How Investors Are Reacting To Zimmer Biomet (ZBH) Raising Its Earnings Outlook and Easing Tariff Pressures

- Earlier this quarter, Zimmer Biomet reported second quarter results that exceeded analyst expectations, with adjusted earnings per share of US$2.07 and revenue of US$2.08 billion, leading management to raise its 2025 adjusted EPS forecast to between US$8.10 and US$8.30.

- An important aspect in the announcement was management’s reduction of expected tariff headwinds for the year, which may ease some cost pressures for the company.

- We’ll now examine how Zimmer Biomet’s improved earnings outlook and reduced tariff headwinds could influence its overall investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 30 companies in the world exploring or producing it. Find the list for free.

Zimmer Biomet Holdings Investment Narrative Recap

To be a shareholder in Zimmer Biomet, you need conviction in the long-term expansion of orthopedic procedure volumes and the company's ability to strengthen its position through innovation and operational execution. The recent beat on earnings and upward revision of guidance, paired with lessened tariff pressures, potentially reinforce near-term earnings confidence; however, the biggest short-term catalyst, accelerated adoption of Zimmer Biomet’s surgical robotics, remains somewhat distinct, as competitive pressure from established peers continues to loom as the greatest current risk.

Of the recent company announcements, the August 7 guidance raise stands out, as it directly follows better-than-expected results and a reduction in anticipated tariff costs. This supports a stronger-than-anticipated earnings outlook, though the rapid evolution in orthopedic robotics technology and persistent competition make it vital for investors to assess whether Zimmer Biomet can maintain its product and market momentum. But, in contrast, persistent concerns around pricing pressures and reimbursement challenges remain risks that investors should be mindful of, especially if...

Read the full narrative on Zimmer Biomet Holdings (it's free!)

Zimmer Biomet Holdings is forecast to reach $9.2 billion in revenue and $1.3 billion in earnings by 2028. Achieving this outlook would require annual revenue growth of 5.5% and an earnings increase of about $476 million from current earnings of $823.5 million.

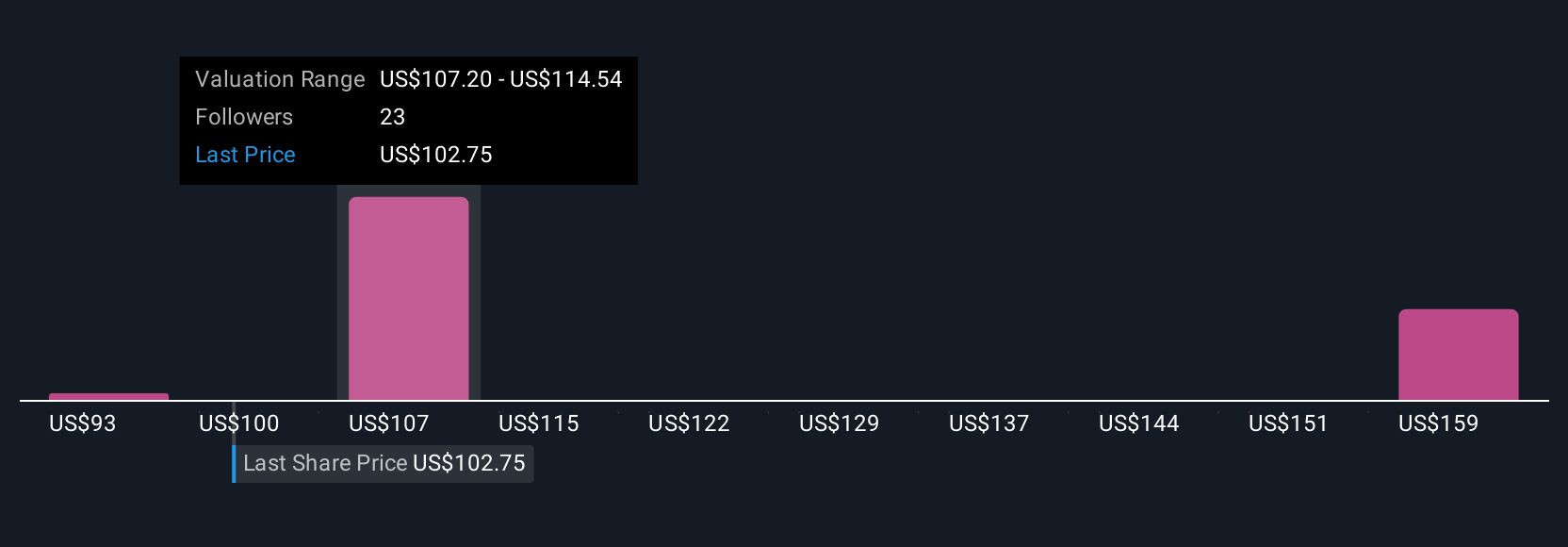

Uncover how Zimmer Biomet Holdings' forecasts yield a $110.92 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Four perspectives from the Simply Wall St Community estimate Zimmer Biomet’s fair value between US$92.52 and US$169.56. While growth catalysts around the adoption of robotics are key, these wide-ranging views demonstrate how much investor conviction can differ, inviting you to explore several alternative viewpoints.

Explore 4 other fair value estimates on Zimmer Biomet Holdings - why the stock might be worth as much as 69% more than the current price!

Build Your Own Zimmer Biomet Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zimmer Biomet Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Zimmer Biomet Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zimmer Biomet Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal