Will TPL’s NYSE Texas Dual Listing Redefine Its Investor Base or Test Board Stability?

- Texas Pacific Land Corporation announced it would dual list its common stock on the new NYSE Texas exchange from August 15, 2025, while retaining its primary listing on the New York Stock Exchange; the company also disclosed a minor insider stock purchase and the upcoming departure of board member Eric L. Oliver, who will not stand for reelection in 2025 due to personal reasons unconnected to any board disagreement.

- The decision to dual list is expected to increase the company's market visibility and potentially attract a broader base of investors by providing access to a new regional exchange.

- We'll assess how the NYSE Texas dual listing could reshape Texas Pacific Land’s appeal to institutional and regional investors.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Texas Pacific Land Investment Narrative Recap

Texas Pacific Land shareholders need to believe in the sustainability of royalty revenue growth and expanding water services, both key earnings engines. The NYSE Texas dual-listing is unlikely to materially affect these immediate catalysts, nor does it diminish significant exposure to fluctuations in Permian Basin production, which remains the company’s main short-term risk.

Among recent updates, TPL’s Q2 earnings report revealed continued increases in both oil and natural gas production, supporting recurring revenues and margin stability. This operational resilience ties directly to the growth narrative, especially as future cash flows rely on consistent extraction activity across TPL’s acreage.

By contrast, investors should also be aware that prolonged shifts in Permian Basin operator activity could...

Read the full narrative on Texas Pacific Land (it's free!)

Texas Pacific Land's projections call for $895.3 million in revenue and $610.3 million in earnings by 2028. This outlook is based on a 7.2% annual revenue growth rate and reflects a $150.1 million increase in earnings from the current $460.2 million level.

Uncover how Texas Pacific Land's forecasts yield a $921.93 fair value, a 5% upside to its current price.

Exploring Other Perspectives

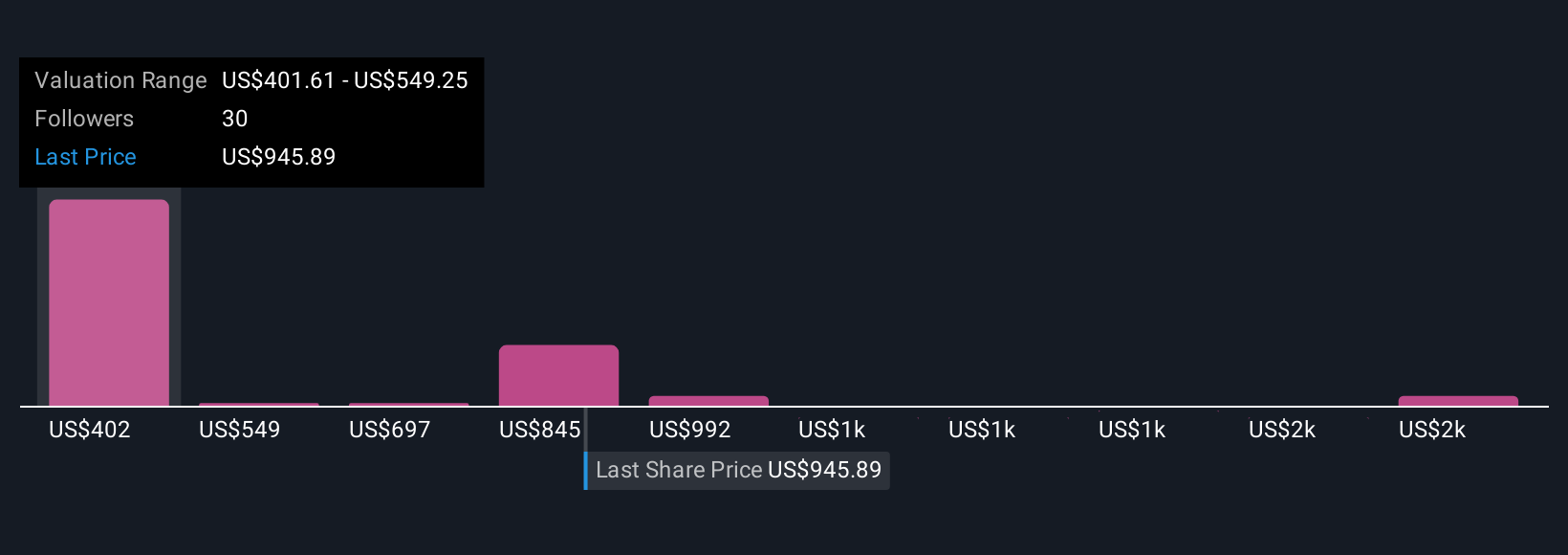

Fifteen fair value estimates from the Simply Wall St Community for TPL range widely from US$401.61 to US$1,877.96. While opinions differ, the company’s dependence on robust Permian production is a common thread affecting broad confidence in future earnings stability.

Explore 15 other fair value estimates on Texas Pacific Land - why the stock might be worth over 2x more than the current price!

Build Your Own Texas Pacific Land Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Pacific Land research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Texas Pacific Land research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Pacific Land's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal