Qorvo (QRVO): Analyst Upgrades Spark Fresh Debate on Valuation and Growth Prospects

Most Popular Narrative: 5.6% Undervalued

According to the most widely followed narrative on Qorvo, the stock is viewed as undervalued, with analysts projecting upside potential based on future revenue and profit margin gains.

"Qorvo is set to benefit from accelerating adoption and content expansion tied to the rollout of 5G and future 6G networks. This is evidenced by strong design wins in flagship smartphones, Wi-Fi 7/8 deployments, and persistent efforts to increase RF content per device, which directly support multi-year revenue growth and margin expansion."

Curious about what is powering this bullish outlook? The growth story is built on a select set of financial forecasts and profitability targets that few companies can claim. What is it about Qorvo’s earnings projections that has analysts raising price targets and expecting outperformance in a competitive sector? The secret lies in a blend of revenue expansion, margin improvement, and a critical multiple. Ready to uncover what sets this fair value apart from the typical semiconductor stock?

Result: Fair Value of $97.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Qorvo’s heavy reliance on a single major customer and unpredictable global trade pressures could quickly challenge the positive outlook that is taking shape.

Find out about the key risks to this Qorvo narrative.Another View: Market's Multiple Raises Doubts

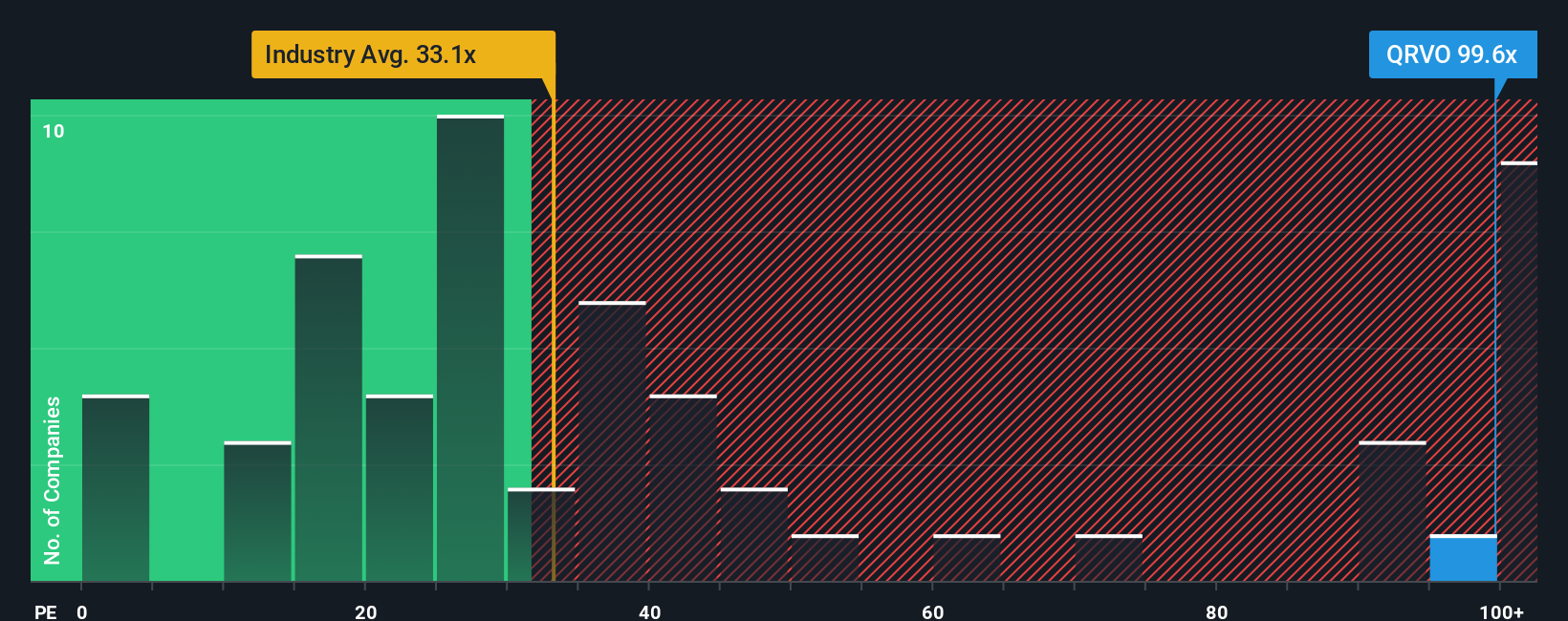

While analysts see Qorvo as undervalued on future growth, the market currently gives the stock a much higher price-to-earnings ratio than most US semiconductor companies. Could this signal optimism, or a risk of disappointment ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Qorvo Narrative

If you think there’s another angle or want to dig deeper into the numbers yourself, you can easily craft a personalized perspective in just a few minutes. Do it your way.

A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next winning idea slip by. Expand your research and uncover fresh opportunities waiting in every corner of the market with these powerful tools.

- Pinpoint value by targeting underpriced companies and track potential standouts among tomorrow’s market leaders with our list of undervalued stocks based on cash flows.

- Capitalize on the rising trend in medical technology and biotech breakthroughs by exploring a curated picks list of healthcare AI stocks.

- Cement consistent income streams by exploring proven companies focused on strong shareholder returns within our handpicked group of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal