How Investors Are Reacting To Walker & Dunlop (WD) Refinancing Seven Nursing Facilities and Board Expansion

- Earlier in September 2025, Walker & Dunlop originated US$68.31 million in HUD-insured loans to refinance seven skilled nursing facilities across Illinois and Wisconsin, while also expanding its board by appointing experienced real estate and finance executive Ernest M. Freedman as an independent director and member of the Audit and Risk Committee.

- This combination of substantial refinancing deals in the seniors housing sector and the addition of proven financial oversight on the board highlights Walker & Dunlop’s ongoing focus on portfolio stability and governance amid sector growth opportunities.

- Let’s explore how the appointment of a highly experienced independent director may shape the company’s investment narrative and risk management outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Walker & Dunlop Investment Narrative Recap

To be a shareholder of Walker & Dunlop, you generally need confidence in its ability to capture growing demand for financing in the multifamily and seniors housing sectors while navigating dependency on government-backed funding. The recent board expansion and skilled nursing loan origination showcase ongoing focus on portfolio stability, yet do not materially change the company’s biggest near-term catalyst, multifamily loan demand, or the main risk posed by regulatory changes to GSE lending.

Of the recent announcements, the US$68.31 million in HUD-insured refinancing for skilled nursing facilities illustrates Walker & Dunlop’s continued push into sectors facing demographic-driven demand. This move aligns with the ongoing catalyst of increased institutional activity and need for stable, long-term financing products.

In contrast, one issue investors should be aware of is that sustained high interest rates may...

Read the full narrative on Walker & Dunlop (it's free!)

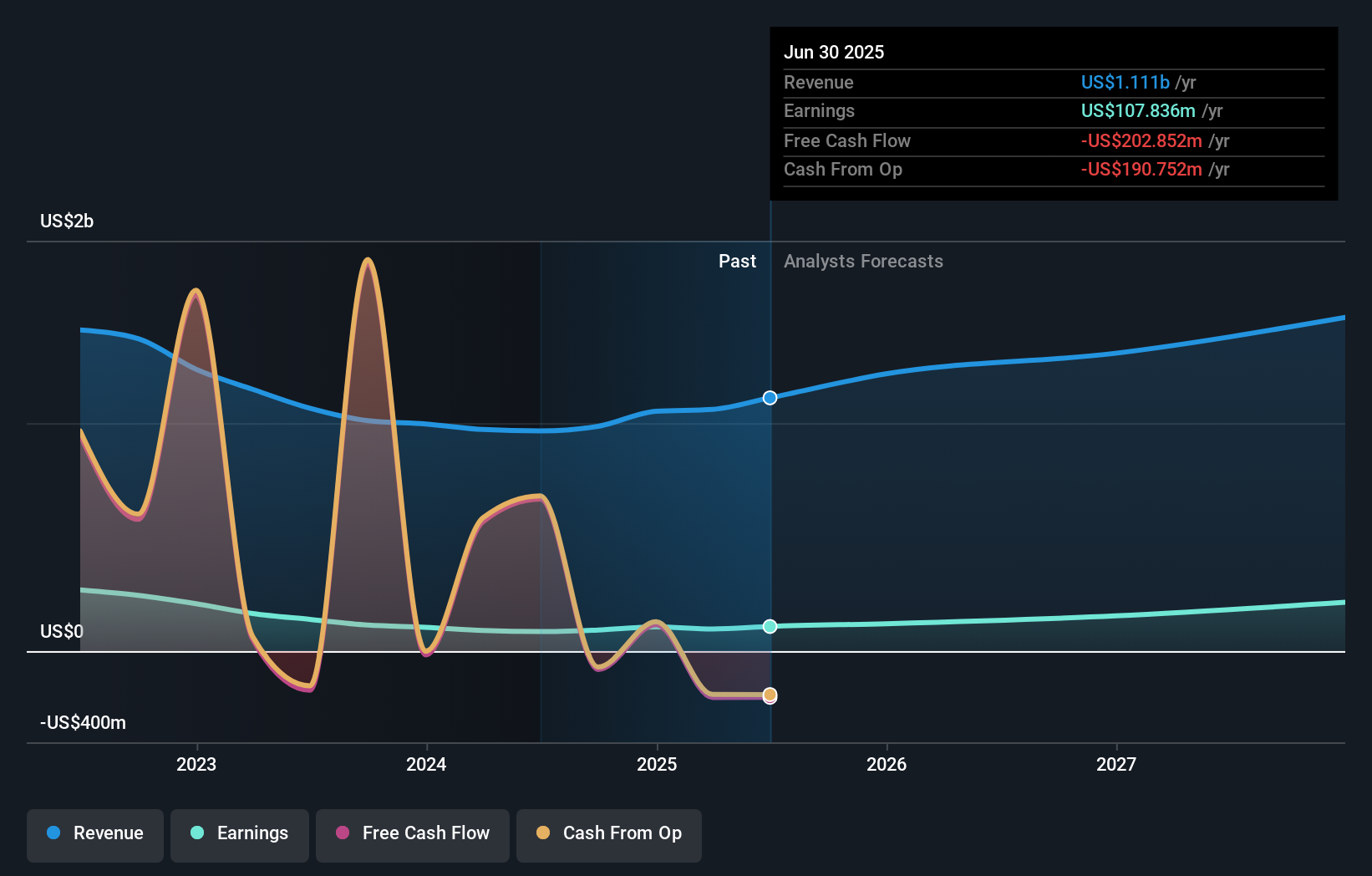

Walker & Dunlop's outlook projects $1.5 billion in revenue and $233.2 million in earnings by 2028. This assumes an annual revenue growth rate of 11.2% and an earnings increase of $125.4 million from current earnings of $107.8 million.

Uncover how Walker & Dunlop's forecasts yield a $92.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Retail fair value estimates from the Simply Wall St Community span US$33.80 to US$92.50 from 3 contributors, showing sharp differences in outlook. Persistent dependence on GSEs for origination volumes suggests further scrutiny of regulatory and policy changes may be essential for understanding future performance drivers.

Explore 3 other fair value estimates on Walker & Dunlop - why the stock might be worth less than half the current price!

Build Your Own Walker & Dunlop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walker & Dunlop research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Walker & Dunlop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walker & Dunlop's overall financial health at a glance.

No Opportunity In Walker & Dunlop?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal