How Investors Are Reacting To Verizon Communications (VZ) iPhone 17 Launch and Public Safety Initiative

- Earlier this month, Verizon Communications launched pre-orders for the Apple iPhone 17 lineup, Watch Series 11, and AirPods Pro 3, offering significant trade-in incentives and bundled perks with its flexible myPlan options on its 5G network.

- The announcement also included news of a major technology deployment and community disaster resilience initiative supporting the Tampa Police Department, highlighting Verizon’s commitment to public safety and advanced communications for first responders.

- We'll examine how Verizon's expanded device offerings and trade-in incentives could support its recurring revenue and customer retention strategies.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

Verizon Communications Investment Narrative Recap

To be a Verizon Communications shareholder today, you need to believe that the company’s scale, high-value network assets, and growing bundled device offerings, such as the new iPhone 17 incentives, will help defend long-term profitability amid a competitive and mature US wireless market. While the latest Apple device launch and trade-in offers could give a near-term lift to subscriber retention, the most important catalyst remains broadband and wireless service revenue growth, and the biggest near-term risk is continued customer churn due to aggressive competitive promotions. This news is a positive for customer engagement, but the overall impact on these core business drivers is unlikely to be material on its own.

The recently announced partnership with the Tampa Police Department stands out because it directly supports Verizon’s 5G Ultra Wideband deployment and showcases the company’s investment in technology that strengthens its offering for first responders, a segment that values network reliability. While device promotions target broader consumer loyalty, serving mission-critical enterprise and government users can reinforce network leadership, a vital underpinning for Verizon’s broader plans to grow business and maintain pricing power even as competition intensifies.

But despite all these developments, investors should keep in mind the ongoing risk that high capital expenditures and a saturated US wireless market could...

Read the full narrative on Verizon Communications (it's free!)

Verizon Communications' narrative projects $144.5 billion revenue and $22.1 billion earnings by 2028. This requires 1.8% yearly revenue growth and a $3.9 billion earnings increase from $18.2 billion.

Uncover how Verizon Communications' forecasts yield a $48.61 fair value, a 12% upside to its current price.

Exploring Other Perspectives

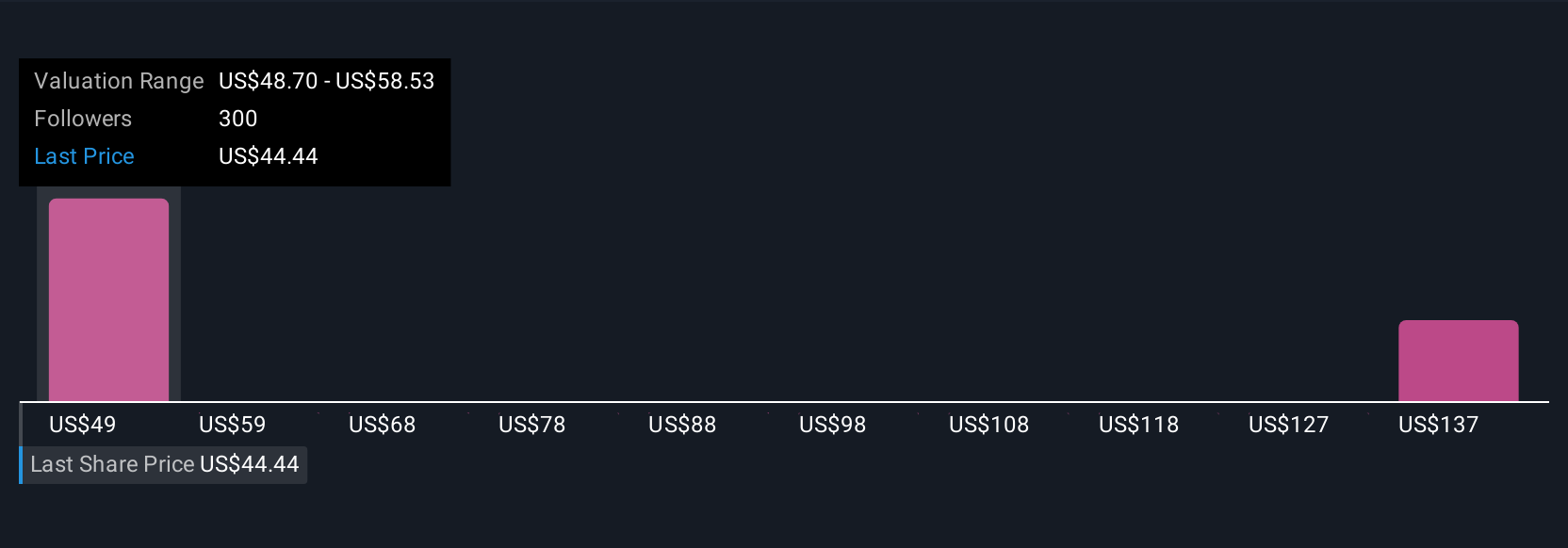

The Simply Wall St Community provided 14 fair value estimates for Verizon, ranging from US$48.61 to US$140.02 per share. Against this broad backdrop of opinions, competitive pressures and customer churn remain front of mind for most participants seeking clarity on Verizon’s future performance.

Explore 14 other fair value estimates on Verizon Communications - why the stock might be worth just $48.61!

Build Your Own Verizon Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verizon Communications research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verizon Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verizon Communications' overall financial health at a glance.

No Opportunity In Verizon Communications?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal