Five Below (FIVE): Exploring Valuation Following Fire Pit Recall and Ongoing Legal Scrutiny

Five Below (FIVE) has landed in the spotlight after announcing a recall of about 66,000 tabletop fire pits due to the risk of fire and serious burn injuries. If that sounds like a headache, there is more. The company is currently facing a securities class action lawsuit after a judge allowed certain claims to move forward, relating to alleged disclosure issues and the sudden exit of its President and CEO. For investors, a recall and legal scrutiny are never welcome news, and both could have meaningful implications for the retail brand’s reputation and future profitability.

Even with these headlines making the rounds, Five Below's stock has shown resilience. The stock has returned 59% over the past year and gained 22% in the past 3 months. The mix of strong sales growth and ongoing store expansion has generally bolstered confidence, but the recent wave of operational and reputational risk has sparked questions among those following the stock’s story. The market’s response suggests momentum is still alive; however, caution is beginning to set in as these issues unfold.

So, after this run-up and the latest sequence of challenges, is there a genuine bargain in Five Below right now, or do shares already reflect hopes for continued high growth?

Most Popular Narrative: 3.3% Undervalued

According to the most widely followed narrative, Five Below appears to be trading slightly below its calculated fair value using an 8.79% discount rate. This suggests the stock may offer a modest opportunity for investors, provided underlying assumptions on growth and profitability hold true.

Five Below's commitment to providing extreme value and trend-right products at low price points is driving broad-based transaction growth, especially as consumers across demographics become increasingly value-focused due to persistent economic pressures. This is expanding the store traffic and addressable market, supporting higher revenue and potential sustained comp sales growth.

Why are analysts forecasting a price target above the current share price? They see a set of finely balanced assumptions involving profitability, sales momentum, and a bold future earnings figure at the core of this fair value story. If you want to discover the single biggest number shaping how this narrative stacks up, there is more behind the forecast than meets the eye.

Result: Fair Value of $157.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing tariff headwinds and the risk of store expansion outpacing demand could still pressure margins and dampen Five Below's future growth story.

Find out about the key risks to this Five Below narrative.Another Angle: Peer Comparisons Tell a Different Story

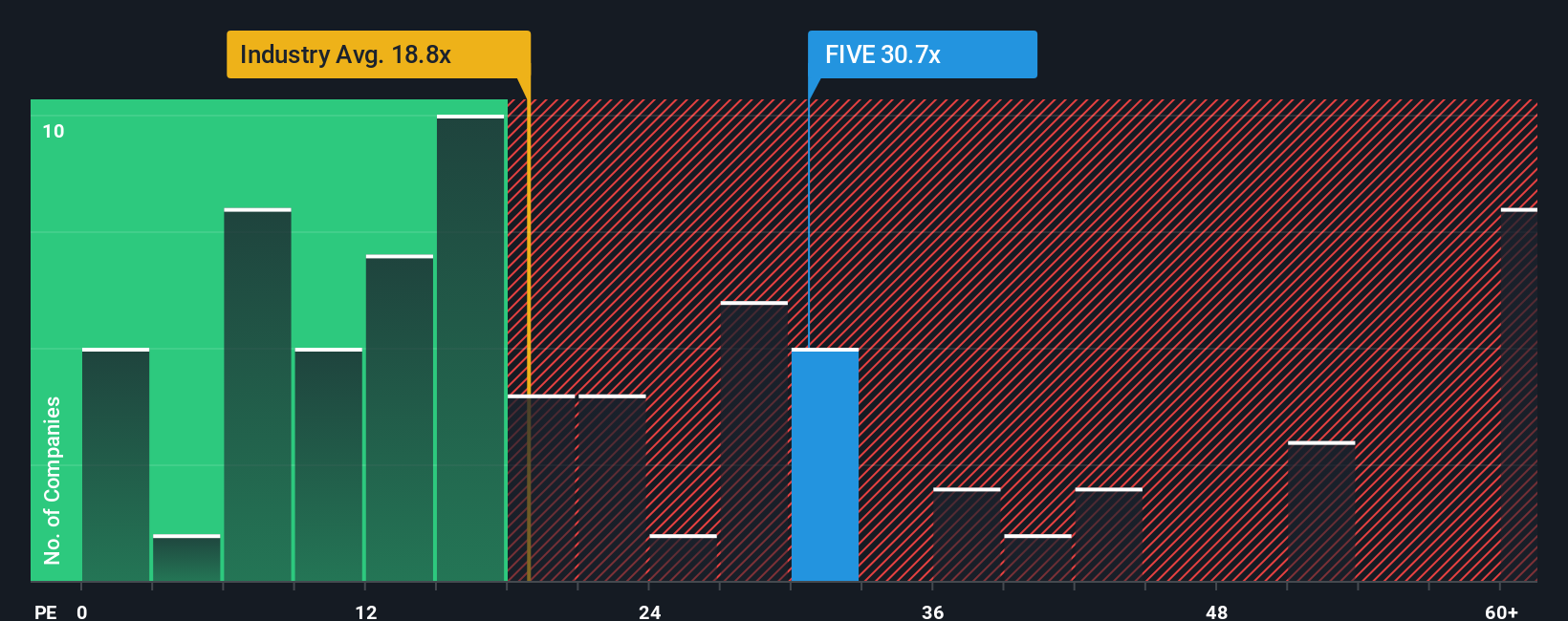

Looking at things through a different lens, Five Below actually appears expensive when we compare its price-to-earnings ratio to other companies in its industry. This raises questions about what investors are really betting on.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five Below Narrative

If you think there is more to the story or want to dig deeper into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Five Below research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know there is always another opportunity waiting. Don’t let the next big trend pass you by. Expand your horizons with unique market movers using the powerful Simply Wall Street screener tools below.

- Unlock high growth potential and tap into tech’s hottest frontier with companies building the future of artificial intelligence through AI penny stocks.

- Capture the upside of up-and-coming market disruptors by seeking out penny stocks with strong financials known for strong financials and bold innovation.

- Secure your cash flow with attractive yields and discover dividend stocks with yields > 3% that consistently reward investors with reliable dividend income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal