Exploring Mosaic (MOS) Valuation After Recent Period of Quiet Share Price Gains

Mosaic (MOS) has been getting a closer look from investors lately, with the stock making some interesting moves that seem to be sparking new questions. There is no single event or headline behind this activity, but it is exactly the kind of quiet momentum that tends to get valuation-watchers talking. When a well-known name starts to drift higher without much fanfare or major news, it can be a subtle signal, one demanding a deeper dive into what the market may be seeing beneath the surface.

Over the past year, Mosaic shares have delivered steady growth, climbing nearly 37%. More recently, the stock has gained just over 4% in the past month after a slightly negative stretch earlier in the quarter. Compared to its performance over the past three years, which has been negative overall, this year’s pickup in momentum stands out. Quarterly financials pointed to modest revenue growth of 3% and a retreat in net income, reflecting some of the cyclicality and challenges in the materials sector.

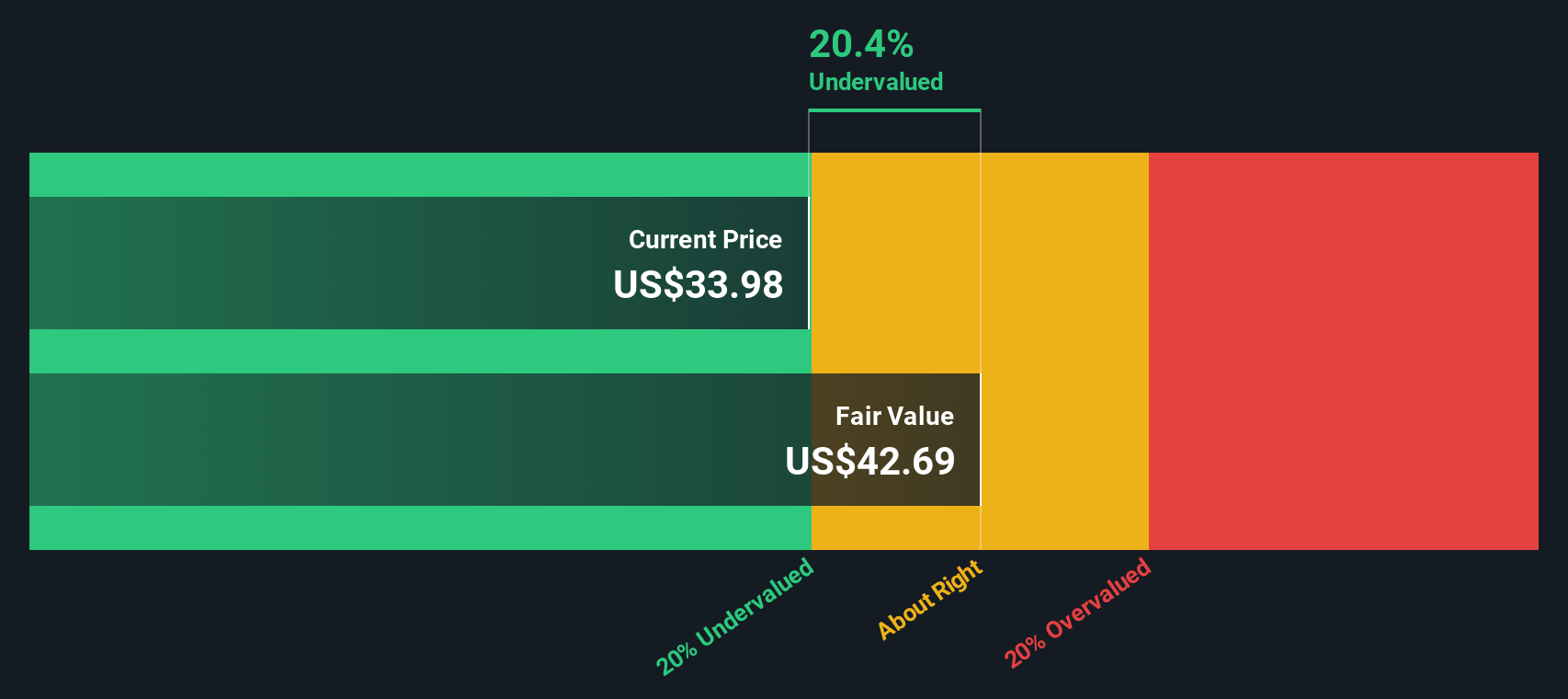

After this year’s solid performance, is Mosaic still trading at a bargain, or could the recent run-up mean the market is now fully pricing in future growth?

Most Popular Narrative: 16% Undervalued

According to the most widely followed narrative, Mosaic is seen as undervalued by 16%. This suggests analysts believe there is room for the stock to rise based on projected earnings and growth catalysts.

Investments in asset reliability, automation, and cost reductions (especially in Brazil and in U.S. phosphates) are expected to enable higher production volumes and lower unit costs going forward. This would directly enhance net margins and earnings as asset downtime and extraordinary maintenance costs recede.

What could possibly justify this undervaluation? The answer lies in the details. Analysts are betting on Mosaic’s operational upgrades and its global expansion paying off in a significant way. Want to unlock the assumptions behind this ambitious price target? Find out what’s included in their forecasts, including one key projection that could potentially change expectations for future profits.

Result: Fair Value of $40.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges such as tightening environmental regulations and increased global fertilizer supply could put pressure on Mosaic's margins and test its growth expectations.

Find out about the key risks to this Mosaic narrative.Another View: What Does Our DCF Model Reveal?

Looking at Mosaic through the lens of our discounted cash flow (DCF) model, a similar picture emerges, with the company appearing undervalued. Although this approach factors in future cash projections, it still leaves room for debate. Is the market missing something, or are both models too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mosaic Narrative

If you think the numbers tell a different story or you’d rather draw your own conclusions, take a few minutes to explore and build your own view. Do it your way

A great starting point for your Mosaic research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Miss out on new opportunities and you could leave potential gains on the table. Let Simply Wall Street’s Screener connect you to fresh, exciting stocks now.

- Pinpoint companies overflowing with value and future potential as you tap into our selection of undervalued stocks based on cash flows built on powerful cash flow insights.

- Get ahead by tracking trailblazers in artificial intelligence and unlock tomorrow’s leaders with our curated lineup of AI penny stocks.

- Boost your income stream by targeting stocks offering strong yields using our tailored dividend stocks with yields > 3% engine focused on steady dividend performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal