MINISO (NYSE:MNSO) Valuation in Focus Following Analyst Outlook Shift and Lowered Earnings Estimates

Most Popular Narrative: 43.1% Undervalued

The narrative from SuEric presents MINISO as significantly undervalued, with a calculated fair value well above the recent share price. The argument focuses on the company’s rapid operational expansion, improving profitability, and robust global growth plans.

Strong Q1 2024 Performance: In Q1 2024, $MNSO revenue surged 26% year-on-year to $515.7 million, with adjusted EBITDA margin expanding by 200 basis points to 25.9%. This growth was fueled by a robust strategy of opening new stores globally. Aggressive Expansion Plans: $MNSO plans to open 900 to 1,100 stores annually from 2024 to 2028, aiming for a revenue CAGR of over 20%. As operational efficiency improves, sustained EBITDA margin growth is expected, enhancing the potential for higher dividends.

Could this be the retail growth story investors have missed? This popular narrative draws on bold projections for revenue, margin expansion, and strategic international scale. The fair value model relies on some ambitious assumptions. If you want to discover which specific growth levers and future profit multiples drive this large upside target, you will want to look closer at the underlying math.

Result: Fair Value of $44.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sudden shifts in consumer demand or setbacks in global expansion could quickly put pressure on those optimistic growth and profitability forecasts.

Find out about the key risks to this MINISO Group Holding narrative.Another View: The Multiples Perspective

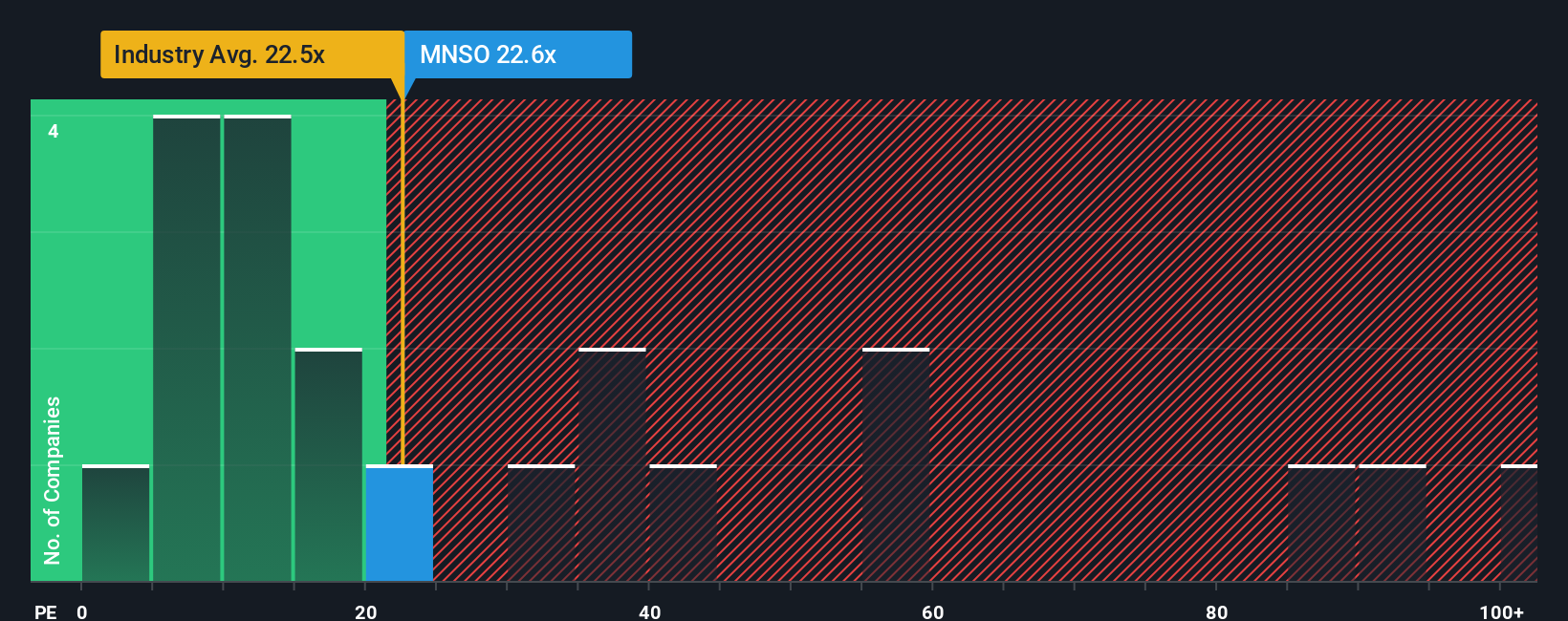

Switching focus from future projections to the current earnings landscape, another widely used approach suggests a less optimistic outlook for the stock. This method compares MINISO’s share price to industry averages and suggests that the valuation may already factor in much of its growth story. Could this more cautious stance be the reality investors must weigh?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MINISO Group Holding Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to create your own view from the ground up. Do it your way

A great starting point for your MINISO Group Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Smart Move?

Don’t stop at just one opportunity. The Simply Wall Street Screener opens the door to game-changing investment ideas you won’t want to miss.

- Target high-yield potential as you search for steady income and growth. Spot companies with dividend stocks with yields > 3% right now.

- Get ahead of the crowd by spotting promising innovation leaders as you scan for AI penny stocks with breakout potential in artificial intelligence.

- Unlock hidden gems that could be trading well below their real worth. Start your hunt for value with our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal