How Investors May Respond To MYR Group (MYRG) Amid Rate Cuts and Shifting Infrastructure Momentum

- The Federal Reserve recently cut its benchmark interest rate by 25 basis points and signaled potential for further reductions, fueling broad market optimism.

- MYR Group was among several companies that benefited from improved investor sentiment as easing inflation data added to positive momentum for infrastructure-related sectors.

- We’ll explore how the Federal Reserve’s dovish policy stance could influence MYR Group’s earnings visibility and market positioning going forward.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

MYR Group Investment Narrative Recap

To be a MYR Group shareholder, you need to believe in the long-term strength of North American infrastructure investment and the company’s ability to secure recurring, high-margin utility contracts. While the Federal Reserve’s interest rate cut has buoyed near-term market sentiment, the central catalyst for MYR Group remains its contract backlog and underlying demand from utilities. The biggest risk is still erratic revenue visibility if C&I or utility projects slow; this Fed decision does not substantially change that risk in the short term.

Among recent announcements, the five-year master service agreement with Xcel Energy stands out, expected to add over US$500 million in new work and expand backlog visibility. This deal is especially relevant now, as it should provide a buffer against swings in investor sentiment and help offset the lumpiness and unpredictability that can accompany project-based infrastructure businesses. Despite renewed optimism, investors should be mindful that any sustained drop in utility demand could...

Read the full narrative on MYR Group (it's free!)

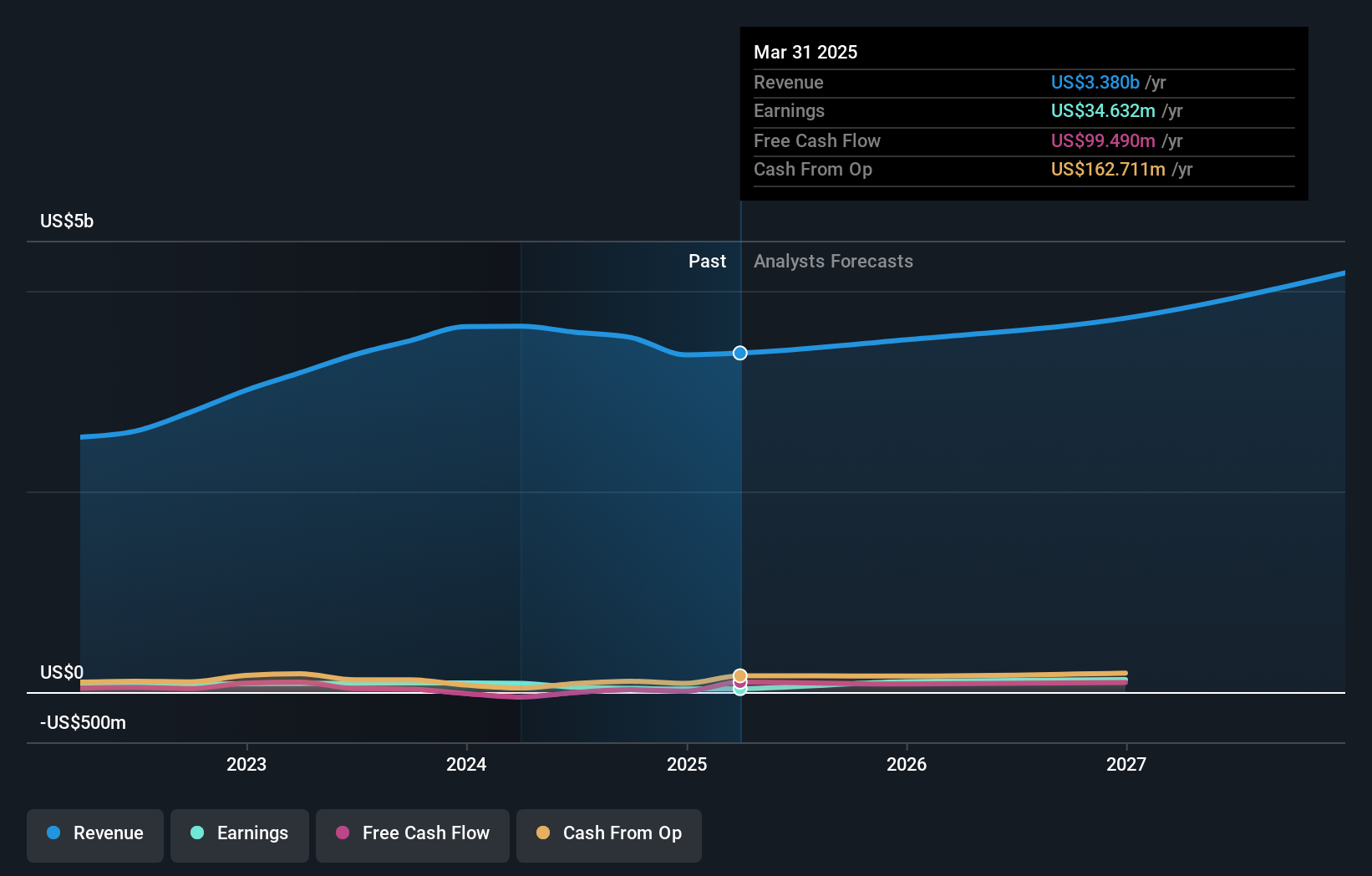

MYR Group is projected to reach $4.3 billion in revenue and $157.2 million in earnings by 2028. This outlook relies on an annual revenue growth rate of 8.0% and an increase in earnings of $80.8 million from the current level of $76.4 million.

Uncover how MYR Group's forecasts yield a $209.60 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have issued two fair value estimates for MYR Group, ranging from US$206.98 to US$209.60. While opinions differ, many are watching how consistent project wins might influence MYR Group’s future earnings stability.

Explore 2 other fair value estimates on MYR Group - why the stock might be worth as much as 17% more than the current price!

Build Your Own MYR Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MYR Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free MYR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MYR Group's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal