Could Butterfly Network's (BFLY) Leadership Moves and Accolades Shape Its Innovation Edge?

- Butterfly Network, Inc. recently announced the appointment of Victor Ku as Senior Vice President and Chief Technology Officer, entrusting him to lead the company’s technology strategy and innovation roadmap on a global scale.

- The company was also named to TIME’s inaugural list of the World’s Top HealthTech Companies for 2025, marking a significant recognition of its ongoing innovation and expanding reputation within the sector.

- We’ll explore how Butterfly Network’s selection by TIME as a top HealthTech innovator could influence its investment narrative and growth outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Butterfly Network Investment Narrative Recap

To be confident holding Butterfly Network stock, one needs to believe that the company’s ultrasound imaging and AI-powered software can drive widespread adoption in clinical and emerging healthcare markets, setting the stage for rapid revenue growth as funding clarity returns. The appointment of a seasoned CTO and TIME’s HealthTech Company recognition highlight momentum around innovation, but these events do not directly address the company’s most pressing short-term catalyst, landing large enterprise and medical school deals, and do little to resolve the main risk of slow sales cycles in a challenged funding environment.

Of the recent announcements, the transition in the CFO position stands out as particularly relevant, given analyst concerns about management depth and execution during a critical period for new deal closures. With an interim CFO still in place, the potential for strategic or operational disruptions remains top of mind as Butterfly aims to capitalize on its enhanced visibility and accelerate key contract wins.

However, investors should stay alert to the possibility that, despite growing recognition and product innovation, management turnover during a critical execution window could...

Read the full narrative on Butterfly Network (it's free!)

Butterfly Network's narrative projects $135.9 million in revenue and $17.0 million in earnings by 2028. This requires 15.8% yearly revenue growth and a $79.8 million increase in earnings from the current -$62.8 million.

Uncover how Butterfly Network's forecasts yield a $3.17 fair value, a 71% upside to its current price.

Exploring Other Perspectives

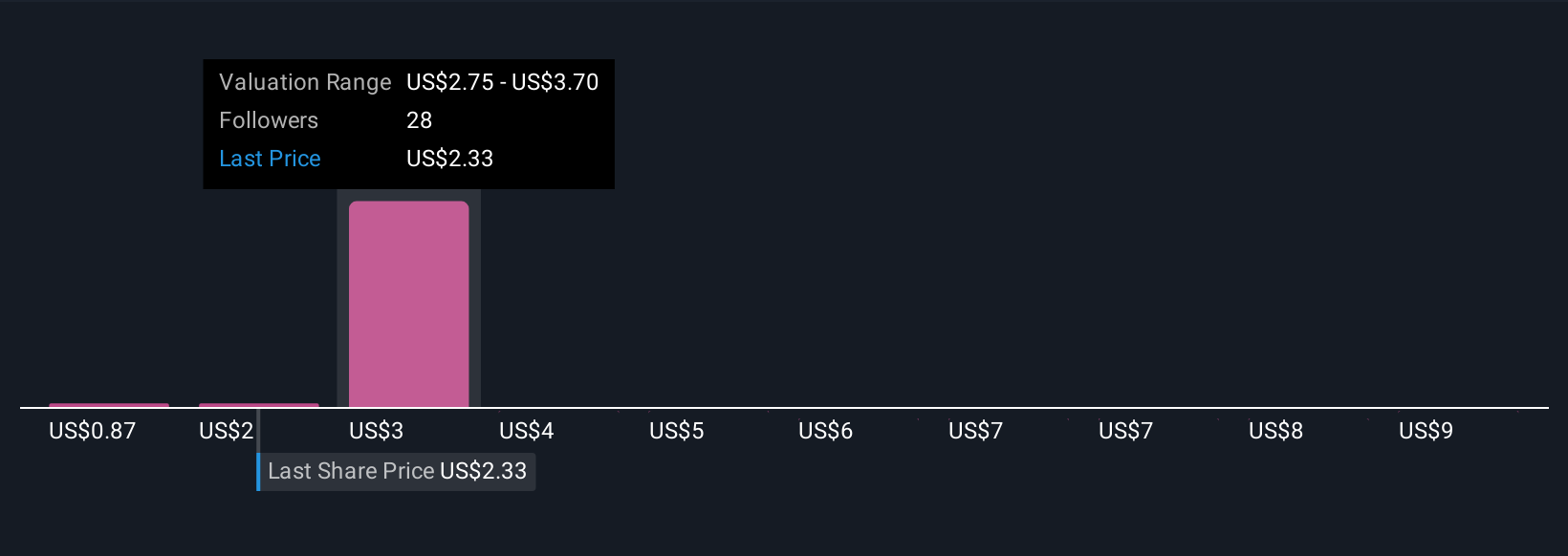

Fair value estimates from seven members of the Simply Wall St Community range from US$0.89 to US$10.29 per share. With such diverse outlooks, keep in mind that slow sales cycles and deferred capital spending remain a key challenge as you consider different opinions.

Explore 7 other fair value estimates on Butterfly Network - why the stock might be worth less than half the current price!

Build Your Own Butterfly Network Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Butterfly Network research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Butterfly Network research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Butterfly Network's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal