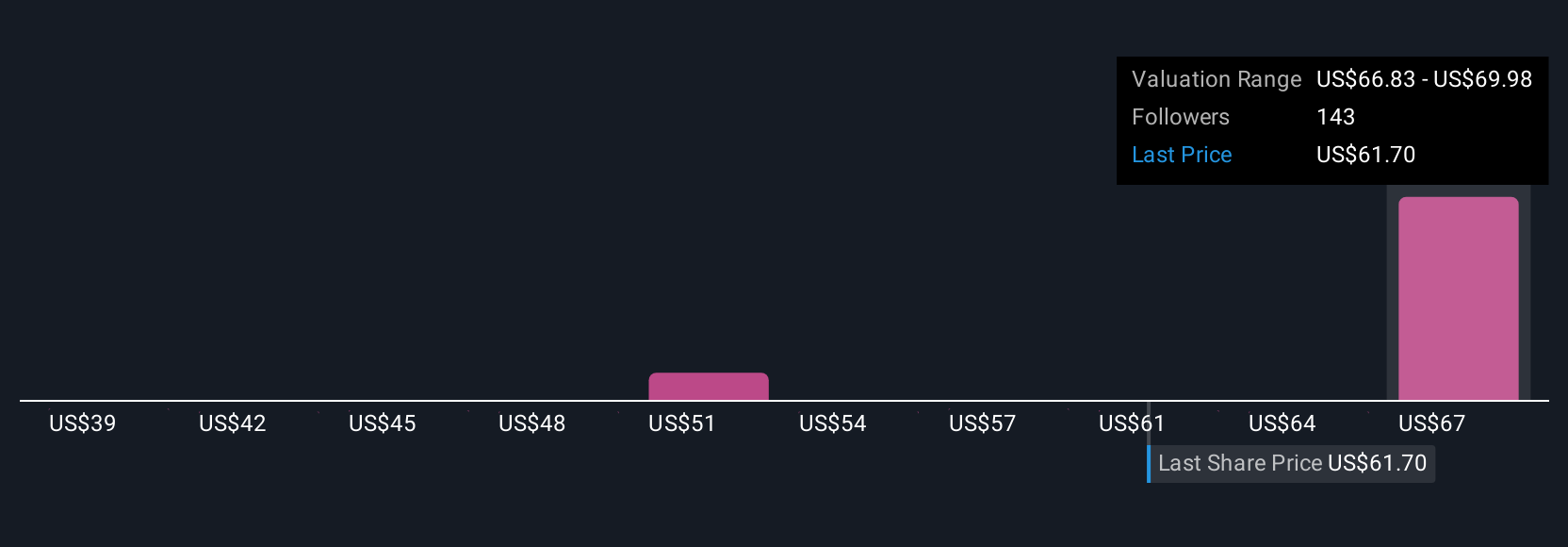

Twelve members of the Simply Wall St Community see fair value for Newmont ranging from US$40 to US$88.63 per share. As you consider these differing perspectives, keep in mind that forecast earnings are expected to decline on average by 1.4 percent per year, a factor that can affect long-term value and should be weighed against any short-term news.

Explore 12 other fair value estimates on Newmont - why the stock might be worth as much as 8% more than the current price!

Build Your Own Newmont Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newmont research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Newmont research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newmont's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal