Assessing UniFirst's Valuation as Its OSHA Hearing Test Expansion Broadens Tech-Enabled Services

If you’ve been following UniFirst (UNF), this week’s announcement might have caught your eye. UniFirst’s First Aid & Safety team is teaming up with Soundtrace to deliver on-site, AI-powered audiometric testing for workplaces. This move is aimed at simplifying compliance with OSHA’s hearing conservation rules. For employers facing everything from tight production schedules to hefty penalties for non-compliance, this expansion could deliver genuine operational relief while plugging a persistent gap in workplace health.

This is not an overhaul that will transform every corner of UniFirst overnight, but it is the kind of partnership that broadens their service offering. That is why it is interesting against the current backdrop: despite annual revenue and net income growth, UniFirst’s stock price has lost momentum with a decline over the past year and a more modest three-year total return. While there has been growth on the operations side, the share price has not reflected that energy yet, and short-term momentum remains muted.

With expansion into new tech-enabled services underway and shares still out of favor, investors now face the classic dilemma. Is UniFirst undervalued based on its latest moves, or is the market simply staying cautious until growth materializes?

Most Popular Narrative: 5.5% Undervalued

According to the most widely followed valuation narrative, UniFirst is currently considered undervalued by just over five percent. This view draws on forecasts of moderate earnings and revenue growth, ongoing operational improvements, and the impact of efficiency initiatives in the years ahead.

Significant investments in technology, specifically an ERP system, are anticipated to enhance efficiency. This may lead to improved profitability and reduced operational costs once fully implemented, which could positively impact net margins in the long run. Expansion of the distribution center in Owensboro, Kentucky, is expected to improve speed and efficiency in direct sales of uniforms. This could potentially drive revenue growth through enhanced operational capacity.

Curious about the blueprint behind this “undervalued” label? The narrative hinges on forward-looking assumptions that push profit margins higher and forecast steady revenue gains. Want to see what it would take for this stock to surprise on the upside and close the price gap analysts see? Dig into their bold projections and decide if these ambitions match up with reality.

Result: Fair Value of $178.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, weaker customer demand and rising health care costs remain real challenges that could undermine UniFirst's ability to meet its ambitious projections.

Find out about the key risks to this UniFirst narrative.Another View: SWS DCF Model

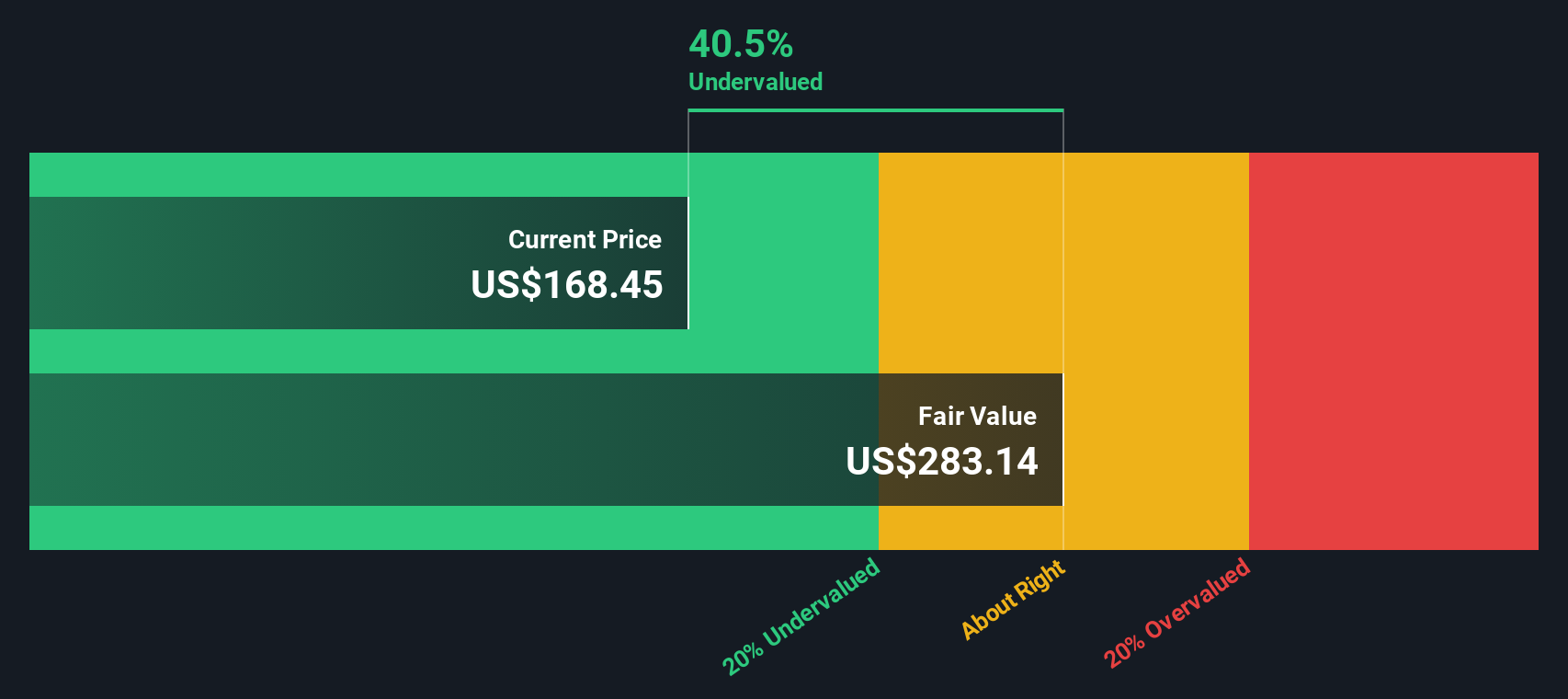

A different approach comes from our DCF model, which points to UniFirst being undervalued by a much wider margin than analyst price targets suggest. Does this gap highlight a hidden bargain, or are market headwinds stronger than projections?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own UniFirst Narrative

If the standard valuation story doesn't fit your perspective, you can dive into the numbers yourself and see how your take stacks up. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding UniFirst.

Looking for More Investment Opportunities?

Your next winning idea might be just a click away. The right stock could be hiding in plain sight, and you do not want to miss a golden chance to get ahead. Put your curiosity into action and check out these powerful strategies:

- Capture steady income streams by browsing dividend stocks with yields > 3% with yields above 3% to see which companies reward their investors best.

- Tap into tomorrow’s technological breakthroughs and high-growth potential by scanning a curated list of AI penny stocks that are shaping entire industries.

- Find hidden value plays quickly by sorting through undervalued stocks based on cash flows to spot stocks trading well below their estimated worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal